On August 27, the private start-up electric vehicle manufacturer Rivian submitted a widely anticipated confidential draft registration statement on Form-1 to the SEC. This submission starts a process that is expected to lead to a Rivian IPO sometime before U.S. Thanksgiving in late November.

The most interesting (surprising?) aspect of Rivian’s filing is that, according to reporting by Bloomberg, the company is seeking a US$80 billion valuation. To put this figure in perspective, Tesla’s (NASDAQ: TSLA) stock market capitalization is around US$700 billion. Lucid Group, Inc. (NASDAQ: LCID) and Fisker Inc. (NYSE: FSR), electric vehicle (EV) start-ups which, like Rivian, have yet to record any revenue from vehicle sales, are valued at US$33.8 and US$4.2 billion, respectively.

Rivian raised US$2.5 billion and US$2.65 billion in private funding rounds in July 2021 and January 2021, respectively. In total, the company has raised US$10.5 billion in private funds since 2019.

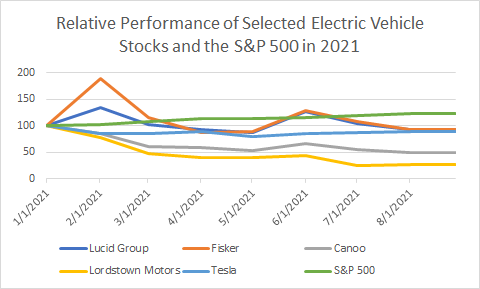

Importantly, the January 2021 funding was based on an overall valuation of just under US$28 billion. If the Bloomberg reporting is correct, that implies that Rivian’s value — without delivering one vehicle to a customer — has nearly tripled in seven months, a stretch over which most fledgling EV start-up stocks have struggled mightily. Even Tesla’s shares have declined more than 10% since mid-January. Phrased simply, a US$80 billion valuation for Rivian looks either implausible or unsustainable (or both).

In the figure below, the performance of selected EV stocks since December 31, 2020 is shown versus that of the S&P 500. The S&P 500 and each of the stock prices are presented in index form where 100 is the uniform starting point. The S&P 500 has dramatically outperformed all EV companies.

Unfortunately, the key takeaway from Rivian’s presumed IPO valuation on currently trading EV manufacturers (like Lucid, Fisker or Lordstown Motors) is that they could be pressured until the time of Rivian’s IPO. Investors may save the dollars they would otherwise allocate to the space for the “hot” November IPO.

A Few Details on Rivian

Rivian plans initially to produce an all-electric pickup truck, the R1T, and an all-electric SUV, the R1S. The starting price for both models is around US$70,000, and each has a range of 300+ miles. The vehicles will be manufactured at the company’s plant in Normal, Illinois. Deliveries are expected to begin this fall.

In 2019, Amazon, which is one of Rivian’s core investors, announced it would purchase 100,000 electric delivery vehicles from Rivian as part of its pledge to achieve net-zero carbon emissions firmwide by 2040. Other core investors include Ford Motor Company and money managers T. Rowe Price Associates and BlackRock.

Reports of a US$80 billion valuation attached to Rivian’s IPO later this year could represent another obstacle for the beleaguered group of EV OEM stocks. It is quite possible that investors decide to wait to allocate much of their incremental EV stock investment dollars to this IPO.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.