Already closed shop and planning to return money to its investors, hedge fund firm Melvin Capital Management is still being hounded by ghosts of meme-stocks past.

The US Securities and Exchange Commission is reportedly launching an investigation into the former investment management firm on how it well communicated risks controls and disclosures to its investors in January 2021, according to information intimated to The Wall Street Journal by people familiar with the matter. The regulatory body is said to be conducting interviews with Melvin Capital investors inquiring about what the hedge fund founder Gabriel Plotkin and fellow executives told them about the meme-stock rally and the consequential fundraising that followed.

The agency also has obtained Melvin Capital’s general communication materials to its investors at the time and is on a mission to figure out if the risks disclosures communicated to clients about the firm’s investment strategy were sufficient.

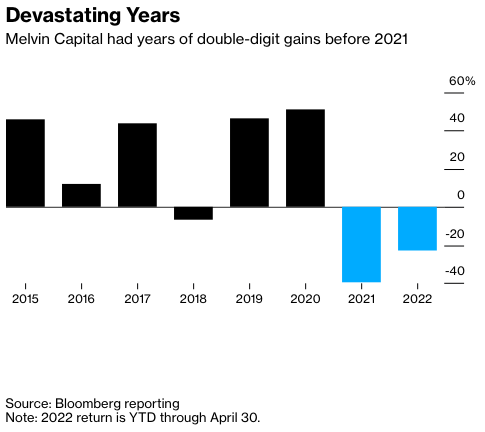

Back in January 2021, Melvin Capital lost around US$6.8 billion after retail investors targeted the firm’s short positions–at one point, losing US$1 billion a day. The hedge fund’s short position in GameStop in particular resulted in more than 139% of existing shares of the gaming company being shorted, making its stock the most shorted equity in the world.

In an attempt to “soldier on”, Melvin Capital raised fresh a US$2.75 billion from Ken Griffin’s Citadel and Steven A. Cohen’s Point72 Asset Management in exchange for a non-dilutive share of its revenues. After the squeeze, the hedge fund was able to gain back some of the losses but wasn’t really able to breakeven from its short positions. It also made additional losses from its growth stocks positions when these were sold off in a market rout in early 2022.

In May 2022, Plotkin announced that Melvin Capital will be closed down and plans to return the money to its clients. At that time, the firm’s was managing around US$7.8 billion in assets with its clients losing around 57% of their initial investments.

Information for this briefing was found via The Wall Street Journal, Bloomberg, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.