In a little-noticed press release on May 26, just before the Memorial Day holiday weekend in the U.S., State Farm General Insurance Company announced it would stop accepting new applications in California for certain coverage items. The change is said to impact all business and personal lines for property and casualty insurance (e.g., home insurance) effective the next day. Existing policies will remain in effect.

State Farm meanwhile still plans to sell new auto insurance policies in the state.

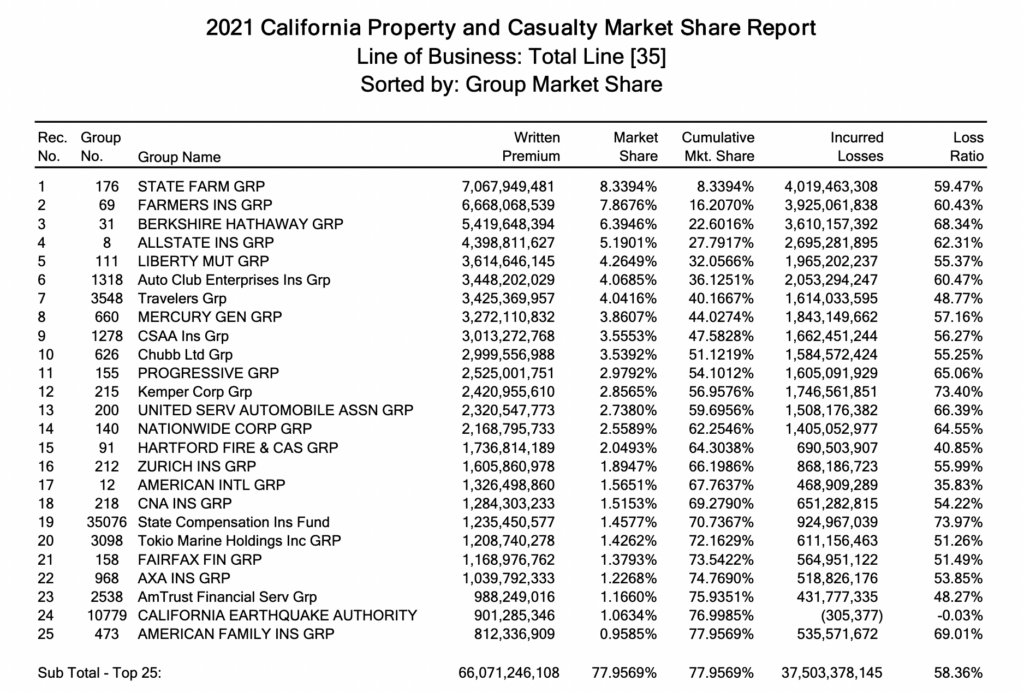

State Farm, which had the largest market share (8.3% in 2021) of all insurers in California’s property and casualty market and is the nation’s biggest home and car insurer by premium volume, took this action because of rapidly increasing wildfire risk in the state and the attendant inflationary pressures in construction costs. Another insurer, American International Group, Inc. (NYSE: AIG), 17th on the list in the table below, stopped selling home policies in California in 2022.

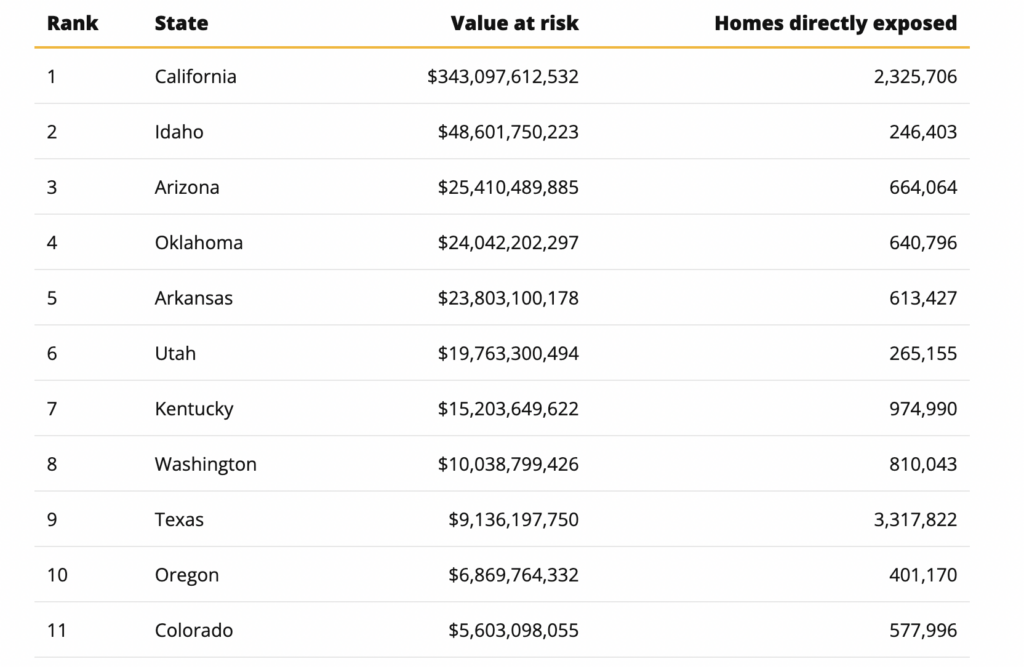

Wildfire property damage has become a significant risk and liability for U.S. home insurers. A disproportionate amount of the risk is in California, but other western states like Idaho and Arizona are significantly affected as well. The U.S. Forest Service estimates that 2.3 million homes in California, with an aggregate value of more than US$300 billion, are directly exposed to wildfire danger.

The implications of State Farm’s actions cannot be considered good for existing California homeowners and potentially for homeowners in other at-risk areas of the western United States. Since State Farm and AIG have stopped writing new home insurance policies in California presumably because the potential profits don’t exceed the risks, other insurers must be considering this move as well. As fewer insurers offer coverage, the cost of that insurance seems certain to soar.

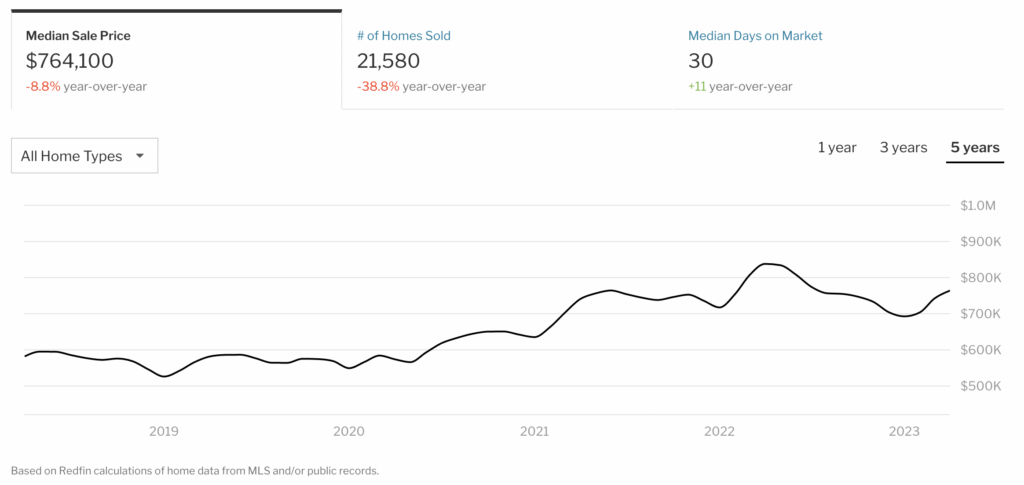

Furthermore, it is not impossible to think that finding any insurance company to write a home insurance policy might be difficult some years from now if the number and scope of wildfires continue to grow. We note that a buyer who intends to secure a mortgage loan as part of a home purchase must also buy a home insurance policy. If it becomes difficult to get such a policy, the pool of potential home buyers will shrink, which in turn would pressure housing prices.

California housing prices are down about 9% year-over-year, according to Redfin. Most of this decline is due of course to rising mortgage interest rates over this period. It is possible that a decline in the availability of home insurance in the Golden State (and potentially other western states) could depress future housing prices.

Information for this briefing was found via California Department of Insurance, State Farm, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.