SSR Mining (TSX: SSRM) has released the results of a technical report summary conducted on their recently acquired Cripple Creek & Victor Gold Mine in Colorado, which they acquired from Newmont earlier this year for $275 million.

The operating mine is estimated to have an after tax net present value (5% discount) of $824 million at $3,240 an ounce gold. That valuation rises to $1.5 billion at $4,000 an ounce gold.

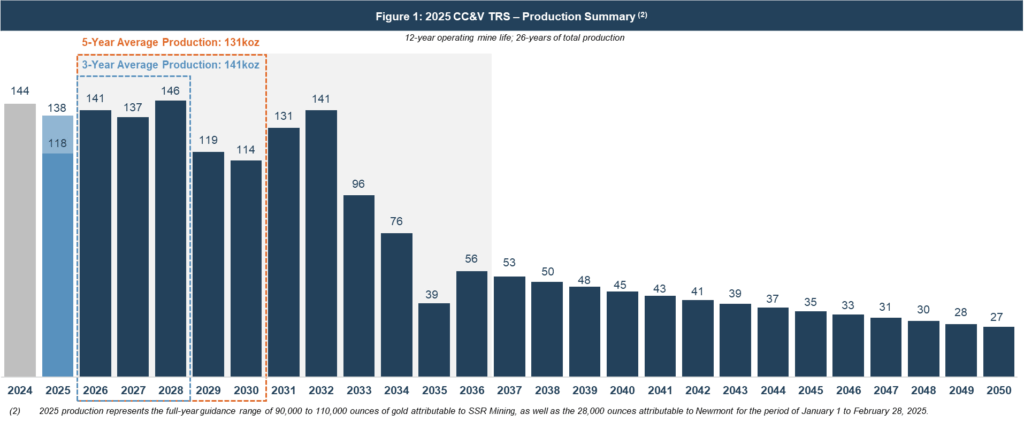

The estimate is based on current gold reserves of 2.8 million ounces, which are expected to allow for a 12 year mine life. Average annual production is estimated at 141,000 ounces from 2026 through to 2028, with production expected to drop off thereafter. Cash costs during that period are estimated at $1,800 an ounce, while all in sustaining costs climb to $2,051 an ounce.

Estimates were also provided for a five year period, from 2026 through to 2030, when production is expected to average 131,000 ounces a year overall, at cash costs of $1,902 an ounce and all in sustaining costs of $2,135 an ounce.

Under the three year outlook, average annual free cash flow is expected to come in at $128 million, however under the five year outlook that average drops to $96 million.

Since closing on the acquisition on February 28, SSR Mining has seen total production from the mine of 85,165 ounces, with guidance calling for between 90,000 and 110,000 ounces of production this year. Mine site after-tax free cash flow is estimated at $115 million year to date.

“The transformational acquisition of CC&V established SSR Mining as the third largest gold producer in the United States, with two core operations each with mine lives in excess of 10 years. Following a very successful integration process, CC&V has already paid back the initial $100 million upfront acquisition price in mine-site after-tax free cash flow. Including the total potential transaction outlay of $275 million, the results from this initial Technical Report Summary demonstrate a transaction IRR in excess of 100%, a truly exceptional outcome with meaningful growth potential for the operation still ahead,” commented Rod Antal, Executive Chairman of SSR Mining.

SSR Mining last traded at $29.18 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.