The special purpose acquisition company associated with Donald Trump is ruminating its need for more time to enact a business combination, but the former US president is projecting confidence that he might not even need the blank check firm at all.

Digital World Acquisition Corp (Nasdaq: DWAC) announced on Tuesday that it will be holding a special stockholders meeting to vote on the proposed 12-month extension on the firm’s deadline to complete a business combination. Originally slated to adjourn on Tuesday, the vote is being extended until Thursday to secure more votes.

Should the stockholders vote in favor of the measure, the firm will have until September 8, 2023 to finalize the merger.

The SPAC is also extending the deadline for redemption until Wednesday.

But people familiar with the matter told Reuters that the proposed extension isn’t likely to secure enough shareholder support to push through. The SPAC needs 65% of its shareholders to vote in favor of the proposal but has seen a less than ideal number of votes as of Monday evening.

In the event that the stockholders wouldn’t approve of the extension, the blank check firm’s sponsor–ARC Global Investments–committed to add US$2.9 million to the trust account and extend the initial business combination deadline until December 8, 2022. The contribution is taken as a non-interest bearing loan.

Trump announced in October 2021 a SPAC merger deal to take his media firm Trump Media & Technology Group public through Digital World Acquisition. The former manages the social networking site Truth Social–Trump’s own take on Twitter.

The deal announcement gained popularity and financial support–securing a total investment of US$1.0 billion from certain undisclosed institutional investors as of December 2021. However, the company is also under the scrutiny of FINRA related to the firm’s trading prior to the deal, and the SEC is investigating the transaction itself.

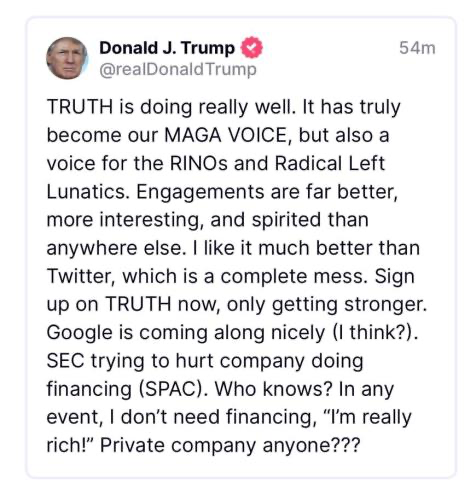

But for Trump, he might not even need to take his firm public.

“SEC trying to hurt company doing financing (SPAC). Who knows? In any event, I don’t need financing, “I’m really rich!” Private company anyone???” Trump posted on Truth Social.

DWAC last traded at US$22.64 on the Nasdaq.

Information for this briefing was found via Reuters, Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.