The sensation surrounding memecoins has exploded as of late, as investors— armed with social media-inspired bullish bets— pile into newly created digital tokens beyond the traditional likes of bitcoin and ether. However, sometimes those bets can go awry, as traders of recently-minted memecoin SQUID found out— the hard way, of course.

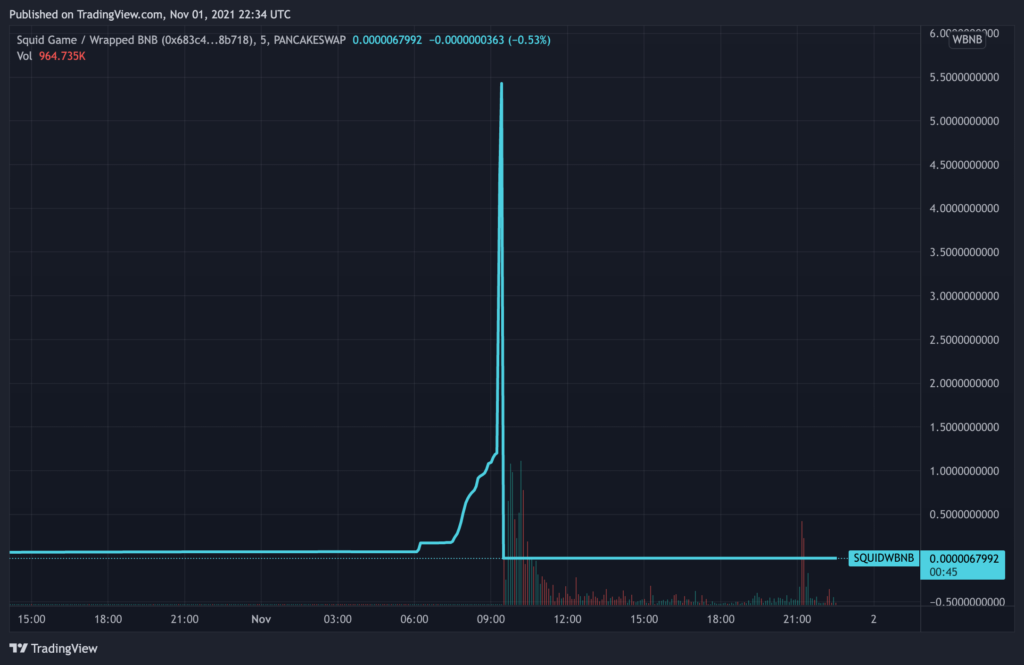

Although the SQUID crypto coin was only created last week— with an abundance of red flags— it did not stop a plethora of traders from piling into the digital coin. SQUID, inspired by the Netflix series Squid Game, has skyrocketed by a staggering 230,000% over the past seven days to $2,861 according to data from CoinMarketCap, becoming the latest sensation to grip the attention of the memecoin enthusiasts.

However, the cryptocurrency soon plummeted to an eye-watering $0 come Monday, after it was discovered the joke currency was actually a joke. However, the only people laughing are its creators, who took off with an estimated $2.1 million after a “rug pull” drained all of the funds from decentralized exchange PancakeSwap. Indeed, the SQUID crypto coin was riddled with brightly illuminated red flags, such as a three-week old website boasting numerous spelling errors, and the fact that traders were only able to buy the coin but not sell it.

Although the SQUID page on CoinMarketCap did warn traders to “do your own due diligence and exercise extreme caution. This project, while clearly inspired by the Netflix show of the same name, is not affiliated with the official IP,” it did not stop many from dumping their funds into the meme token. The Squid Game white paper also warned that market purchases release “selling credits,” but once the selling credits are drained from the pool, some traders won’t be able to execute sales anymore.

“The reality is that very few retail buyers of these memecoins actually spend the time to read the white paper or try to understand the tokenomics and governance frameworks of these coins,” explained PwC crypto leader and partner Henri Arslanian to Bloomberg. The SQUID token’s website— which was hosted on SquidGame.cash— is now nowhere to be found, as well as all other social media accounts created by the token’s creators scammers.

However, despite all of the warning signs that SQUID is in fact, too good to be true, it did not stop major news outlets such as CNBC, Business Insider, and even Yahoo News from reporting on the Korean Netflix-inspired cryptocurrency, and its jaw-dropping ascent to a brief market cap of more than $174 million.

Information for this briefing was found via CoinMarketCap and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.