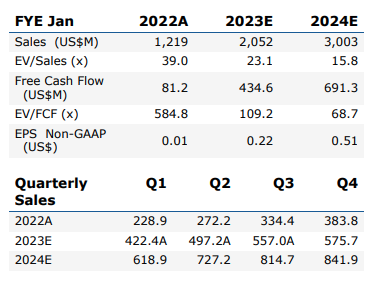

Snowflake (NYSE: SNOW) last week reported its third-quarter financial results. The company announced that product revenue came in at $522.8 million, with total revenues hitting $557 million, up 66.6% year over year. Gross profits went in the same direction, growing 71.4% to $366.31 million, or a 72% margin.

Though it appears that operating profits before non-recurring expenses went the opposite way, with Snowflake seeing a wider loss than a year ago at -$206 million. Similarly, net income decreased on a year-over-year basis to -$201 million. Cash flow from operations for the quarter saw a 410% yearly increase and a quarterly increase to $79.28 million. At the same time, free cash flow also saw a yearly and quarterly lift, growing to $65 million.

The company said that it had performance obligations of $3 billion, an 66% year-over-year increase and that the net revenue retention rate was 165% as of the quarter end.

Lastly, the company provided fourth-quarter guidance. The company expects product revenue to be between $535 and $540 million, roughly 50% growth year over year and a slight quarterly increase. The firm also targets a 1% operating margin for the fourth quarter.

Snowflake currently has 42 analysts covering the stock with an average 12-month price target of $200, representing an upside of roughly 34%. Out of the 42 analysts, eight have strong buy ratings, 20 have buys, and 12 have sell ratings. One analyst has a sell rating, and another analyst has a strong sell rating on the stock. The street-high price target sits at $500, or an upside of almost 234%.

In Canaccord’s note on the results, they reiterate their buy rating and slash their 12-month price target to $195, down from $220, saying that their new price target would mean the stock trades at 23x 2023 enterprise value to sales.

Canaccord writes that Snowflake has “executed admirably” this quarter and against high investor expectations. Product revenue grew faster than the sell side consensus, and EBIT margins came in at 8% versus the 2% consensus estimate. Not only this, but against a bad macro backdrop, which included growth deceleration and consumption trends suggesting a soft print, the company was able to outperform the consensus estimates.

Snowflake’s long-term growth target of $10 billion in product revenue by fiscal 2029 is still feasible after these results, Canaccord says. They add that the growth target “leaves plenty of room for deceleration from current growth rates of >60%.” As a result, it seems like they expect Snowflake to revise its top-line revenue growth for the next few quarters as the macro slowly deteriorates. However, they believe it is a good time to bring down “aggressive” street estimates.

On the company’s fourth-quarter guidance, Canaccord says that this shows conservatism as the company’s guidance suggests a beat for the fourth quarter, but one that is less than this quarter’s beat. Additionally, they note that on the call, management sounded cautious, noting weakness in SMBs.

Below you can see Canaccord’s estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.