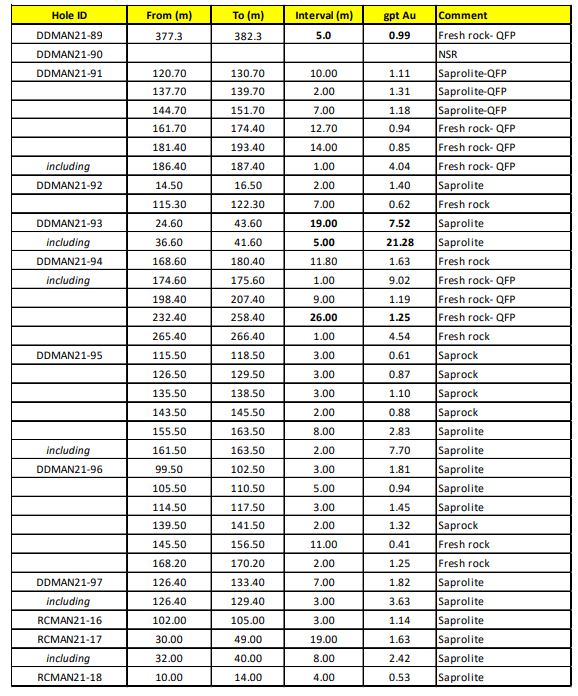

On April 19, Roscan Gold Corporation (TSXV: ROS) reported constructive assay results from its 12-hole, 2,205-meter drilling program at the Southern Mankouke Zone on its flagship Kandiole Project in Mali, West Africa. Specifically, hole DDMAN21-93 intersected 7.52 grams of gold per tonne (g/t) of resources over a 19-meter segment, including 21.28 g/t of gold over a 5-meter stretch. The strike length of the Mankouke South Discovery Zone (MS2) is 100 meters and remains open.

Part of a 400 square-kilometer land package, the Kandiole Project includes the key deposits of Kabaya and Mankouke South (MS1). Roscan has reported significant drilling successes in both areas. At Kabaya, Roscan has drilled 23 holes; each intersected mineralization. The holes reached a depth of 196 meters versus the previous drilling depth of 58 meters. Kabaya is open along strike and at depth. A drilling program remains ongoing.

At MS1, Roscan has intercepted significant areas with high-grade gold mineralization. Three major discoveries there include Kandiole North (a 1,500-meter gold mineralized strike length); Walia (a separate 1,500-meter strike length); and Moussala North (which displays wide, high-grade surface mineralization).

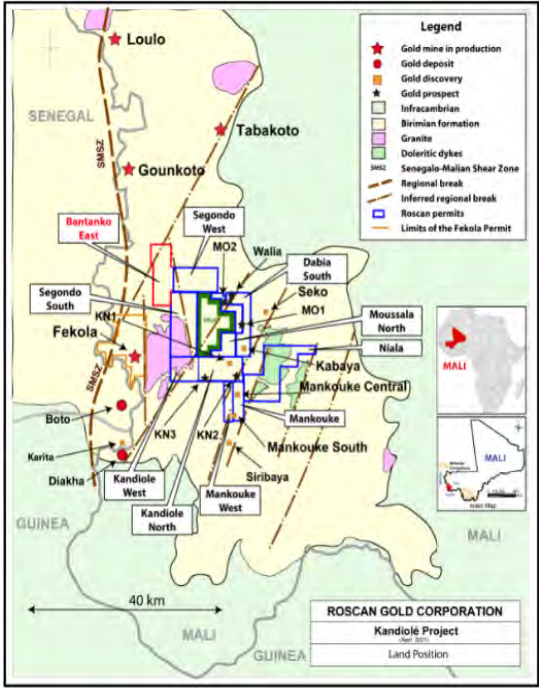

Roscan’s properties are located near a number of operating mines in Mali and, equally important, those mines are owned by much larger mining companies, including Barrick Gold, B2Gold and IAMGOLD. The figure below outlines the proximity of numerous operating mines relative to that of Roscan’s exploration property.

Roscan’s Cash Outlays Have Increased as It Ramped Up Drilling Programs

Roscan’s operating cash flow deficits increased noticeably beginning in the quarter ended July 31, 2020, as the company ramped up its Mali drilling programs. Its operating cash flow shortfall has averaged just over $6 million per quarter over the last three reported quarters versus only about $2 million during the prior two quarterly periods.

Roscan has addressed its cash requirements over the intermediate term by raising $15 million in an early April 2021 overnight public offering of common stock and warrants. This offering added to the company’s approximate $2 million cash balance as of January 31, 2021.

| (in thousands of Canadian $, except for shares outstanding) | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | ($7,001) | ($8,757) | ($8,451) | ($3,159) | ($2,035) |

| Operating Cash Flow | ($6,293) | ($5,995) | ($5,996) | ($2,494) | ($1,443) |

| Cash – Period End | $2,058 | $2,356 | $8,226 | $3,284 | $2,883 |

| Debt – Period End | $36 | $43 | $85 | $98 | $110 |

| Shares Outstanding (Millions) | 278.1 | 244.7 | 243.8 | 191.4 | 167.4 |

Roscan has made several positive drilling results over the last handful of months. If future results were to be less constructive, the company’s share price could be affected. Similarly, any significant decline in gold prices could also impact investor perceptions of Roscan.

Roscan has made several high-grade gold discoveries on its Mali, West Africa land package. In addition, at last four substantially larger companies operate mines in that region which are only 20-80 kilometers away. Roscan is likely to release a string of assay results from its drilling programs over the next few months, and if those announcements are constructive, the stock could continue to perform well.

Roscan Gold Corporation last traded at $0.58 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.