Snowline Gold (TSXV: SGD) has released the results from a much-anticipated preliminary economic assessment for their flagship Valley gold deposit, which is part of the Rogue Project in the Yukon.

The study, which uses a base case of US$2,150 an ounce gold, has identified Valley as having a net present value of $3.37 billion and an IRR of 25%, using a 5% discount rate. That figure balloons to US$6.8 billion alongside an IRR of 37% at $3,150 an ounce gold. Project payback is estimated at 2.7 years under the base case scenario, which shrinks to 2.1 years under the spot case.

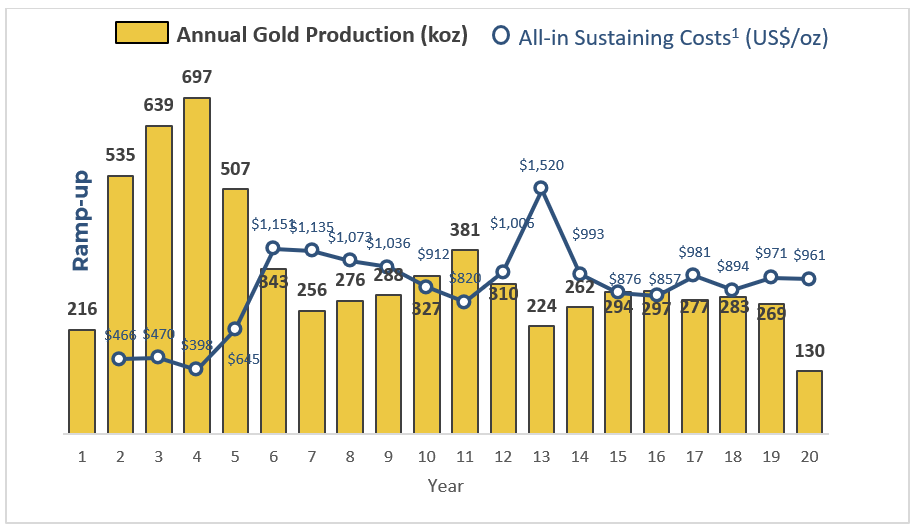

The figure is based on an open pit operation that would see 544,000 ounces of average annual production over the first five full years of production. Over the entire 20 year mine life, production is expected to average 340,549 ounces, with a total of 6.8 million ounces expected to be pulled out of the ground over that time frame at a strip ratio of just 1.09:1.

Average grades over the first five years are expected to come in at 2.01 grams per tonne gold, which drops down to 1.34 g/t over the entire mine life. Recoveries of 92.2% are expected.

In terms of processing, a 25,000 tonne per day processing facility is expected to be established, which will consist of grinding, gravity separation, and carbon-in-leach to ultimate produce gold dore bars, with no heap leaching involved. Notably, mining and processing estimates used a lower gold price of US$1,950 an ounce to calculate the operation, with the US$2,150 figure used solely for NPV calculations.

Initial capital for the operation is estimated at $1.69 billion, with that estimate factoring in the construction of the mine, process plant, fuel and power infrastructure, water and tailings storage, accommodations for a 250 person camp, a 1,400 metre long airfield, waste storage facilities, and administrative buildings. All power for the project is assumed to be generated on site by diesel generators.

Operationally, unit costs are expected to come in at $37.09 per tonne processed. Total cash costs are estimated at $690 per ounce over the 20 year mine life, while all in sustaining costs are pegged at just $844 an ounce. For those five years of higher grade production, cash costs are anticipated to come in at just $460 an ounce, while AISC is pegged at $569 an ounce.

Under current modeling, Valley is expected to be construction ready by 2030, with construction expected to take a total of 3.5 years.

“In less than four years, we’ve gone from soil sampling and Valley’s first drill holes to a significant conceptual NPV. This serves as an important milestone as we continue to press forward on multiple fronts to efficiently and responsibly move Valley forward. Multiple field studies to support advanced technical studies are now underway on site, alongside environmental baseline work to inform future assessment and permitting. Combined with our ongoing regional exploration, we are excited by the path ahead and the opportunity to advance an important new contributor to the Canadian gold mining landscape,” commented Snowline CEO Scott Berdahl.

Snowline Gold last traded at $7.92 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.