No one wants cannabis beverages.

Or, at least that’s the line long time cannabis enthusiasts have been touting for ages as they watched industry majors such as Canopy Growth Corp (TSX: WEED) (NYSE: CGC) and Hexo Corp (TSX: HEXO) (NYSE: HEXO) push ahead with major plans for beverage operations. Both firms partnered with big hitters from the alcohol industry, yet have disappointed the market thus far with their liquid products.

To be fair, those products in Canada have been few and far between. Canopy Growth just launched their beverages recently after numerous delays, despite the billions invested in the company by Constellation Brands (NYSE: STZ) and their wealth of beverage alcohol experience. The product they elected to launch, a tonic water, has had mixed reviews at best (stay tuned for our own review, as a comparison to the Tinley Beverage (CSE: TNY) review from last year) despite the massive backing they have.

And Hexo Corp, despite the joint venture they have with Molson Coors Beverage Co (NYSE: TAP) has yet to actually hit the market, disappointing many. In fact, some of the first beverage products to hit the market in Canada was that of The Valens Company (TSXV: VLNS), who saw a beverage product hit store shelves last month, despite the lack of a massive beverage alcohol backer, suggesting that money can’t buy everything in this space.

Despite the troubles exhibited in Canada for cannabis infused beverages, recent sales data out of the US has posted very promising figures. Through the ongoing COVID-19 pandemic that is hitting the globe, Headset IO has been providing a daily update on different aspects of the cannabis market and their sales trends. With cannabis being labeled an essential service by many regions (except Ontario who just repealed the title), many whom are in quarantine are stocking up on the essentials needed to pass the time.

And it appears that products being purchased for use during quarantine are quite different from typical consumption habits.

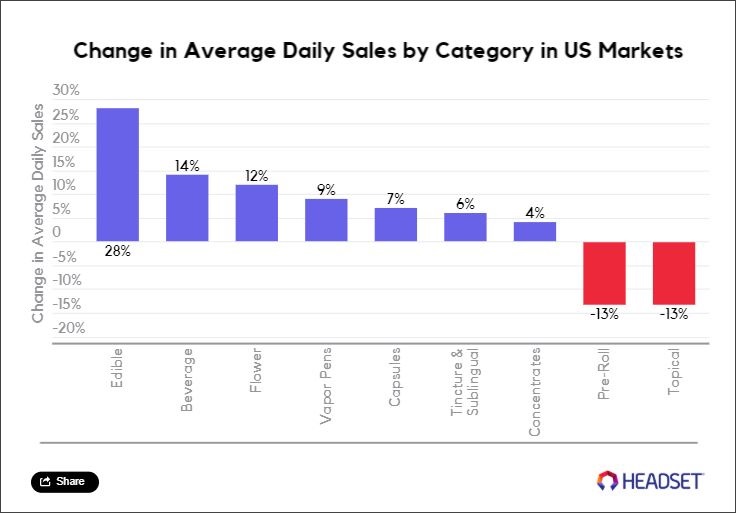

On Wednesday, Headset focused on product categories and their sales trends as of late given quarantine measures that are in place. In the chart below, Headset compares pre-quarantine (January 1 through March 6) sales data with that of post-quarantine (March 7 through March 31). Sales across the US were said to increase by 10% on average, with certain categories proving to be strong winners.

The biggest winners in terms of product categories? Smokeless variants. The logic here is simple – with people locked inside from quarantine, consumers have switched to consumption methods that don’t involve combustion, as can be seen by the massive fall in demand for pre-rolls. Comparatively, edibles and beverages are the clear product category winners with the ongoing pandemic, with sales up 28% and 14% respectively.

This theory was hypothesized by Tinley Beverage Co, a manufacturer of two premium cannabis-infused beverage product lines, only two days prior to the news coming out, with the company stating the following in a news release.

“Cannabis dispensaries have been deemed essential services under the COVID-19 orders issued in California on Thursday, March 19, 2020. As a result, licensed adult use and medical dispensaries and the companies that supply them may continue operating under these orders. Dispensaries throughout the state have reported surges in demand as consumers stock up on cannabis, often with lineups comparable to grocery stores. With residents throughout the state under a “stay at home” order, fewer opportunities exist for consuming cannabis out of the home, potentially increasing the desirability of smokeless forms of cannabis, such as edibles and drinks. Much like home deliveries in groceries and other mainstream retail, cannabis home delivery services have reported an increase in demand. The Company’s products have been restocked and are again available for home delivery throughout California. Ordering information is available at www.drinktinley.com.“

Will the coronavirus pandemic be the trigger that normalizes the consumption of cannabis beverages across the US? While the jury may still be out right now, the current trend is a positive for the niche category.

FULL DISCLOSURE: Tinley Beverage is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Tinley Beverage on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

The author has no securities or affiliations related to any other organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.