Silvercorp Metals (TSX: SVM) has released the results of a preliminary economic assessment conducted at their Condor gold project in Ecuador. The study follows a mineral resource estimate update published by Silvercorp for the project in May,

The study has outlined an after-tax net present value for Condor of US$522 million, alongside an internal rate of return of 29% under the base case scenario, which is based on US$2,600 an ounce gold, US$31.00 an ounce silver, and a discount rate of 5%. Project payback is estimated at 3.0 years.

At spot metal prices of US$4,300 an ounce gold and US$60.00 an ounce silver, that NPV figure is said to rise to $1.56 billion. A payback period estimate was not provided for the spot pricing scenario.

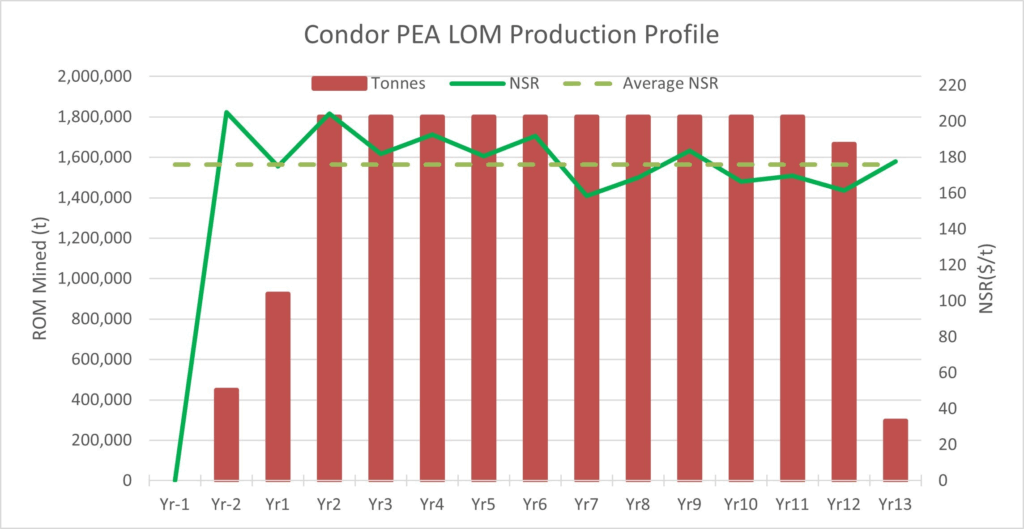

The estimate is based on an underground mining operation with a 13 year mine life, which would produce on average 114,000 ounces of gold equivalent annually at an all in sustaining cost of US$1.359 an ounce.

Under the proposed scenario, mining would be conducted by a contractor at a rate of 5,000 tonnes per day. Mill feed would be processed using a carbon-in-pulp cyanidation circuit that is integrated with a gravity concentrator to preconcentrate coarse nugget gold to create dore. Flotation would then be conducted to recover residual silver, lead and zinc to produce silver-lead and zinc concentrates. Grades are expected to average 2.15 g/t gold and 14.20 g/t silver, with average recoveries of 93.9% for gold.

On the costing side, initial capital costs are estimate at $292 million, the bulk of which, $118 million, is attributed to the processing plant. Sustaining costs meanwhile are pegged at $382 million.

As for next steps, the company has received approval for its environmental impact study, with the permitting process now focused on the Participation Process of Citizens. Once completed, the company will be able to begin underground development. The process is expected to take up to 4 months to complete.

Underground development in the interim meanwhile will focus on underground access tunnels into the Camp and Los Cuyes deposits, which will enable underground drilling and further exploration to take place in support of pre-feasibility and feasibility studies.

Silvercorp last traded at $12.28 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.