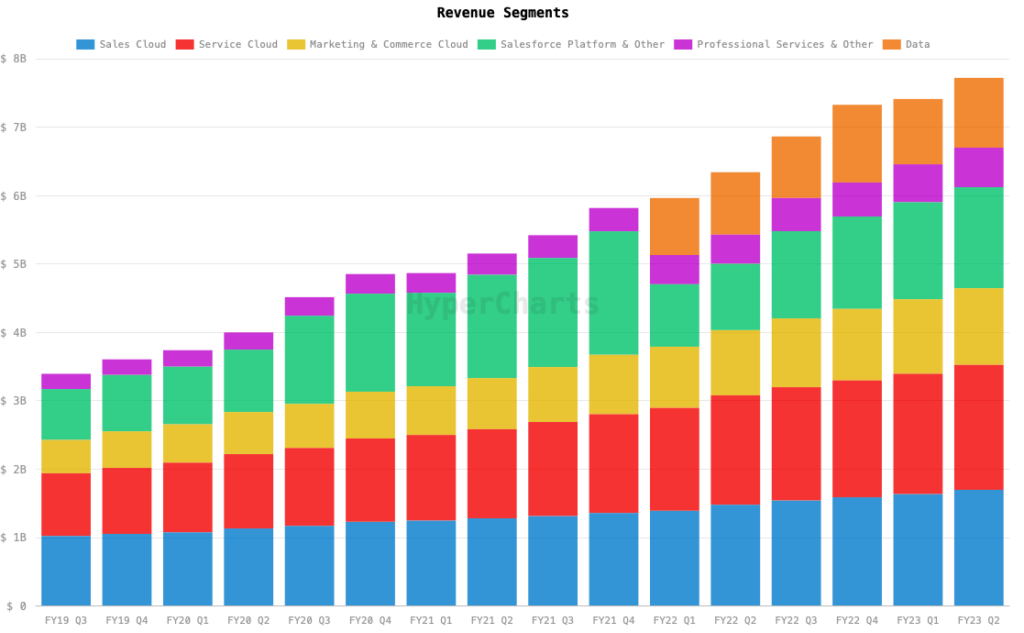

Salesforce (NYSE: CRM) reported on Wednesday its financial results for fiscal Q2 2023, highlighting revenue of US$7.72 billion. This is an increase from Q1 2023 revenue of US$7.41 billion and from Q2 2022 revenue of US$6.34 billion.

“Our results demonstrate the strength and diversity of our product portfolio across regions, industries and segments,” said Co-CEO Bret Taylor. “In this more measured buying environment, our Customer 360 portfolio is even more strategic and relevant as our customers focus on productivity, efficiency and time to value.”

The topline revenue figure also beat the street estimate of US$7.70 billion.

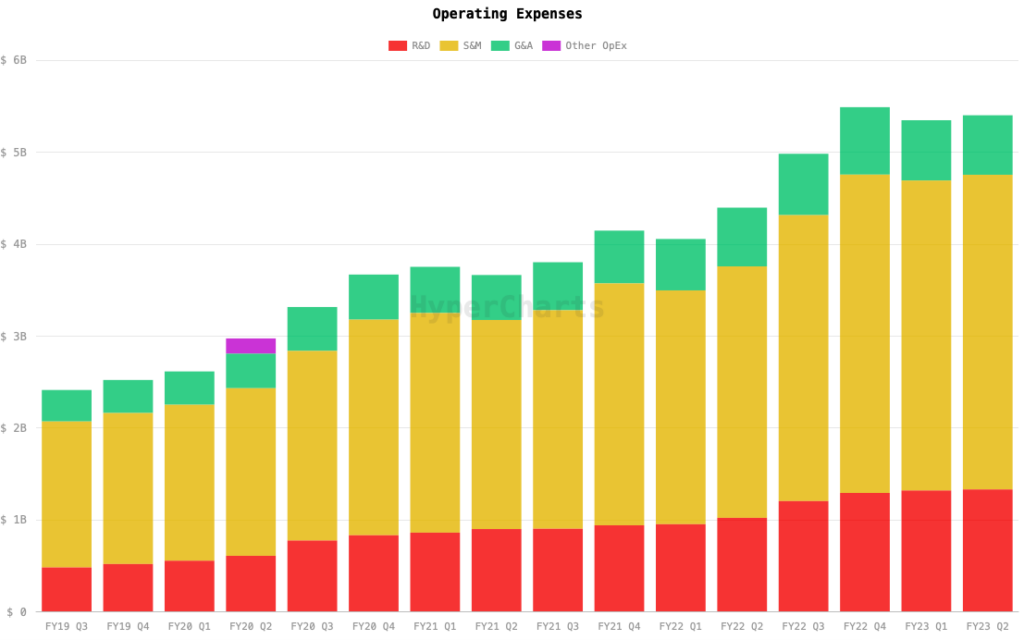

However, the company recorded a higher operating expenses compared to last year, leading to a lower operating income of US$193 million compared to previous year’s US$332 million. But the quarterly figure is an increase from last quarter’s US$20 million operating income.

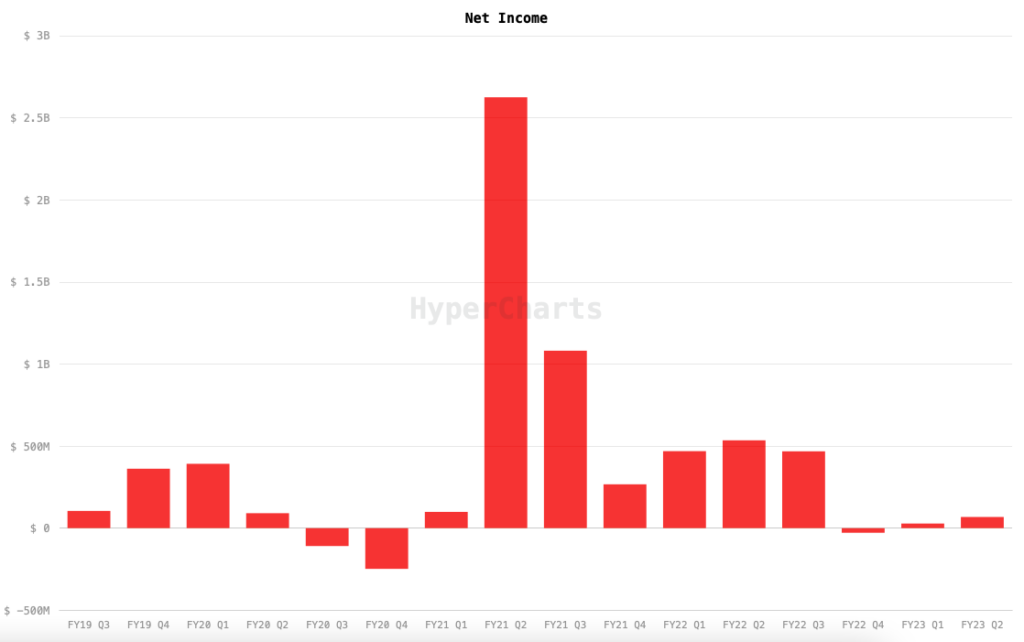

Quarterly net income came down to US$68 million from last quarter’s US$28 million and last year’s US$535 million–the year-on-year decline can be attributable to the US$526 million net gain on investments recorded last year. The bottomline figure translates to US$0.07 earnings per share.

Adjusting for financial items–including an US$851 million stock-based compensation–non-GAAP net income came down to US$1.19 billion, also down from last year’s US$1.40 billion. Non-GAAP EPS also came in at US$1.19, beating the consensus US$1.03 per share.

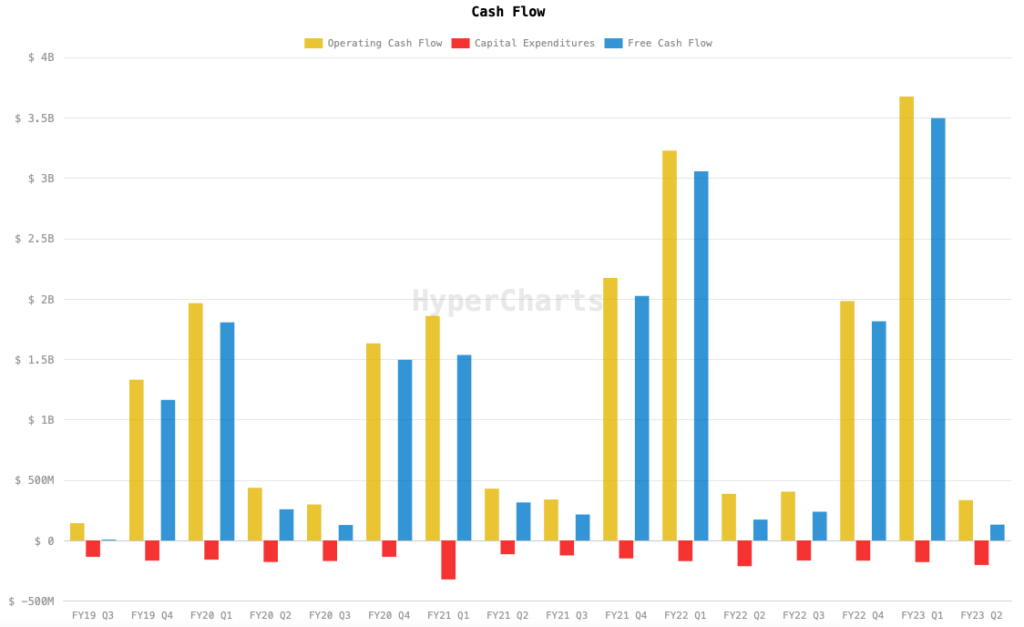

The firm also generated US$334 million operating cash flow during the quarter, spent US$203 million in capital expenses, and ended with US$131 million in free cash flow. This is a decline from last quarter’s US$3.68 billion in operating cash flow and US$3.50 billion in free cash flow, as well as last year’s US$386 million in operating cash flow and US$173 million in free cash flow.

The quarter’s operating cash flow missed the consensus US$645 million.

The firm ended the quarter with US$6.93 billion in cash and cash equivalents, putting the company’s current assets at US$21.25 billion. Meanwhile, current liabilities came in at US$20.08 billion.

The CRM company also announced its US$10 billion share buyback program, albeit no details have been intimated yet by the firm.

“[We’re] thrilled to initiate our first-ever share repurchase program to continue to deliver incredible value to our shareholders on our path to $50 billion in revenue in FY26,” said Board Chairman Marc Benioff.

For fiscal Q3 2023, the company is estimating revenue to land between US$7.82 and US$7.83 billion while non-GAAP earnings per share to came in US$1.20 – US$1.21. The estimates are below the consensus means of US$8.05 billion and US$1.29 for revenue and adjusted earnings per share, respectively.

For full-year 2023 guidance, the firm is looking at revenue to come between US$30.9 – US$31.0 billion, anticipating around US$800 million impact from foreign exchange. This also misses the consensus US$31.74 billion in revenue.

The firm has generated US$15.13 billion in revenue for the first six months of the fiscal year.

Salesforce last traded at US$167.42 on the NYSE, slumping nearly 7% in early morning trading.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.