Sigma Lithium (TSXV: SGMA) appears to be the latest target in the lithium space, with rumours put out by Bloomberg this evening that electric vehicle manufacturer Tesla (NASDAQ: TSLA) is weighing a takeover of the company.

The rumour has been attributed to “people with knowledge on the matter,” stating that Elon Musk has been “speaking with potential advisers about a bid.” Sigma however is said to not be the only firm that Tesla is considering acquiring.

Brazilian private equity fund A10 Investimentos, a 46% owner of Sigma, is said to have been exploring the potential for a sale of the company while taking interest from both miners and carmakers alike. Discussions with Tesla meanwhile are said to be in the early stages and may not yet result in a transaction occurring.

Representatives for Tesla are said to have not responded to Bloomberg or Reuters in relation to the matter. Sigma Lithium meanwhile declined to comment on rumours.

Sigma’s lithium asset

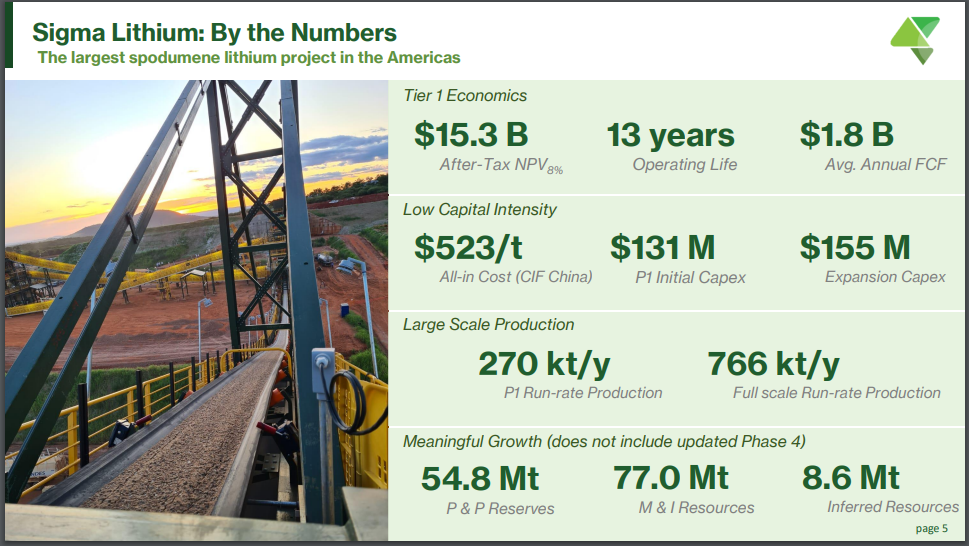

The primary asset being developed by Sigma Lithium is its Grota do Cirilo property, which is said to be the largest lithium hard-rock asset in the Americas. Battery-grade lithium concentrate has been in production since 2018 at the project at a pilot-scale, with phase one production slated to result in 36,7000 tonnes of lithium carbonate per year.

The first phase of production, the development of which is said to be fully funded, is expected to have an operating life of 13 years and is expected to result in average annual free cash flow of $1.8 billion. Phase one production is slated to begin in April, with feasibility studies and detail engineering for the second and third phases targeted to be completed in the first quarter of 2023.

General Motors move into the space

Tesla’s potential move to acquire Sigma Lithium follows General Motors’ (NYSE: GM) lead in terms of automakers taking a leading role in securing raw battery materials. GM earlier this month revealed that it would be making a $650 million in Lithium Americas (TSX: LAC) and their Thacker Pass project in Nevada.

READ: Lithium Americas To Receive $650 Million Investment From General Motors

General Motors agreed to invest those funds in two tranches, the first of which closed earlier today, with its investment part of a deal to secure an off-take deal related to the phase one production of the mine, once final approvals and construction is completed. The off-take arrangement outlines that GM will have exclusive access to lithium carbonate produced in the first phase of production, which is estimated to amount to 30,000 tonnes per year.

General Motors meanwhile is said to also be mulling taking a stake in the Brazilian nickel miner VALE, which could amount to up to a 10% interest in the miner.

Sigma Lithium last traded at $39.84 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.