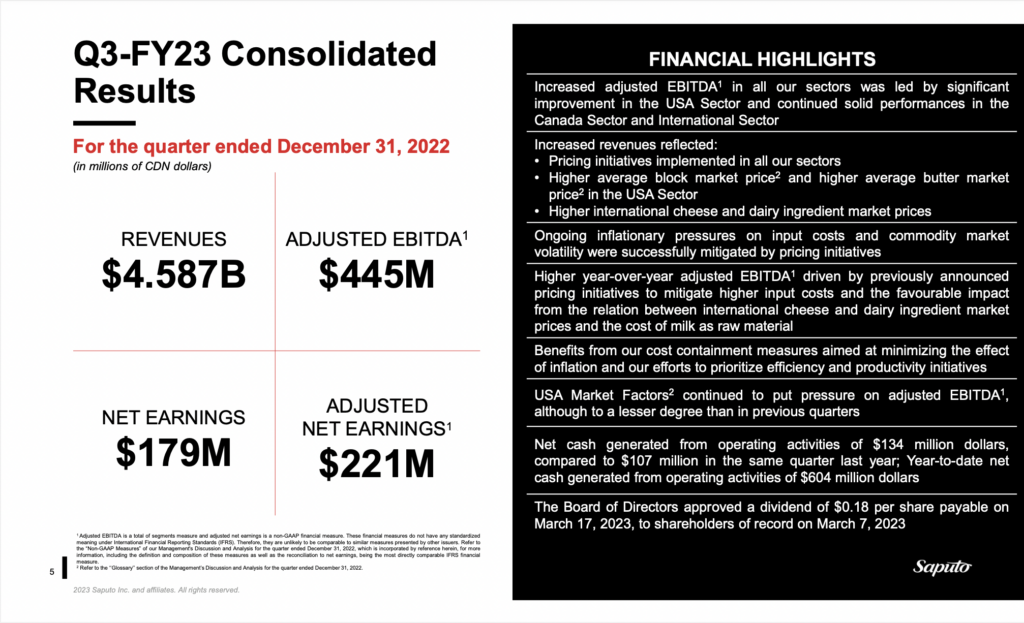

Saputo Inc. (TSX: SAP) said Friday that its profit more than doubled in the most recent quarter due to increased prices, improved production, and robust sales.

The Montreal-based dairy processor, which manufactures popular brands such as Armstrong cheese, Scotsburn ice cream, and Baxter, Neilson, and Dairyland milk, reported $4.6 billion in revenue for its fiscal third quarter of 2023 ended December 31, 2022–up 17.6 percent from $3.8 billion the previous year.

“Consolidated revenues increased to 18% versus the prior year due to both inflation driven price increases and improvements in our ability to supply ongoing demand,” CEO Lino Saputo said in the earnings call. “Our focus on inflation driven pricing actions and on operational improvements position us well from a margin perspective going forward.”

Meanwhile, net earnings for the third quarter were $179 million, more than doubling the $86 million reported the previous year. This translates to $0.43 earnings per share, also up from last year’s $0.21.

The firm’s shares rallied on Friday following the earnings call, jumping by 5.3% and outperforming the TSX index.

Adjusted EBITDA for the third quarter of fiscal 2023 totaled $445 million, an increase of $123 million or 38.2% over the same time previous fiscal year.

“We continued to benefit from previously announced pricing initiatives implemented to mitigate higher input costs, such as consumables, packaging, transportation, and fuel, in line with ongoing inflationary pressures and commodity market volatility,” the company said in its financials.

The dairy processor also reiterated this quarter that they “will implement further price increases as deemed necessary, as part of [its] pricing protocols, if inflation continues to persist.”

In the Canadian division, Saputo saw a 9% year-on-year increase in revenue contribution from the market, adding that they recorded “solid year-over-year results despite challenging market conditions relative to labour and inflation.”

“What I would say in Canada in particular, is that, from a timing perspective, what we’re seeing is operational efficiencies benefiting also from prior initiated projects,” Saputo said. “We’re also seeing a shift in channels so the food service sector recovered very well in calendar 2022 here, and from an overall business, that was favorable to us, from a margin perspective as well.”

The chief executive also noted that “the Canadian team fared better, certainly than the American division with regards to labor attraction and retention,” adding that there were smaller gaps in vacancies.

Carl Colizza, President and COO, North America, also noted that while price increases have been prevailing in the industry, it did not have a negative impact on their sales volume.

“Pricing and the pricing actions that we have taken has not negatively impacted demand from the marketplace,” Colizza said.

He qualified that the firm is “back on track” in the cheese sector and demand actually “continued to increase materially” on the dairy side.

“We’ve taken the necessary pricing actions across our portfolio as needed and I would say that we’re effectively, I will use the word caught up at this point. And I also want to qualify that we’ve done everything we can and we continue to do everything we can to mitigate costs as they come through and before we think of the pricing actions,” Colizza added.

The Canadian Dairy Commission was recently set to implement a 2.2% increase in the farm gate milk price following their annual review conducted in October 2022. This translates to $0.0174 per liter.

The minor increase comes alongside an online video trending about a Southern Ontario dairy farm operator showcasing how the facility had to dump their milk production in excess of their quota due to federal regulation on supply management.

The video stirred widespread attention from Canadians at a time when milk retails for as much as $7 per liter for some brands.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.