Yesterday, US President Joe Biden announced that he is taking steps to make right what a failure the war on drugs has become. He announced that he would be pardoning all prior federal offenses of simple marijuana possession, saying that this affects thousands of people. Additionally, he is calling on state governors to pardon simple state marijuana possession offenses. It should be noted that there is a more meaningful amount of people in jail at the state level than at the federal.

In this same announcement, he stated that he will ask the Secretary of Health and Human Services and the Attorney General, “to initiate the administrative process to review” how marijuana is currently scheduled under federal law. It is noted that cannabis is currently a schedule 1 drug, which the DEA defines as “drugs with no currently accepted medical use and a high potential for abuse.”

As a result, a number of U.S cannabis companies saw their stocks make massive gains, and many analysts are now coming out with their perspectives on the news. In Stifel-GMP’s note on the news, they say that the White House actions, “could catalyze a secular cannabis bull market.”

Stifel calls this news “the most important development in US cannabis history since the Cole Memo and could snowball into multiple industry tailwinds.” For which they anticipate shares of U.S cannabis companies to increase “up to 3x from current levels in short order.”

One of the larger tailwinds that U.S cannabis investors were looking forward too in the interim was the SAFE act passing during the lame duck session in congrress. Stifel-GMP says that this news out of the White House increases the odds for SAFE to pass, in which they believe there will be a snowball effect, which leads to an ultimate decrease in the cost of capital, uplisting and the inclusion of these companies in major indices, which will help drive institutional shareholder adoption. And lastly, the potential for outside companies to make strategic acquisitions.

Stifel-GMP says that the cannabis review could lead to cannabis becoming a Schedule 2 drug, which they admit, “may result in no meaningful change to MSO’s operating environment,” but note that if cannabis becomes a Schedule 3 or higher drug, 280E would no longer apply to these businesses.

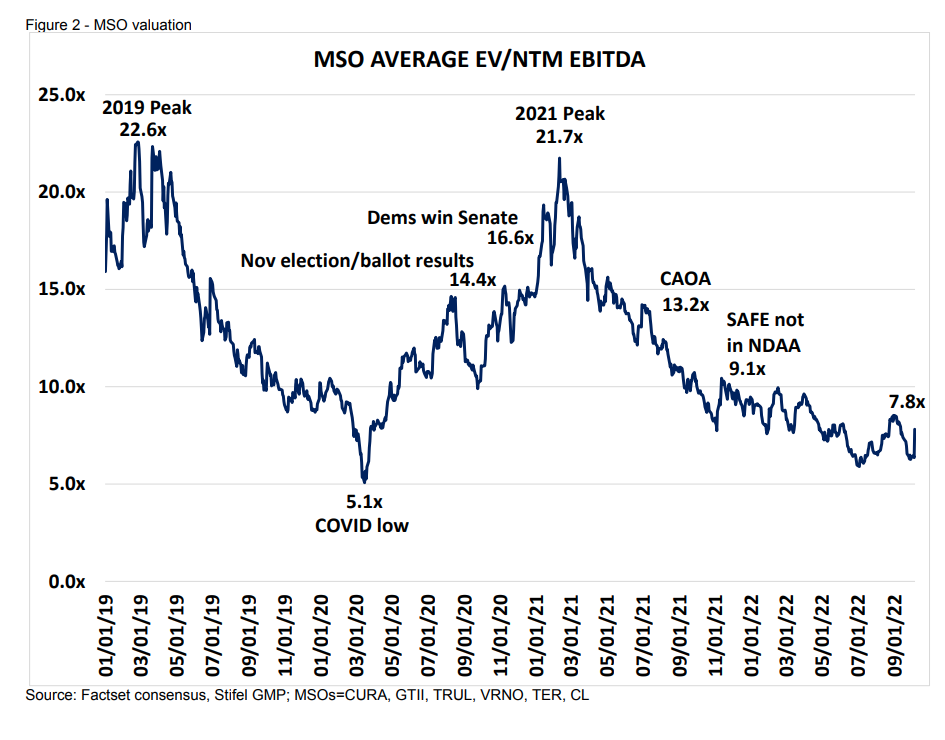

Lastly, Stifel says that “history suggests” shares could rise over 300% near term. Stifel adds that during the 2020 cannabis bull run, the peak valuation of the sector saw firms valued at up to 21x EV/NTM EBITDA. With these companies currently trading at 8x this multiple, they suggest that this is where these companies could be heading.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.