FULL DISCLOSURE: The Deep Dive is long the equity of Steadright Critical Minerals.

Steadright Critical Minerals (CSE: SCM) has upgraded the memorandum of understanding that is in place to acquire the polymetallic copper-zinc-lead-silver-gold mine referred to as the Goundafa Mine. The company has modified the MOU in place to be binding following further due diligence being conducted.

The company has advanced the MOU to a binding status by providing a US$500,000 non-refundable deposit for the acquisition of the mine, with the terms of the arrangement being revised to allow for the mine to be paid for over a thirty six month term, rather than mines as contemplated under the original MOU.

Payments are also eligible to be accelerated through cash or shares as further exploration warrants.

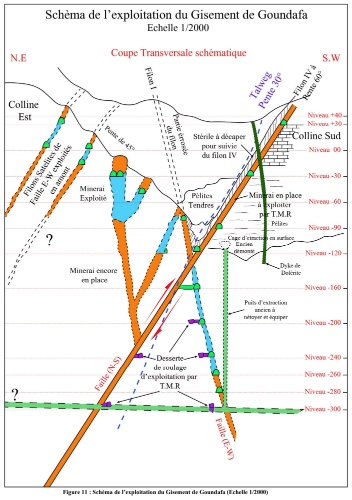

The Goundafa mine consists of 1,600 hectares of concessions within south central Morocco, with the operation said to be fully permitted with a Mining and Environmental Production License. The operation is centered on a series of steeply dipping mineralized veins that contain copper, zinc, gold, lead, and silver, with mineralization exposed at surface.

The mine previously operated from 1926 through to 1956, with operations halting due to political changes followed Moroccan independence. Full production figures are not available, however in 1920, 2,000 tones of ore was recovered with average grades of 22.14% zinc and 11.31% lead, while by 1956 320,000 tons of material was recovered.

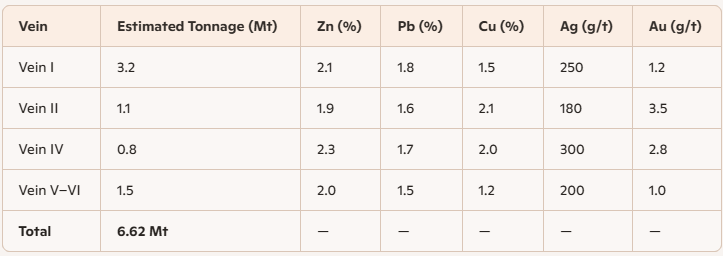

A 2022 non-NI 43-101 compliant geological report identified that conceptual resources of up to 6.62 million tons exists on site, with grades of 2.1% zinc, 1.8% lead, 1.5-2.1% copper, and up to 3.5 g/t gold in select zones. XRF-measured grades from inside the mine are said to show strong potential for significantly higher metal grades in some areas that are more consistent with historical mining results.

“The signing of a binding Memorandum of Understanding on the historic Goundafa Mine is a huge milestone for Steadright Critical Minerals. The duration of the MOU has increased from 9 months to 36 months, and it is now heavily back-ended. This gives us the ability to do significant exploration, which should greatly increase the value of the project and substantially derisk it. Boots have been on the ground since June,” commented Matt Lewis, CEO of Steadright Critical Minerals.

Under the terms of the MOU, Steadright is to pay US$8.0 million in cash or shares, or a combination thereof, with the mine expected to be paid in full by December 28, 2028. The arrangement calls for an initial US$500,000 payment, which has already been paid, followed by a US$1.0 million payment that is due in December 2026. US$750,000 payments will then be made semi-annually through to June 2028, before a final US$4.25 million balloon payment is due at the end of 2028.

Any profits generated from the project are to be split 50/50 until the asset has been paid for in full.

Steadright Critical Minerals last traded at $0.275 on the CSE.

FULL DISCLOSURE: Steadright Critical Minerals is a long investment of Canacom Group, the parent company of The Deep Dive. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.