This afternoon, rumors started swirling that Canopy ($WEED) is looking to acquire Acreage Holdings ($ACRG.c). This deal would likely require regulations to be loosened by the exchanges or some very creative “lawyering”.

As Todd Harrison pointed out earlier, this deal would be difficult given that Canopy has an NYSE listing.

This👇 but how w NYSE listing?

— Todd Harrison (@todd_harrison) April 17, 2019

*CANOPY GROWTH IS SAID TO BE NEAR DEAL TO BUY ACREAGE HOLDINGS

-BBG

/position $CGC $ACRGF https://t.co/1uom3TPa9g

Melissa Lee from CNBCs Fast Money tweeted out the following:

BREAKING: Canopy is near a deal to buy Acreage Holdings. The companies were scheduled to hold a call tonight to finalize a deal. Acreage was not the only takeout target on Canopy's radar. DETAILS tonight @CNBCFastMoney , and what this means for US multi state operators.

— Melissa Lee (@MelissaLeeCNBC) April 17, 2019

Or perhaps, a wild idea. Canopy leaves the NYSE and TSX for the CSE. From the author of this post.

Wild idea. But if there were any truth to the $CGC / $ACRG.U rumours. Perhaps Canopy is looking at leaving the NYSE / TSX and moving over to the CSE…. Just a crazy idea…

— SmallCapSteve (@smallcapsteve) April 17, 2019

Updated: 8:50PM (4/17/2019)

Market Watch is reporting the deal would give Canopy “the right to buy Acreage,” which sounds very similar to the exchangeable share transaction Canopy did with Terreascend.

How it worked:

Canopy made an investment into a CSE cannabis company called Terrascend in Nov 2017.

11 Months later, Terrascend announced they would be entering the US.

To get around exchange rules (TSX/NYSE), Canopy agreed to convert their shares into exchangeable shares, effectively turning their investment into an “option” that converts back to common equity when cannabis is descheduled in the US.

The drawback to such a transaction, is during the period where the shares are exchangeable, Canopy has no voting power over their stock until it converts back.

It still has yet to be confirmed if Canopy is doing an exchangeable share transaction.

Reuter’s is reporting the following:

The deal is expected to fetch a premium of about 28 percent to Acreage’s five-day average trading price – or roughly 25 percent of its closing price on Wednesday, the source said.

The transaction could be announced as soon as later on Wednesday, the source said, but cautioned there is no certainty that the two parties will agree to any deal.

Updated: 9:00AM (4/18/2019)

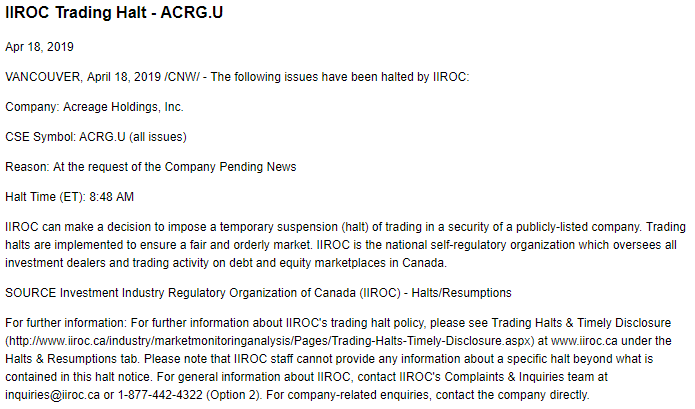

Acreage is halted. Pending company news.

Updated: 10:15AM (4/18/2019)

The deal was announced this morning by Canopy. It will be a US$3.4B right to purchase 100% of Acreage, for a US$300 cash payment to shareholder of Acreage. For a breakdown on the deal, see here.