Last week Kazatomprom (LSE: KAP), one of the largest uranium producers reported it’s full-year 2021 results and updated investors on the geopolitical event of Russia and Ukraine. For the results, the company reported full-year revenues of US$1.62 billion, up 14% year over year. This was because of a monster fourth quarter, wherein the company saw revenue balloon from US$224.9 million in the third quarter to US$834.2 million, which is up 270% year over year.

The company saw its gross profits grow 4% year over year to US$673.87 million, again thanks to the fourth quarter where gross profits grew 365% year over year to US$394.32 million. Total expenses grew 21% year over year to US$1.06 billion, putting the company’s operating profit at US$561.49 million, an increase of only 3% for the year. The majority of this increase came from the fourth quarter, which grew almost 500% year over year to US$354.05 million.

Even with the great fourth quarter helping the company’s full-year results, the company saw its net income and earnings per share decrease year over year. Net income came in at US$330.15 for the full year, down 25.7% while earnings per share dropped from US$1.74 last year to US$1.27 this year.

Kazatomprom’s CEO says that though the sanctions on Russia have not directly impacted the uranium and nuclear industry, the company is continually assessing all potential risks, and with the situation changing every minute it is difficult to predict “the possible impact and consequences on Kazatomprom’s activities.” With that, he reassures investors that the company remains prepared with plans that cover a variety of scenarios.

The company notes that it currently has a Uranium Processing Agreement with the Uranium Enrichment Center, which is a resident of the Russian Federation. Though they expect that the services under the agreement to continue they comment that “There may be a risk of difficulty in making mutual settlements in US dollars with UEC in the event of restrictions and blocking of the UEC’s foreign currency accounts or in the event of the withdrawal of Russian banks from the SWIFT system.”

Kazatomprom currently has 10 analysts covering the stock with an average 12-month price target of US$34.33, which represents a 21% upside to the current stock price. Out of the 10 analysts covering the stock, 2 have strong buy ratings, 1 has a buy rating, 4 have hold ratings, and the last 3 have sell ratings. The street high sits at US$50.80, which is an 80% upside to the current stock price.

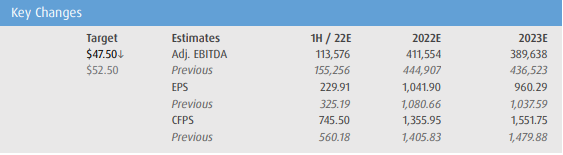

BMO Capital Markets posted a note on the company’s results, lowering their 12-month price target from US$52.50 to US$47.50 while reiterating their outperform rating on the stock. They say that the price target lowering comes from management flagging cost headwinds which will affect the company’s near-term earnings and erosion of sentiment on heightened geopolitical uncertainty. Though they say, “given limited operational impacts to date and Kazatomprom quelling logistical challenges we continue to believe the concern is overdone,” and because of this they believe the stock remains an excellent opportunity to get exposure to the Uranium sector.

BMO says they have now updated the company’s cost basis on the updated 2022 guidance, commenting that they are now in line with maiden’s all-in sustaining cost of US$16 to US$17.50 per pound. They add that wages are the main driver behind the company’s cost increase and now expect costs to come in at KZT$165 billion.

BMO also hosted an investor call with Kazatomprom management following its results last week. The questions reportedly focused on three things: costs, the company’s exposure to Russia, and production plans based on higher spot prices. The management said that they have alternative shipping routes established outside of Russia and that their overall exposure is limited. On increasing production, management said that they “remain committed to production discipline,” though noting they have the potential to see production growth in 2024.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.