SSR Mining Inc. (TSX: SSRM) reported today its financial results for the second quarter of 2022, highlighting a quarterly revenue of US$319.6 million. This is a decline from Q2 2021’s revenue of US$377.0 million but beat the street estimate of US$292.6 million.

“The second quarter of 2022 demonstrated the continued resilience of our globally diversified business in the face of inflationary pressures, as our consolidated production and cost metrics tracked well against our year-to-date targets,” said CEO Rod Antal.

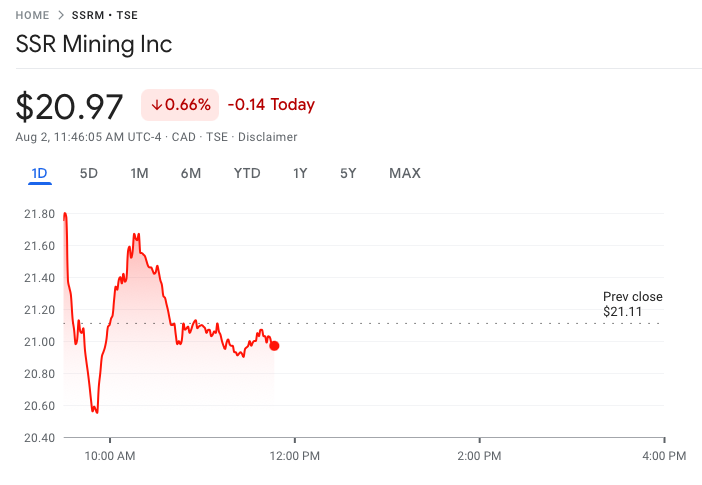

After the announcement, the company’s shares rallied by 3% when the market opened. But the gain immediately dissipated back to levels seen in the prior trading day.

The topline figure comes from selling 167,201 gold equivalent ounces during the quarter, down from the 201,504 ounces sold in the previous year. All-in sustaining costs rose to US$1,267 per ounce this quarter compared to US$938 per ounce last year.

On the production side, the firm also produced less this quarter ending at 159,262 ounces compared to the 199,673 ounces produced last year.

“We are however continuing to face increased cost pressures especially in fuel, electricity, and reagents across the business that have outpaced our various cost mitigation efforts this year. As a result, we are reaffirming our production guidance, albeit at the bottom end of the guidance range,” Antal added.

The firm reiterates that its year-to-date production of 333,201 gold equivalent ounces is on track to meet the lower end of the 2022 guidance of 700,000 – 780,000 ounces.

Antal also said that the mining firm is revising its cost guidance higher for the year “to reflect these macroeconomic pressures and the temporary suspension of the Çöpler mine.”

The firm’s AISC guidance for the year is now at US$1,230 – US$1,290 per ounce from the previously announced US$1,120 – US$1,180 per ounce. To date, the firm’s AISC for the first six months is at US$1,177 per ounce.

The company seem to have paused its operations at the Çöpler mine. Operations on the Turkish asset have been halted after the Ministry of Environment, Urbanization and Climate Change tweeted that resumption of your branch’s status depends on if environmental improvement works have been completed.

The operating income for the quarter also went down to US$70.1 million from last year’s US$103.7 million. Further down, net income decreased to US$67.5 million from last year’s US$77.8 million. The quarterly net income translates to US$0.27 earnings per diluted share.

On a non-GAAP basis, earnings per share comes up to US$0.30 per share, also beating the street consensus of US$0.21 per share.

The company ended the quarter with US$938.6 million in cash and cash equivalents, putting the balance of current assets at US$1.61 billion. Meanwhile, current liabilities came in at US$226.4 million.

SSR Mining Inc. last traded at $20.71 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.