On December 1st, Salesforce.com (NYSE: CRM) announced a definitive agreement to buy Slack (NYSE: WORK) for a total of $27.7 billion. Each Slack shareholder will receive $26.79 in cash and 0.0776 shares of Salesforce common stock for each Slack share, which translates to roughly $45.52/share.

This comes after a rumor on November 25th by a CNBC reporter saying that Salesforce has been in talks to buy Slack. On that day, Slack shares set their largest one day gain going up $11.15 or 37.7%, ending the day at $40.70. The buyout marked a ~53% premium to where the stock was trading before November 25th.

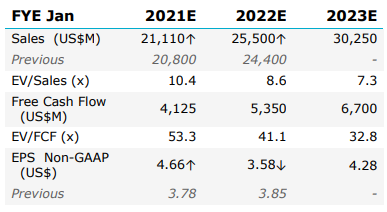

Salesforce currently has 43 analysts covering the company with a weighted 12-month price target of $275.97. This is down slightly from the average at the start of the month, which was $277.34. 11 analysts have a strong buy rating, while the majority, 24 analysts, have a buy rating. Seven analysts now have a hold rating compared to 3 last month, and one analyst has a sell rating.

David Hynes Jr, Canaccord’s SAAS Analyst, kept their 12-month price target at U$270 and reiterated their buy rating on Salesforce, headlining, “Taking another big bite, but organic growth forecast looks solid.”

He says that although investors might gripe about the $27.7 billion price tag or the 5% dilution that is coming their way, he suggests to investors to step back and take a look at the big picture. “Salesforce is in a pretty good spot. Solid performance in the quarter was generally broad based across clouds, and management suggested that the pipeline continues to be encouraging – this is surely supported by a willingness to guide five quarters out.”

He adds that Slack is filling a gap for the company and is, “providing a collaborative system of engagement that avails a front end to connect Salesforce’s services, essentially creating an operating system for growth that is more relevant than ever given the pronounced shift to work-from-anywhere.”

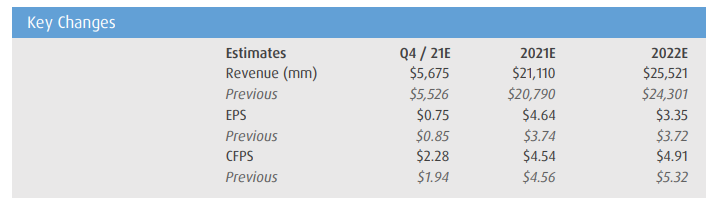

Full year estimate adjustments made by Canaccord can be found below.

On another note, David Hynes Jr did downgrade Slack’s rating to a hold but moved their 12-month price target up to U$45. The reason he gives for this is, “Given that we now view WORK as an arbitrage play, we are downgrading the stock to HOLD and increasing our target price to $45, a final value that will be at least partially susceptible to changes in CRM stock price.”

In BMO’s note, Keith Bachman, BMO’s software analyst, elected to keep their $285 12-month price target and Outperform rating on Salesforce. Bachman says that they have previously written about their support for Salesforce to acquire Slack, “as we don’t think that current in-house collaboration tools like Quip and Chatter have generated great traction.”

He says that roughly 90% of Slacks enterprise customers are also Salesforce customers, and they believe that customers will see added value from a deeper integration of Quip and Chatter. They also anticipate that Slacks data will be leveraged into Salesforce’s Customer 360 and Einstein.

Below you can see the adjustments made to BMO’s 2021 and 2022 estimates.

Daniel Ives, Wedbush’s analyst, also did not change their outperform rating or $300 12-month price target on Salesforce. He says that the core reason for Salesforce to make this acquisition is to keep pace with Microsoft, which has the other cloud services Azure/Office 365 and Teams, which “has dominated the cloud over the past few years and accelerated its growth during this COVID backdrop. “

He makes light that Benioff talked down the idea of any M&A 3 months ago. Now they are making one of the largest deals ever and says, “Street is left a bit frustrated and we believe the stock will be in the penalty box/range bound until investors start to get more comfort with the rationale and cross-selling potential around this deal.”

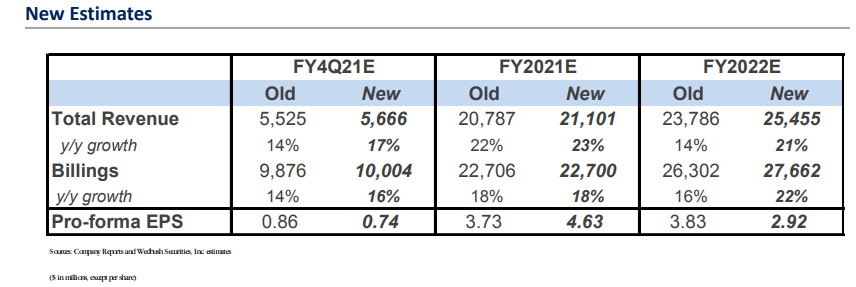

Ives believes that this acquisition is akin to a “long-term gain poker move for Benioff & Co. in hopes of further building out its product footprint and competing with Redmond in the cloud wars.” Wedbush’s new estimates can be found below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.