Two creations to come out of the recent stock market craze are Weber (NYSE: WEBR) and Traeger (NYSE: COOK), both of which sell grills and barbeques, and whom boast a combined $8 billion market capitalization. Weber says that they sell outdoor products “that include gas grills, charcoal grills, wood pellet grills, electric grills, smokers, grilling accessories, and solid fuel products including charcoal briquettes, lump charcoal, pellets, and wood chips and chunks.” While Traeger “is engaged in designing, sourcing, selling, and supporting wood pellet fueled barbeque grills sold to retailers, distributors, and direct to consumers.”

Traeger currently has 10 analysts covering the stock with an average 12-month price target of $31.33, or a 22% upside. The street high sits at $36 while the lowest comes in at $28. Out of the 10 analysts, 4 have strong buy ratings, 5 have buys and 1 analyst has a hold rating. While Weber currently only has 1 analyst who has a $19 price target and hold rating.

BMO Capital Markets initiated coverage on both names earlier this month. They gave Traeger a $33 12-month price target and outperform the rating, while Weber got a $19 price target and market performance rating. For Traeger, they say that this company is still in the early innings of growth for the reason as to why the rating and price target. While for Weber, which has a $5 billion market cap, they say that the valuation is keeping them away from a better rating.

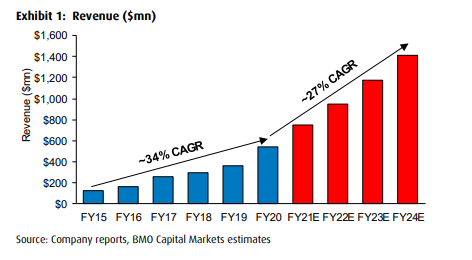

On Traeger, BMO seems to be very bullish on the name, saying that between management guidance and their estimates, they believe the company should grow revenue 20% annually for a few years as the company continues to increase its brand awareness, optimizing its distribution networks, international expansion, and “introducing/disrupting cooking experiences.”

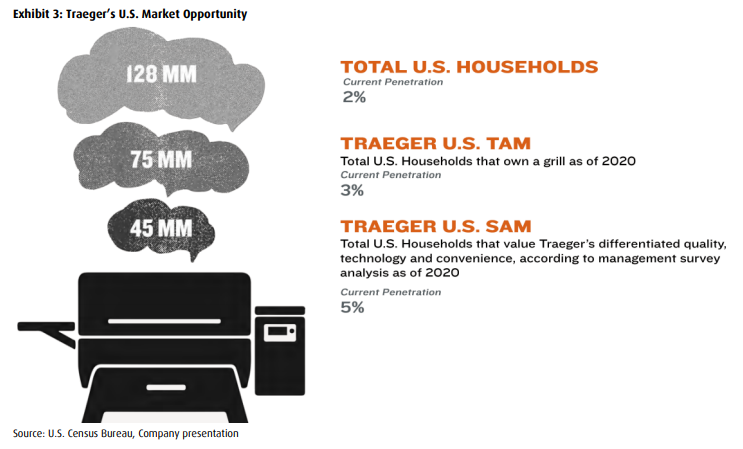

Currently, Traeger believes that they have captured only 2% of the 128 million U.S households, or 3% of the 75 million households who own a grill. BMO believes that they will start to increase their market share as more people are replacing their gas grills with pellet grills.

BMO also says that Traeger can start obtaining higher margins as it shifts its revenue mix from 92% wholesale revenue to more direct-to-consumer channels. Currently, Traeger is in >1,700 retail partners which equate to over 10,000 doors but, BMO says, “DTC can reach certain customers that do not shop its retail partners.”

For Weber, BMO says “As the clearly dominant brand, Weber commands approximately one-quarter of the grill industry, with a diversified portfolio across products and regions.” BMO believes that the companies diversified revenue growth makes the company more interesting.

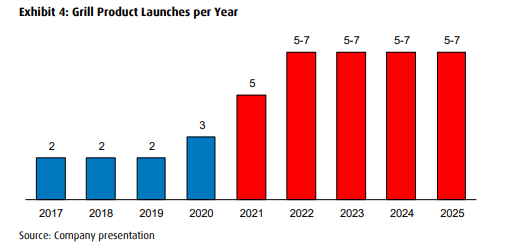

They believe as the company shifts its revenue segments to more wood pellet/electric smokers the company will get a lift in adjusted EBITDA margins. The company is expecting to launch 5-7 new grill products per year till 2025 which is anticipated to add >$600 million in new revenue.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.