Investors sold shares of SVB Financial Group (Nasdaq: SIVB) and other US banks after the tech-focused lender reported it lost about $2 billion selling assets due to a larger-than-expected decrease in deposits.

SVB announced late Wednesday that it will book a $1.8 billion after-tax loss on investment transactions and seek to raise $2.25 billion through the sale of a mix of common and preferred stock.

In 2021, the bank’s assets and deposits nearly increased, with SVB investing heavily in US Treasury bills and other government-backed debt products. The Federal Reserve soon began hiking interest rates. This hammered the tech startups and venture capital firms that Silicon Valley Bank services, causing a faster-than-expected decrease in deposits that is still gaining traction.

Customers’ “cash burn” increased in February, causing deposits to fall short of expectations, according to CEO Greg Becker in a letter to investors. When combined with rising capital costs, this puts pressure on margins and income, he says.

In response, SVB stated that it plans to raise more than $2 billion, with $500 million coming from private equity company General Atlantic and $1.75 billion coming from a public equity offering.

Now SVB is planning to sell $2.3 billion in shares to cover the bond losses.

— Genevieve Roch-Decter, CFA (@GRDecter) March 9, 2023

The stock crashed 54% today, for many reasons.

Mainly, SVB is scrambling to shore up liquidity.

That’s worrisome.

And selling shares to potentially cover losses on investments is a huge red flag. pic.twitter.com/tXBsrg2PPq

In addition, the corporation liquidated the majority of its securities portfolio, collecting $21 billion, which it intends to reinvest in shorter-term debt while tripling its term borrowing to $30 billion.

“We are taking these actions because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients,” Becker said. “When we see a return to balance between venture investment and cash burn – we will be well positioned to accelerate growth and profitability.”

Becker clarified that SVB is “well capitalised”.

SVB also released updated outlook estimates, predicting a “mid-thirties” percentage reduction in net interest income this year, up from the “high teens” drop predicted seven weeks ago.

It now expects net interest margins to decrease to 1.45-1.55% this year, down from 1.75-1.85% in January.

Compounding the concerns, The Information reported that at least four SVB clients have been informed wire transfers may be delayed, and the bank’s support phone lines were recently unavailable. Some customers reported difficulties accessing the company’s website to examine their account details and make transfers.

One founder who spoke with an SVB customer service representative Thursday afternoon claimed the bank’s “systems are down, wires are backed up, and there’s no way for me to login right now or for them to help me” wire money over the phone.

Several wires were successfully transmitted, according to other clients, throughout the day. Meanwhile, other banks such as JPMorgan attempted to persuade some SVB customers to transfer their funds.

SILICON VALLY BANK TOLD SOME CUSTOMERS MONEY TRANSFERS ARE 'BACKED UP': INFORMATION

— FXHedge (@Fxhedgers) March 9, 2023

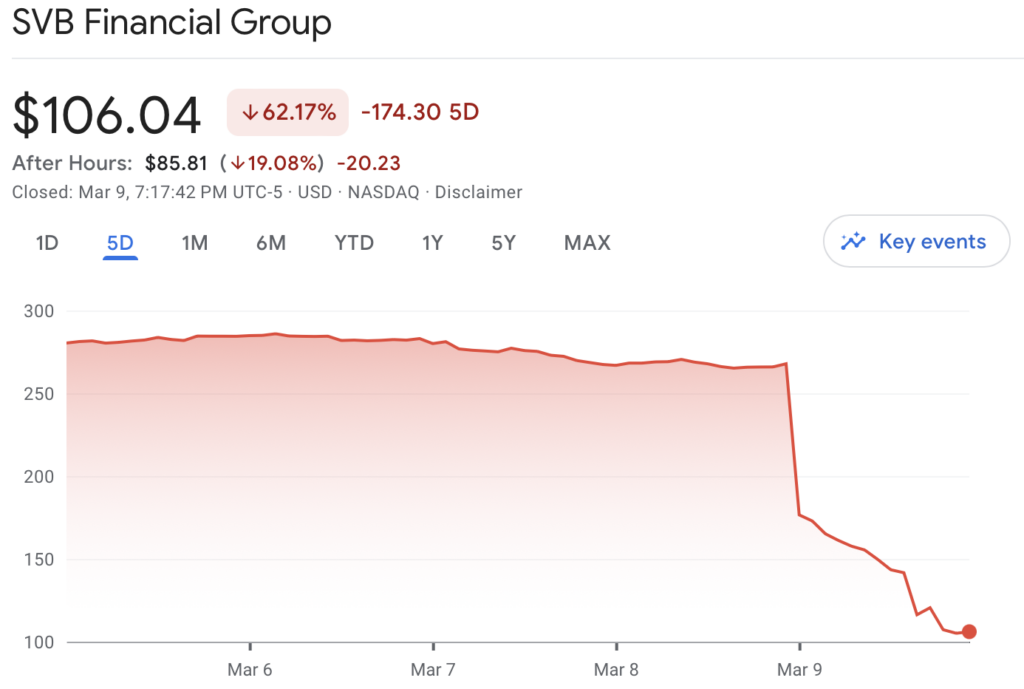

SVB shares plunge over 60% on the day following the news, with a further 19% decline in after-hours trading.

The bank took the industry along in their decline. The four largest banks in the United States lost $52 billion in market value on Thursday. The KBW Nasdaq Bank Index fell the most since the pandemic roiled markets nearly three years ago.

Banks incur no losses on their bond portfolios if they can keep them until maturity. But, if they are forced to sell the bonds at a loss in order to raise cash, accounting regulations require them to include the realized losses in their earnings.

IMO, the significance of the $SIVB debacle is not the news overnight, or even the market’s response to it today, but rather that their disastrous asset/liability mismatch has been well-known for months now. Yet it didn’t matter until management said it did. Efficient markets?

— Diogenes (@WallStCynic) March 9, 2023

Information for this briefing was found via The Wall Street Journal, Reuters, The Information, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.