Yesterday morning, Beacon Securities initiated coverage on Twitter’s favourite cannabis name, Stem Holdings (CSE: STEM), saying the company is currently building the UberEATS of cannabis. This is the first analyst to initiate coverage on the name. They have a 12-month price target of C$3 and a buy rating.

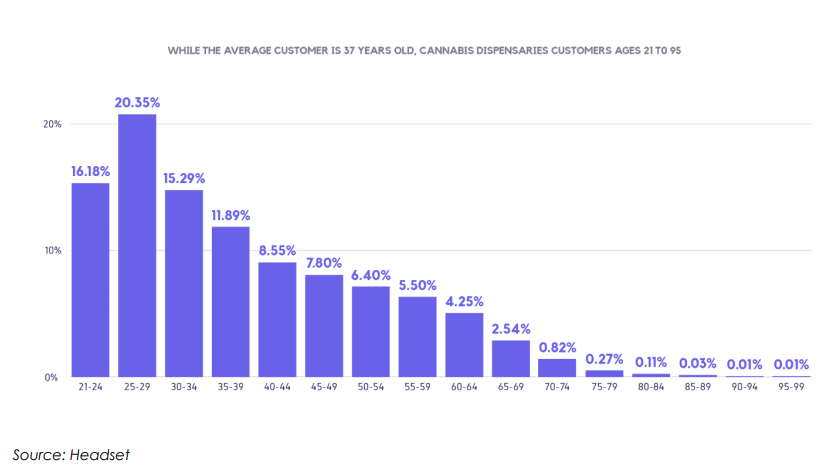

Doug Cooper, Beacon’s analyst, says that there is a secular trend towards online shopping, and one senior cannabis c-suite has said, “In cannabis, delivery is how people have shopped forever. The dispensary is the new, unusual shopping behaviour.” Cooper cites the decline in brick and mortar stores for years and the average age/demographic for people who consume cannabis. According to Headset data, more than 60% of cannabis users are under 40 years old. Their preferred way of shopping is obviously online.

Cooper believes that Stem Holdings will become a leader in DaaS, or Delivery as a Service, due to their recent acquisition of Driven Deliveries. They currently have 250 drivers and +300,000 registered customers in California. They expect them to expand their DaaS into Oregon as well. He writes, “We believe DaaS (Delivery as a Service) will be the fastest-growing segment of the cannabis distribution ecosystem.”

He believes that COVID-19 has only accelerated the switch from brick and mortar/retail sales to online sales. He notes that BDSA recently said they saw curbside pickup sales increase to 40% of all cannabis sales in the spring of 2020.

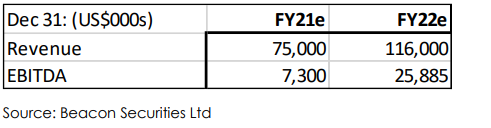

The company has issued 2021 guidance of $75 million in revenue. Beacon’s guidance is currently in-line with management, but they have broken down the revenue into segments. Retail is expected to do $20 million, Cultivation/Edibles will do $20 million, while the delivery business will do $35 million. Their 2022 estimate for revenue is $116 million. They expect a 15% growth in both its retail and cultivation segment but a 100% increase in their delivery business.

FULL DISCLOSURE: Driven By Stem is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Driven By Stem on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.