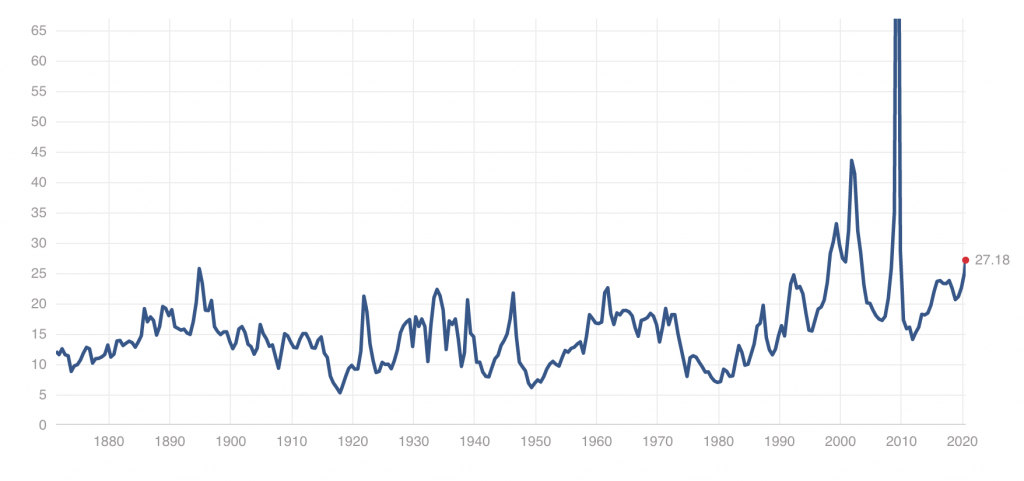

As the Federal Reserve continues to prop up various businesses and corporations across the US with its coronavirus stimulus aid, the new market liquidity has caused a sudden influx of investors seeking stocks and bonds. Despite much of the US struggling to maintain viability amongst the soaring coronavirus infection rates and diminishing consumerism, both the Dow Jones Industrial Average and the S&P 500 have increased by more than 40% since their downfall in March, with the Nasdaq composite soaring by almost 60%.

In the meantime, the forward price-to-earnings ratio for the S&P 500 currently sits at 27.18, with such an unprecedented level not witnessed since the dotcom boom of over 20 years ago. According to Refinitiv international financing review data, US equity capital markets raised a record total of $184 billion in just the second quarter of 2020, while over $8.9 billion IPOs were priced well in excess of their target range – a level not seen since 2014.

With the Federal Reserve promising unrestrained asset purchases during the pandemic, its balance sheet has increased from February’s $4.3 trillion, to a current total of $7 trillion. According to NatAlliance head of international fixed income Andrew Brenner, the stock markets have so far been inversely related to the coronavirus pandemic; the worsening of COVID-19 across the US will keep the Federal Reserve pledging more stimulus support, thus driving markets to perform at unparalleled levels.

Although the Federal Reserve has not been outright purchasing stocks with its stimulus programs, it has brought down interest rates to near-zero while introducing a variety of credit supports to US corporations and businesses. The Fed’s bond-buying programs have prompted corporations to take advantage of credit markets, with a total of $1.2 trillion in investment-grade paper being sold in just the first half of 2020. According to the Securities Industry and Financial Markets Association, this is the highest issuance volume ever recorded.

Information for this briefing was found via Reuters, Forbes, and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.