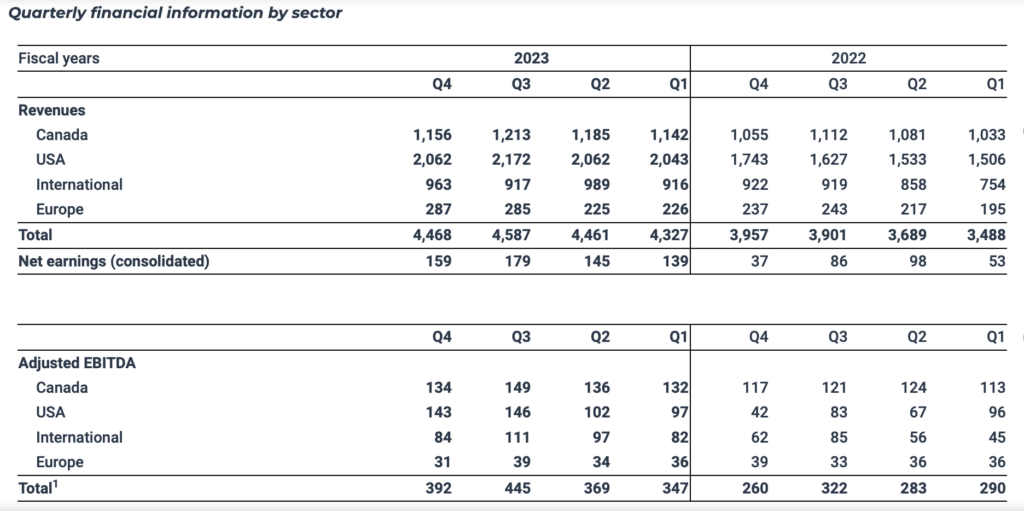

Saputo Inc. (TSX: SAP) reported its fiscal Q4 2023 financials, topbilled by a quarterly revenue of $4.47 billion, up from Q4 2022’s $3.96 billion.

“We delivered a solid performance in the fourth quarter, notably through pricing initiatives, strong international markets, and favourable commodity prices. We also made progress across our supply chain which allowed us to further improve our ability to supply our customers, notably in our USA Sector,” said CEO Lino Saputo.

The firm said revenues saw a notable increase thanks to strategic pricing measures across all sectors. This boost was driven by favorable fluctuations in the average block market price and average butter market price in the USA Sector, along with higher prices in the international cheese and dairy ingredient markets.

The firm’s net earnings jumped to $159 million from $37 million a year ago. This translates to $0.38 earnings per share.

Calibrating for select financial items, adjusted EBITDA and adjusted net earnings came in at $392 million and $196 million, respectively. Both are increases from the comparable period last year, which posted $260 million in adjusted EBITDA and $108 million in adjusted net earnings.

Adjusted earnings per share came in at $0.47 per share.

“Although the current macro backdrop remains challenging, we expect a year of organic growth in fiscal 2024, with a focus on expanding our adjusted EBITDA1 margins, maximizing our cash flow, and driving operating leverage,” Saputo added.

The adjusted EBITDA showed significant improvement, primarily led by the USA Sector’s impressive performance, according to the firm. The USA Sector contributed $2.06 billion in revenue and $143 million in adjusted EBITDA.

The firm generated operating cash of around $421 million in the three-month period, compared to $184 million generated in the year-ago period. The company ended the quarter with a cash balance of $263 million.

Current assets landed at $4.85 billion while current liabilities ended at $3.00 billion.

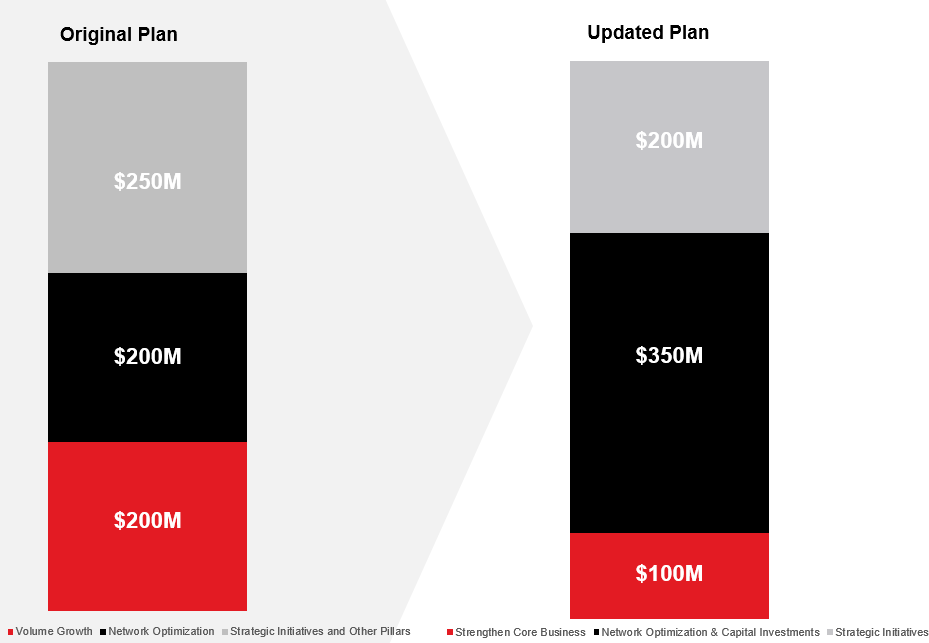

Saputo also reaffirmed its target of achieving $2.125 billion in adjusted EBITDA by the end of fiscal 2025. This represents a significant increase of $650 million from the fiscal 2021 baseline.

The firm also expects additional network optimization initiatives to contribute approximately $350 million to the projected growth in adjusted EBITDA, after it has realized additional opportunities for network optimization in line with its Global Strategic Plan. Furthermore, strategic initiatives are anticipated to contribute approximately $200 million, while investment on its core business is expected to add $100 million.

“Our solid foundation will serve us well as we continue to make progress on unlocking the full earnings potential of our Global Strategic Plan,” the chief executive added.

Saputo last traded at $34.82 on the TSX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.