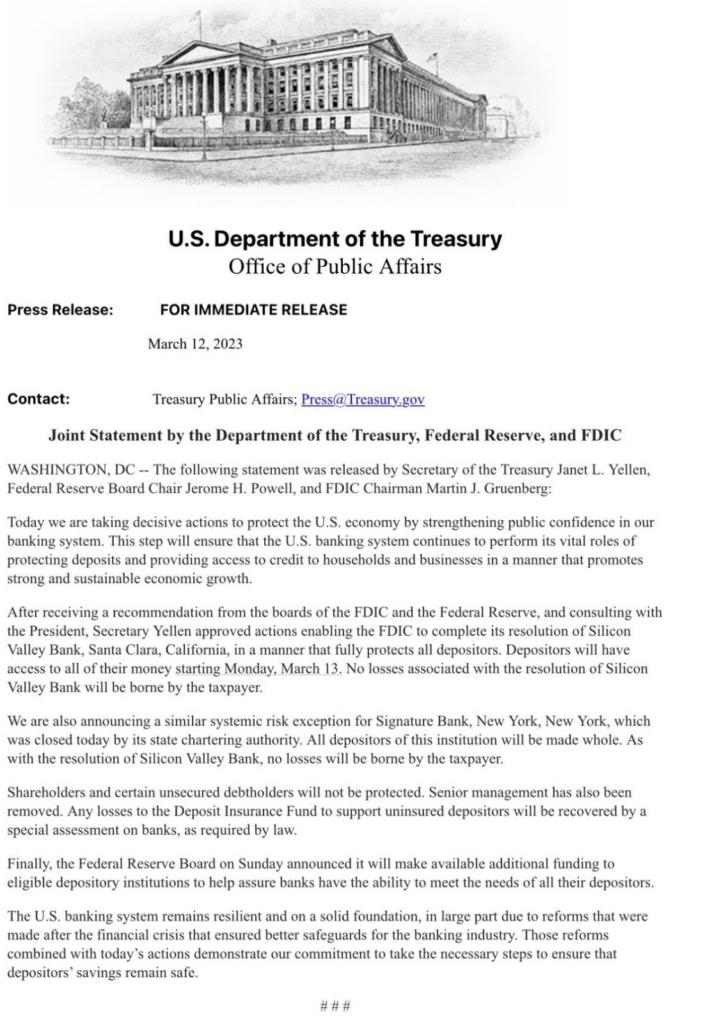

The US government has moved to protect depositors of Silicon Valley Bank (NASDAQ: SIVB) following the forced closure of the bank by the California Department of Financial Protection and Innovation. The measure was announced this evening in a joint statement by the Department of the Treasury, the Federal Reserve, and the FDIC.

At the same time, it was revealed that Signature Bank (NASDAQ: SBNY) has been shuttered by the state chartering authority, with the same “systemic risk exception” being granted for its depositors, whom will also be made whole.

It has been claimed that no losses associated with the resolutions will be borne by the taxpayer.

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth,” said the agencies in making the announcement.

Senior management is said to have been removed from the banking institutions, while any associated losses to support uninsured depositors will be recovered by a special assessment on banks – which no doubt will be passed on to consumers via higher fees. The Fed meanwhile is said to be making available additional funding to depository institutions to ensure they can meet the needs of depositors.

Shareholders and “certain” unsecured debtholders meanwhile will not be protected by government action.

The decision for the government to support deposits follows a weekend whereby the likes of David Sacks, a self-professed “libertarian,” and Bill Ackman, a hedge fund manager, whined on social media about the need for the government to cover the losses of millionaires whom had funds tied up at the bank.

If the Fed doesn’t protect deposits at SVB, will you feel more compelled to move your money to a Big 4 bank (JP Morgan Chase; Citi; BofA; Wells) out of an abundance of caution?

— David Sacks (@DavidSacks) March 11, 2023

If Russia wanted to destroy or materially impair 65k of our most promising new technology and biotech companies, there is no better method than a cyber attack that blows up @SVB_Financial with the @FDICgov not guaranteeing deposits. The irony is that we did it to ourselves. https://t.co/Gl9Rr6HvXc

— Bill Ackman (@BillAckman) March 11, 2023

Depositors meanwhile are slated to have access to their funds as of Monday.

Information for this briefing was found via Edgar, FDIC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.