The Bank of Nova Scotia (TSX: BNS) has been fined by the US Department of Justice along with the Commodity Futures Trading Commission on the basis of metals market manipulation. An aggregate fine of US$127.5 million has been issued as payable to the two entities as a result of the metals market manipulation which is said to have occurred over a number of years.

Additionally, $17 million of that fine is related to the firm intentionally misleading investigators within the initial investigation that was conduced. The fines are the result of an investigation into the metals trading division of the bank, which was closed down earlier this year.

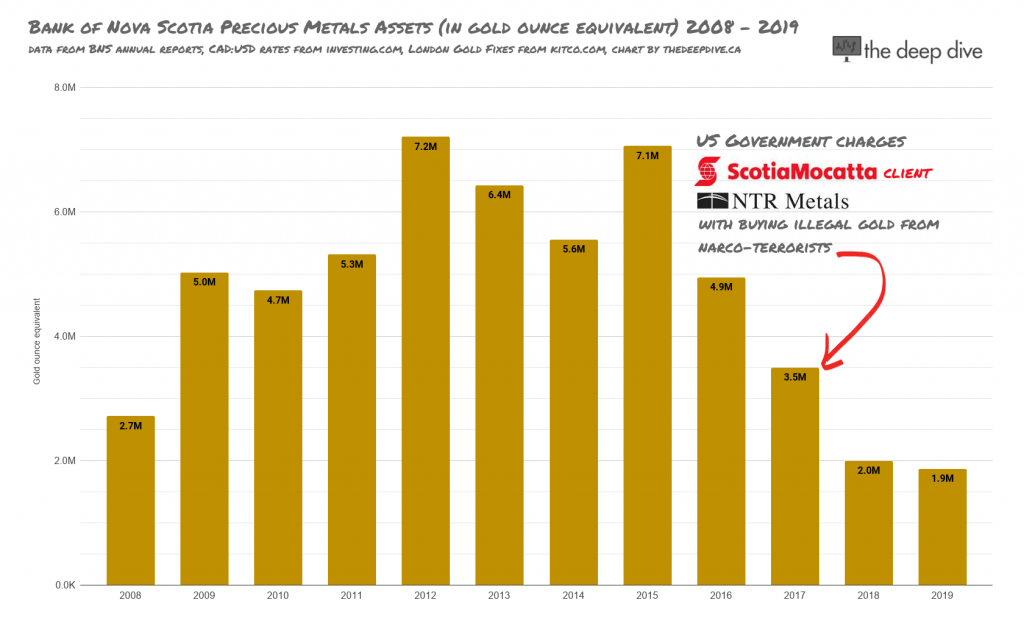

The charges allege that between January 2008 and July 2016, on “thousands” of occassions, four traders with Scotiabank placed orders to buy and sell precious metals contracts which were then cancelled before being filled, referred to as spoofing. Such an act can create the false illusion of demand or supply to other traders, thereby manipulating the price action seen on the metals.

The fines are to be paid by monies set aside by the bank when it first announced the winding down of its metals division, of which a total of $232 million was allocated for potential penalties along with the winding down of the operation.

The Bank of Nova Scotia last traded at $56.56 on the TSX.

Information for this briefing was found via Bloomberg and The Bank of Nova Scotia. The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Banks and corruption kind of go together, don’t they ? 127.5 mil is a drop in the bucket. What does the judge get ?