FULL DISCLOSURE: Silver47 Exploration is a sponsor of theDeepDive.ca.

Silver47 Exploration (TSXV: AGA) has identified multiple exploration targets that are said to have high potential for discovery at their Red Mountain project near Fairbanks, Alaska.

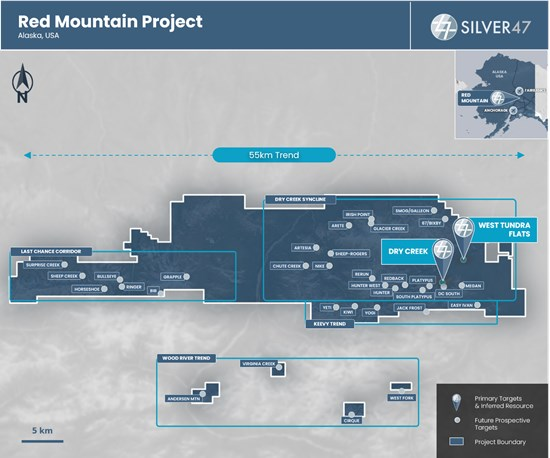

The targets have been identified along a 55 kilometres long trend, with at least 35 mineralized prospects identified following the review of historic geochemical and geophysical data, including 2,643 rock samples, 7,948 soil samples and 15,862 XRF samples. Many of the prospects are undrilled or preliminary drilled discoveries that are open to expansion.

Sampling from these prospects has identified significant polymetallic upside, with sampling highlights including 1,295 g/t silver at Galleon, 16.2% copper at Kiwi, 4,850 g/t antimony at Bib, 149 g/t gallium to the northeast of West Tundra Flats, and 3.8 g/t gold at Horseshoe among other highlights.

“The prospectivity of these targets was first identified by past operators, and I agree; the data suggest the likely presence of additional undiscovered and potentially giant VMS deposits on the project. I am unaware of any other domestic mineral projects with similar polymetallic discovery potential,” commented Galen McNamara, CEO of Silver47.

Four main trends have been identified across Red Mountain, including the Dry Creek Syncline, the Keevy Trend, Last Chance Corridor, and Wood River. Targets across the trends are said to vary from being zinc-rich to copper-rich, with many having associated high grade silver and gold mineralization.

READ: Silver47 Kickstarts 4,000 Metre Drill Campaign At Red Mountain Project

The Dry Creek Syncline is where the most exploration has occurred at Red Mountain, and includes the Dry Creek and WTF deposits, which combined have an inferred mineral resource of 15.6 million tonnes at 335.7 g/t silver equivalent, totaling 168.6 million silver equivalent ounces. VMS targets are found along two limbs of the east-west trending syncline, with 40 kilometres of prospective VMS stratigraphy occurring.

Targets at the syncline include Hunter, where six drill holes have occurred, highlighted by 1.4 metres of 17.4% zinc, 3.9% lead, 1.6% copper, 90 g/t silver and 0.23 g/t gold, Glacier Creek, where seven holes have been drilled dating back to 1998, and Galleon, where sampling has encountered 1,265 g/t silver and 2.18 g/t gold among other highlights.

The Keevy VMS trend meanwhile has several high grade VMS targets along a 25 kilometre trend. Targets here include Kiwi, which samples as high as 316 g/t silver and 16.2% copper, Easy Ivan, which samples 87.1 g/t silver and 6.0% zinc, Jack Frost, which samples 285 g/t silver and 14.0% zinc, and Yeti, which has been found to have black barite associated with elevated silver and strong base metal soil anomalism.

Last Chance Corridor has seen seven targets identified along a 15 kilometres corridor of VMS type mineralization, 40 kilometres to the west of the Dry Creek deposit. Highlight targets here include Horseshoe, with up to 8.3% zinc and 3.8 g/t gold in samples, Bib, with up to 7.3% zinc and 5.1% lead in samples, Grapple, which sampled 139 g/t silver and 5.1% zinc, and Sheep Creek, which samples up to 306 g/t silver and 4.3% zinc.

Finally, Wood River consists of VMS targets along a 24 kilometre trend, which runs parallel to the Dry Creek syncline. Targets here include West Fork, which sampled as much as 1.2% copper and 72 g/t silver, Circque, which sampled 487 g/t silver, 12.4% copper and 3.7 g/t gold, Virginia Creek, which sampled 1.01 g/t gold, 74.1 g/t silver and 1.3% copper, and Anderson Mountain, which sampled 151 g/t silver, 32% zinc and 3.8% copper.

Exploration on site meanwhile is ongoing, with nine holes having been completed under the current drill program. Two of those holes were conducted at Dry Creek, with the remainder occurring at West Tundra Flats. Both infill and step-out drilling has been occurring, with zones of massive, semi-massive, and disseminated sulphides having been intersected.

“Ongoing drilling at Dry Creek and West Tundra Flats continues to intersect promising sulfide zones, with assays pending, positioning Red Mountain to deliver significant value and strengthen domestic critical mineral supply chains in the future,” continued McNamara.

Silver47 Exploration last traded at $0.83 on the TSX Venture.

FULL DISCLOSURE: Silver47 Exploration is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is long the equity of Silver47 Exploration. The author has been compensated to cover Silver47 Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.