Starbucks (NASDAQ: SBUX) opened 3% lower on the 28th before rallying on Thursday’s trading day ending the day up 2%, after its fiscal second-quarter results which generally came in line with analysts’ estimates. The company announced second-quarter revenue of $6.67 billion, along with a gross margin of 27.8%. Net income for the second quarter was $659 million, or a 10% net margin, and earnings per share hit $0.56.

A number of analysts changed their price targets off the back of Starbucks earnings, bringing their average 12-month price target slightly higher from $115.05 to $121.04 from a total of 38 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- Stephens raises target price to $118 from $115

- BMO raises target price to $125 from $120

- Wedbush raises target price to $132 from $124

- Citigroup raises price target to $132 from $119

- MKM Partners raises fair value to $125 from $117

- Credit Suisse raises target price to $125 from $116

- RBC raises target price to $131 from $126

- Cowen and Company raises target price to $126 from $120

- CFRA raises target price by $10 to $125

- Jefferies raises target price to $135 from $118

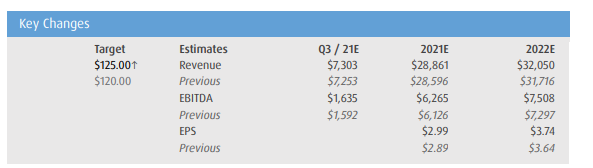

In BMO’s earnings note, they reiterated their outperform rating and raised their 12-month price target from $120 to $125. Alongside raising their price target they have slightly increased their third quarter, 2021, and 2022 estimates to reflect an upside in the companies margins and earnings per shar. Analyst Andrew Strelzik comments on the earnings, “SBUX’s margin targets still appear conservative and sales should continue to build from several drivers.”

Andrew Strelzik remains bullish on Starbucks as he says that the US volumes are improving with the companies 2-year comp improving to 6% higher than the pre-covid numbers, and 11% higher than March. This is due to the drive-through, digit penetration, and check growth.

Although US numbers were solid, Strelzik says that the companies international numbers took a step back this quarter with international and China sales falling short of analyst expectations due to tighter COVID restrictions.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.