FULL DISCLOSURE: This is sponsored content for Sonoro Gold.

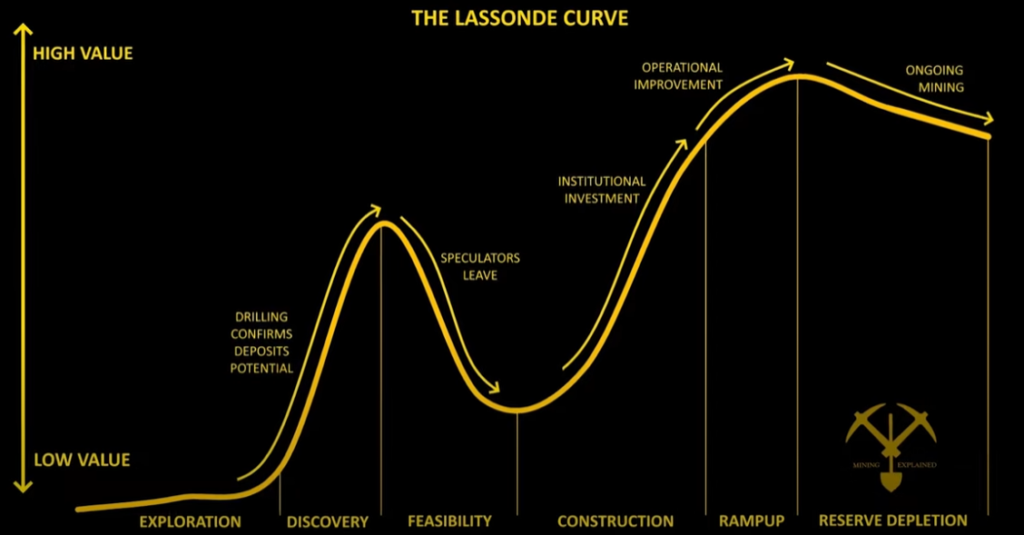

1When it comes to investing in the mining sector, there is a well known model that investors abide by. The Lassonde Curve, popularized by mining investing legend Pierre Lassonde.

Basically, the Curve is a model for the investment cycle of a particular mining asset, which demonstrates the stages of value creation along the development cycle. It starts with exploration, which leads to a discovery and high returns for investors.

But after that discovery, as an asset progresses through the feasibility study stage, valuations drop, before construction begins and sends valuations on the up trend again, with future profitability on the minds of investors.

The time-tested model basically identifies two ideal times to invest to maximize returns. Either in the exploration stage, when speculation of a discovery and the follow-on excitement will drive the valuation of a company higher. Or after studies have been completed and construction is on the horizon, when much of the risk of discovery itself has been removed.

Time tested investors tend to prefer investing in the latter scenario, where less junior mining charlatans and more experienced industry execs hang out. And where a once-explorer or developer can cash in on their efforts as they transition to producers.

One developer currently hanging out in this stage of the Lassonde Curve, is Sonoro Gold (TSXV: SGO).

The High Level

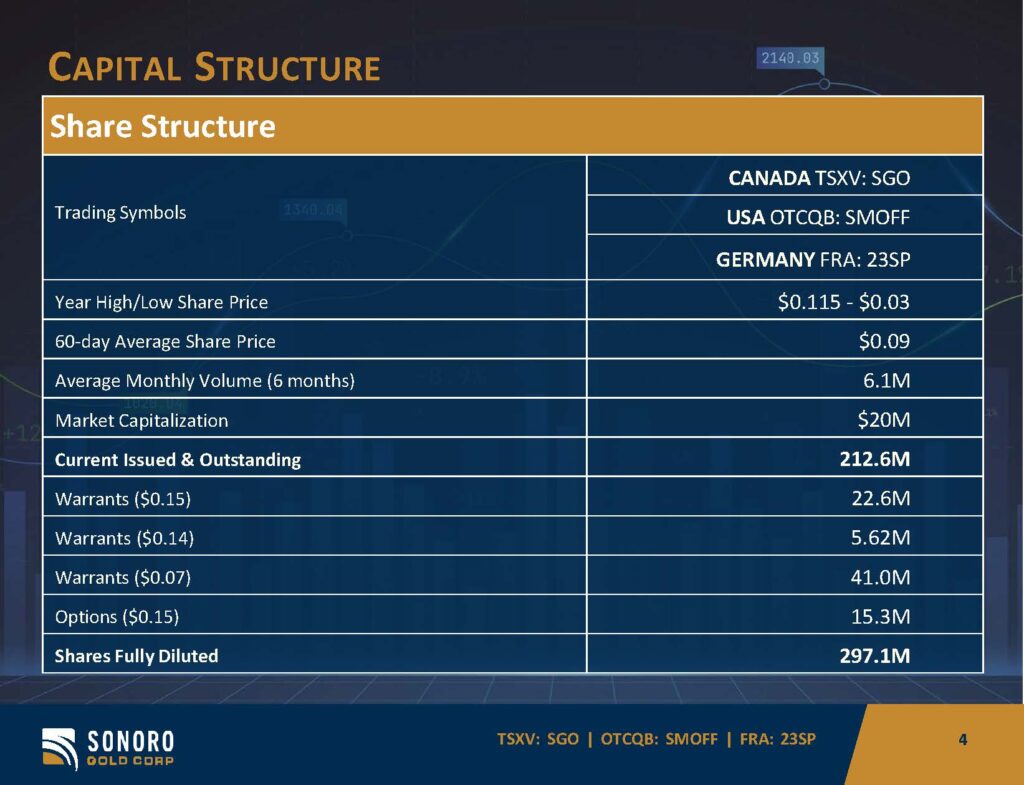

Sonoro Gold is a Mexico-focused junior developer, whom trades on the TSX Venture under the symbol SGO. The company is centering their efforts on pushing their Cerro Caliche project in the state of Sonora into production.

The company is in the final stages of permitting to develop an open pit heap leach mining operation that is capable of processing an initial 12,000 tonnes per day. Cerro Caliche is estimated to have a net present value of $71.4 million on a pre-tax basis, alongside an internal rate of return of 59%, which is based on a preliminary economic assessment conducted back in October 2023 using $1,800 an ounce gold.

While the project may appear small in size relative to some peers, the company has taken a capital-light approach to the project, with the intent on using the cash flow generated from initial operations to fund further exploration and mine expansion. The other aspect to consider is the current price of gold, and the impact that it has on the economics of the project.

From a capital perspective, insiders hold over 24% of the company, and have taken great efforts to preserve the capital structure, which includes loaning the company in excess of $4.2 million so as to reduce the need for further dilution. The team as a whole has extensive experience within the mining sector, having collectively been responsible for the development of 12 gold mining operations.

Now, we know what you’re thinking, so lets address it head on. Open pit mining. And Mexico. But that appears to be of little concern, with the new administration in Mexico having taken a pro-mining stance. Which includes towards open pit mines.

For what it’s worth Grupo Mexico and their mining subsidiary Southern Copper are basically acting like any open pit mine will be approved, with current guidance indicating that a new open pit project of theirs will begin production towards the end of 2027 and the start of 2028. They’re dropping $310 million this year alone on its development. And if anyone has their finger on the pulse of the Mexican government, it’d be them.

Anyways, back to Sonoro.

The Cerro Caliche Project

All right. Lets dig into the Cerro Caliche project a bit more. We’ve already done a full video on the project, but here’s the quick and dirty.

Cerro Caliche is found in the state of Sonora, which is one of the largest mining states within Mexico. The project is found in the middle of a triangle formed by Agnico Eagle’s Santa Gertrudis project, Bear Creek Mining’s Mercedes Mine, and Goldgroup Mining’s Cerro Prieto Gold Mine in the north of the state.

The proposed project is expected to operate at a rate of 12,000 tonnes per day once construction and ramp up is completed, while pulling 286,000 ounces of gold and 938,000 ounces of silver out of the ground over an initial 9 year mine life. Cash costs are estimated at about $1,295 an ounce, which for a small producer isn’t too shabby.

While it may not be record-breaking in terms of production, averaging about 33,000 ounces of gold equivalent a year, the project also doesn’t break the bank. With initial capex costs of just $15.5 million – one of the lowest we’ve seen in this day and age – and sustaining capital costs of $15.5 million. On top of this, once permitted, it’s expected that the timeline to production is just 13 months.

Payback on the project is expected to take about 2.9 years at the $1,800 an ounce gold price – meaning with gold trading well above $1,000 an ounce higher it’s likely significantly shorter.

Sensitivity tables included within the 2023 PEA suggest that payback declines to 2.4 years at $2,000 gold and $28 an ounce silver, and yet those prices still don’t accurately reflect the current precious metals price environment. On a pre-tax basis under this scenario however, the net present value jumps to $116.8 million, while the IRR moves to 85%.

Why a pre-tax basis? Because the company intends to use the cash flow for exploration once production is underway. Thereby limiting the amount of tax that they will actually pay. Which is another reason for why they’re doing things the way they are. A method to the madness, if you will.

Anyways, in terms of resources, Cerro Caliche is estimated to contain 290,000 ounces of indicated gold equivalent at a grade of 0.46 g/t, in addition to 150,000 ounces of inferred gold equivalent at an average grade of 0.44 g/t. And they estimate that an additional 124 to 285 thousand ounces of gold equivalent is waiting to be discovered on site. With exploration to date having covered only about a third of the total property.

The Management

As any half decent mining investor knows. The key to success within junior markets, lies within the management. Without strong management, it really doesn’t matter how good the project is. Fortunately for Sonoro Gold and their investors, this is a box that the team behind the company checks off quite easily.

Sonoro is helmed by John Darch, the Chairman of the company whom has four decades of experience in financing, developing, and operating projects within the resource sector. Starting his career as a commercial banker in the UK and Canada, Darch was behind several successful resource ventures including Crew Gold, which operated six mines and two development projects in Africa, as well as Nevada Goldfields, Botswana Diamondfields and Asia Pacific Resources.

Kenneth MacLeod serves in the role of CEO for Sonoro, whom has 40 years of experience within the natural resource sector. A mechanical engineer by training, MacLeod was behind names such as Kakanda Development Corp, which developed operations across three countries, and served as CEO of Western GeoPower and Pan Pacific Power.

Another key name is Jorge Diaz, VP operations, whom is a professional mining engineer with 25 years of experience operating mines within Sonora state. Diaz was responsible for the construction of the La Colorada project, which produced after just four months of construction, and was one of the leads behind the development of the Mulatos project operated by Alamos Gold.

Finally, there is Melvin Herdrick, VP of Exploration for Sonoro. With over five decades of experience in exploration and development, Herdrick has extensive experience within Mexico and the US. He previously served as a consulting geo for a number of well-known names, including Kennecott Copper, Sundance Mining, and Great Basin Resources. Herdrick was also previously chief geologist for Phelps Dodge, Mexico.

The Comparables

When it comes to comparables, there’s two ways we can compare things. First, is to development stage projects that are in the same region, which are waiting on their permits.

The direct comparable here, is venture-listed Silver Tiger Metals. Led by Glenn Jessome, the company is focused on placing their El Tigre project into production in northeastern Sonora. The project consists of two portions, an open pit project, as well as an underground project.

While a PEA for the underground portion is imminent, a pre-feasibility study was released back in October for the extraction of the pit-constrained 980,000 ounces of measured and indicated gold equivalent ounces. Across all categories, the project contains 1.6 million measured and indicated gold equivalent ounces across all categories, plus 1.0 million inferred equivalent ounces. Based on their market cap of $128 million, it translates to about $49 in valuation per gold equivalent ounce.

By comparison, Sonoro Gold with a market cap of $19 million and 440,000 gold equivalent ounces across all categories, translates to about $43 in valuation per ounce in the ground.

The other way to value things here is based on production estimates relative to small scale producers.

In this context, with estimated average annual production of 33,000 ounces once things are running, Sonoro compares to names such as Heliostar Metals, who is currently valued at $221 million with current annual production of just under 21,000 gold equivalent ounces. Or Avino Silver, who in 2024 produced about 31,000 gold equivalent ounces, whom is currently valued at $349 million.

It’s a bit of a funky metric for a multitude of reasons, but Heliostar trades at about $10,627 per ounce of annual production, while Avino trades at $11,121 per ounce of annual production. Granted, they are actually in production, but in comparison, Silver Tiger trades at about $2,253 per ounce of projected annual production, while Sonoro Gold trades at just $579 per ounce of projected annual production .

Meaning there’s lots of room for appreciation here. And again proving the significance of that Lassonde Curve.

In Closing

All right, lets wrap it up.

Sonoro Gold, arguably, is a name that stands to benefit from the Lassonde Curve. The company is at the end of their developmental studies, and applied for permits back in 2022 to get the show on the road and get Cerro Caliche into production. Which as per the Curve, means returns are on their way.

The risk here, obviously, is mining regulations in Mexico not turning in their favour in a relatively decent amount of time. But if you ask management, permits are expected imminently, which will lead to the next phase of growth for the company.

For investors, Sonoro is basically a bet on the Mexican mining economy. Will the government continue to support the industry, or will they turn their back, as the predecessors to the current government chose to? Given the outsized role mining plays in the economy, my bet is that you start to see a flurry of mining permits issued.

But what do I know. I’m just a YouTube personality with an opinion.

FULL DISCLOSURE: Sonoro Gold Corp is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Sonoro Gold Corp. The author has been compensated to cover Sonoro Gold Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.