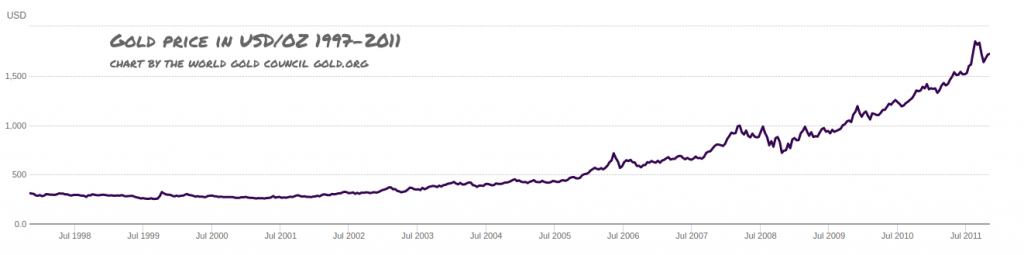

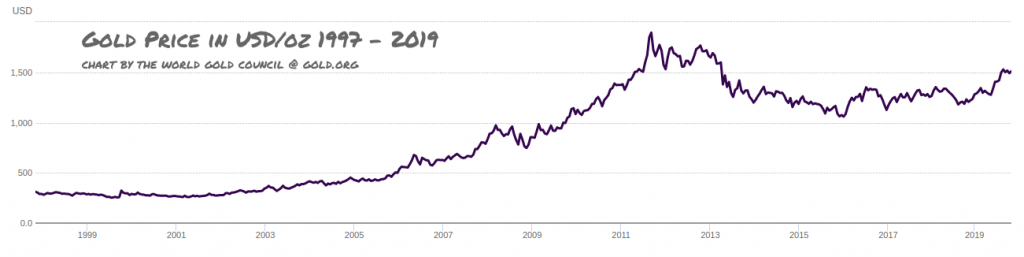

As the price of gold continued its run at all-time highs, fueled by overheated printing presses at central banks and the collective metabolism of a gold bug community dangerously close to paying off an “I-told-you-so!” 40 years in the making, Canada’s only charter bank with a precious metals business is shutting it down in the midst of a class action lawsuit and a newly launched apparent criminal investigation that they assure us are completely unrelated.

The Financial Post reported April 28th that The Bank of Nova Scotia (TSX: BNS) told employees it would be shuttering its precious metals business. It seemed sudden and odd at the time, but started to make more sense last Friday when reports emerged that US regulators were pursuing active investigations into the Scotiabank’s metals trading division. The probes are being continued by the Commodities and Futures Trading Commission, and the US Department of Justice, which suggests criminal activity is being looked into, and that sounds more like the Scotiabank we know.

The Scotia Metals Bank that Was

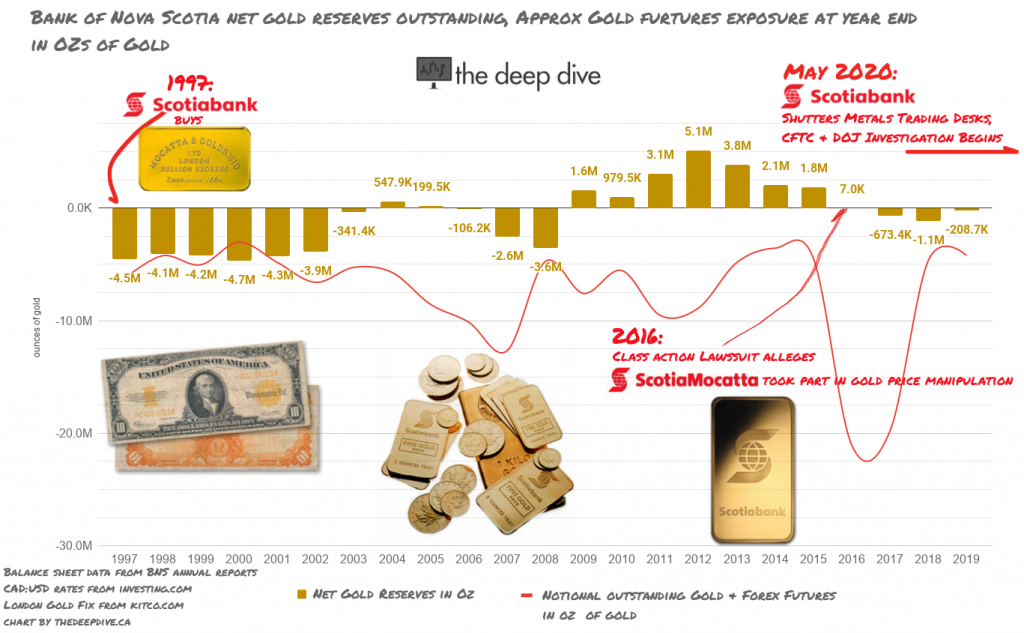

At the end of the 2011 fiscal year, with gold trading at all time highs of $1,800/ounce, Scotiabank’s acquisition of historic bullion merchant Mocatta Bullion in 1997 was paying off handsomely. “ScotiaMocatta” metals traders boasted global offices in New York, London, New Delhi, Hong Kong and Singapore. The bullion banking business provided credit, hedging, order facilitation and so on to both producers and consumers of precious metals. The 2011 gold market was full of speculators in industrial finance as well, and Scotiabank looked pretty smart having bought its way into the epicenter of gold banking.

The Fix

One of the perks that comes with being at the center of the gold world is the ability to fix the gold price. It’s various banks. The London Gold Fix is effectively a market making process in which the representatives of various London bullion bankers simulate a market based on the orders on their book to arrive at a gold price they can publish. It happens twice a day, and you can read more about it here. A tiny bank from Halifax having a seat at that table was a significant marker in Canadian finance and Canadian gold. It put a part of the resource-based country’s economy in a literal seat at the table on a global scale.

Surely, management in Halifax was less pleased when, in 2016, class action lawsuits accused Scotiabank and all of the other banks who contributed to the consensus benchmarking of manipulating the gold price. Of course they were manipulating the gold price! What’s even the point of participating in the “London Gold Fix” if a bank can’t manipulate the gold price?

Scotia put the 340 year old bullion bank that it had spent two decades building up for sale in 2016, but nobody was interested.

Dwindling Reserves

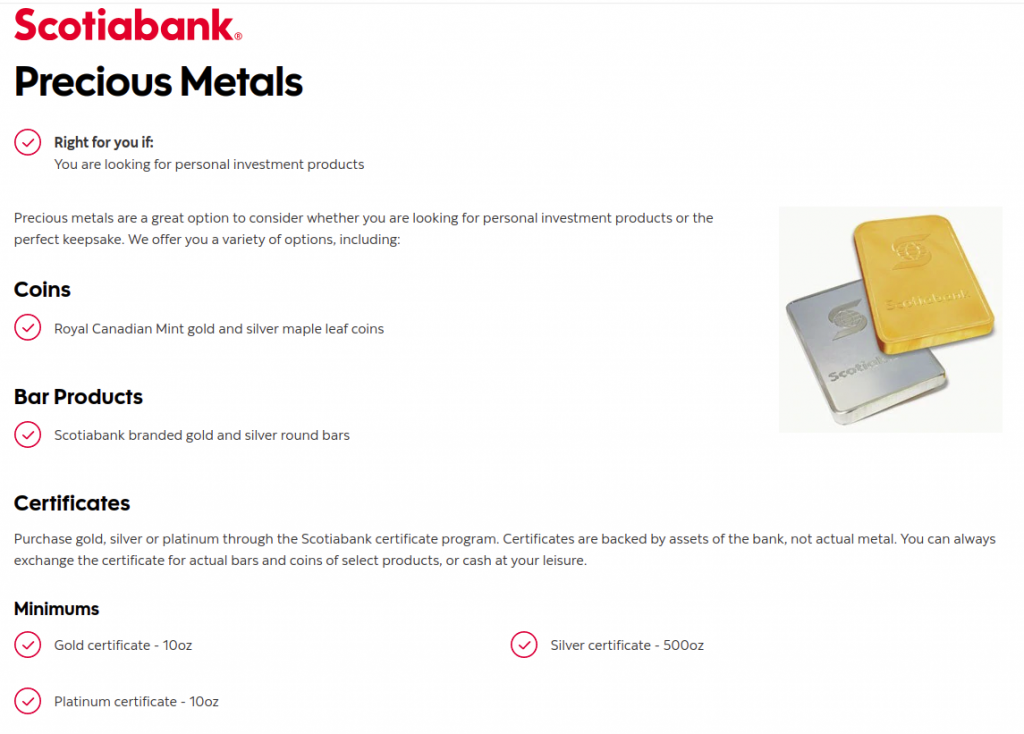

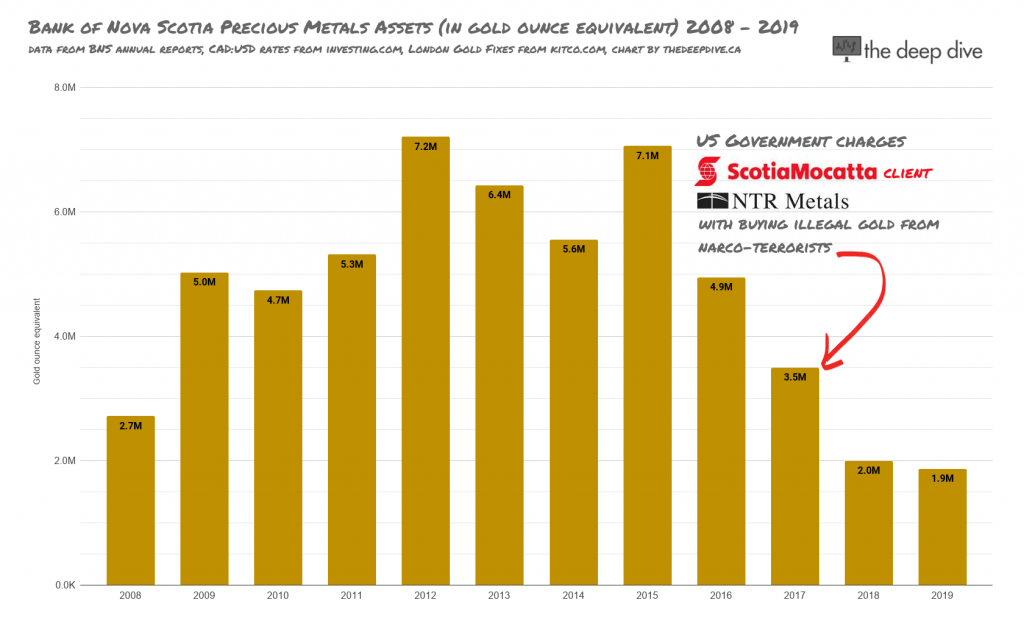

Banking with gold, much like banking with money, is the art of being good for it. Scotia holds physical gold reserves, and sells gold certificates to consumers who want to own gold, but aren’t picky about whether or not that particular gold exists.

This is a chart of Scotia’s net gold reserves; its precious metals assets less its gold and silver certificate liabilities, expressed in ounces of gold, at the price on the date the reserves were published. It indicates that the bank developed a sudden interest in net positive physical gold reserves in 2009, built that reserve base through 2012, then lightened up its net reserves just as the gold bull market rolled over into a multi year decline.

In 2016, with barely any physical metal in its vault, Scotia’s outstanding gold futures derivative liability spikes, as it shows a distinct organizational inclination towards gold contracts that can be settled in paper.

Scotia didn’t buy gold DIRECTLY from the Peruvian narco-terrorists…

Most of the gold traded by chartered banks is traded by contract. But most chartered banks don’t have a metals trading division. Institutional investors are generally happy to have their trades settled on paper, but commercial buyers who make jewelry, industrial wiring, etc. expect to get the goods.

And, like any good gold merchant, Scotia has physical suppliers as clients that they can match with physical consumers. Low or negative reserves don’t matter if the physical settlement can be sourced from a client.

Federal charges were filed against Dallas-based smelting company and Scotiabank client NTR Metals for having purchased gold smuggled illegally from South America in March of 2017. About a year after the price fixing class action was filed against Scotia and its peers. At the end of 2017, Scotia had a net negative gold position and was trying to sell its precious metals business without much success. The gold biz got way too real, way too quickly for bankers in general, and none of them wanted the headache.

How hard could it be to launder dirty gold? What’s to stop any gold smelter from adding black market ounces to its legit bullion casts? And why would the DOJ go after a thousand smugglers moving it by the ounce, when they could go after the central hub, a gold bank that buys and sells it by the ton? The “I was just a financier!” defense doesn’t have a history of going over very well in international smuggling cases.

Gold bugs have been ringing the alarms about banks manipulating the gold price for so long that it’s become a kind of background noise that nobody even hears anymore. The London Gold Fix method used today – supposedly cleaned up to prevent bankers from colluding with each other – is still ripe for abuse, and nobody seems to care. Scotia and its peers got away with that sort of thing for as long as they did, because when the physical gold had to show up, it always did. It could be that, as Scotia’s metals business unwound its reserves, it had to move further and further towards the bottom of the barrel to arrange for physical delivery.

If the recent surge in the gold price was coming from speculators, it would stand to reason that Scotia would be able to find a bid for parts of the business it’s shuttering, but that doesn’t appear to be the case. That might indicate that, finally, the buy-side driving the gold price is coming from investors with a long-term outlook. No well-indoctrinated gold bug buys their gold in certificate form or on the futures market. Even physical, allocated exchange traded funds like the Sprott Physical Gold and Silver Trust (TSX: CEF) get sneered at by true devotees, who prefer the kind of ounces that they can bury in the back yard until the rest of the world finally gets it.

More on the nuts and bolts of the Elemental/NTS Metals collapse from metalhead Joshua Gibbons over at Coinweek.

Information for this briefing was found via Bloomberg, Coinweek, The Chronicle Hearld and The Bank of Nova Scotia. The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

5 Responses

I have 2 silver certificates from Scotia Bank bought in 2010 and 2011.

One is for 500 ounces, and the other is 1000 ounces. How can I redeem them for cash?

Did you ever figure out how to redeem your certificates? My father is in the same boat.

I have certificates from scotiabank

How do we redeem?

Do you know how to redeem them ?

please let me know

I have a lot of silver certificates from Scotiabank

You might look at Indira Samarasekera and her role in Jatin Mehta’s $1 Billion missing Gold payment, her role in Magna Inc. (Austrian Canadian) Frank Stronach and race horse breeding. The Canadian Wirecard AG Asia ($2.1 Billion Philippines missing) buyer Canadian Entrepreneur who likes breeding race horses and the Sri Lanka part in the Bangladesh Central Bank heist (Philippines fronts) and the attempted $80 million laundry operation there.

Then see how it relates directly to Canada.Directly.