As the total number of coronavirus infections worldwide inches closer and closer to the 30 million mark, many countries continue to face unprecedented circumstances that are significantly hampering their economic wellbeing. It has been over six months into the pandemic, and despite extensive stimulus spending, many of those countries still are unable to make any progress in terms of a stable recovery.

According to a recent analysis by International ratings agency S&P Global, it now appears that India will also be joining the ever-increasing list of countries that are unable to climb out of the rut that is the coronavirus-induced economic downfall. S&P Global forecasts that India’s economy will contract by another 9% in the fiscal year that ends in March 2021, after the country’s GDP already fell by a staggering 23.9% between April and June.

Although India began to lift coronavirus restrictions in June, S&P Global anticipates that the pandemic will continue to put further strain on the country’s economy. S&P Global Ratings Asia-Pacific economist Vishrut Rana notes that any additional stimulus support would is most likely unattainable given the increasing worries regarding skyrocketing inflation. The month of August saw retail inflation surge to 6.69%, compared to an inflation rate of 3.28% in August of 2019.

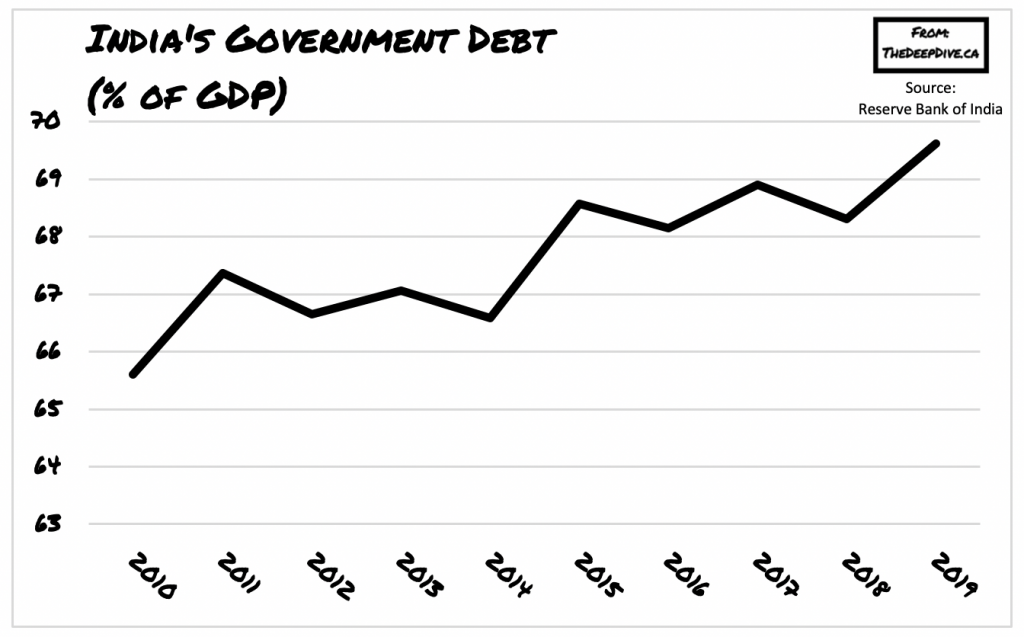

Moreover, the country’s soaring deficit also hampers the likelihood of a smooth economic recovery. The ratings agency anticipates that India’s GDP will grow by 6% in 2022, followed by an increase of 6.2% the following year. Back in pre-pandemic 2019, India’s government debt to GDP stood at 69.62%, hahafter steadily increasing over the previous 9 years.

Information for this briefing was found via S&P Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.