Sundial Growers (NASDAQ: SNDL) reported its first-quarter results on May 11th after the bell. The company reported net revenue of $9.89 million, down from $13.85 million, and marked the third consecutive quarter of declining revenue growth. The company reported positive income from operations due in part to the government giving them $2.18 million in assistance.

Sundial currently has 5 analysts covering the company with a weighted 12-month price target of U$0.75. This is lower than before the results, which was U$0.90. Two analysts have hold ratings, another two have sell ratings and one analyst has a strong sell rating. The street high comes from Cantor Fitzgerald with a U$1.40 price target, while the lowest comes in at U$0.45.

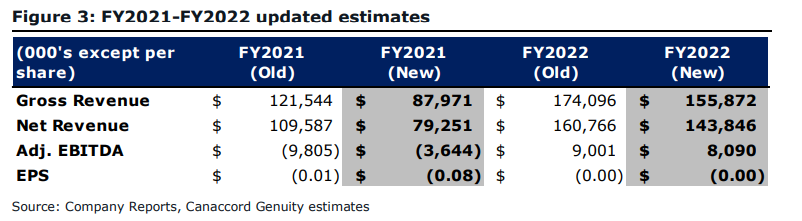

In Canaccord’s note, Shaan Mir, their cannabis analyst, raises Sundial to a hold rating from a sell rating and increases their 12-month price target to U$0.70 from U$0.65. Mir says that they have updated their models to reflect the massive cash position Sundial has, as well as, “the company’s transition away from the discount offerings,” and they included inner spirits revenue to get to the new price target.

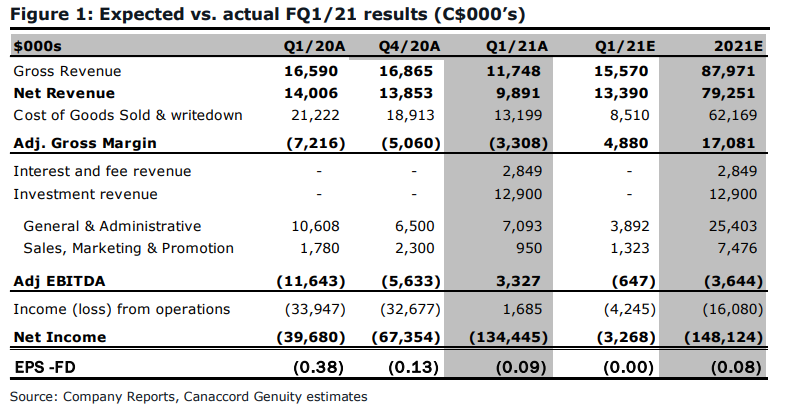

Sundial’s numbers came in just shy of what Canaccord estimated but Mir believes that this was caused by industry-wide headwinds, COVID-related headwinds, price compression, and inventory management that’s happening in many different provinces. Below you can see Canaccord’s estimates.

Mir notes that the revenue decline for the third straight quarter came from the sales mix changing, specifically their vape portfolio, which only brought in $1.4 million in sales versus $4.3 million the previous quarter. However Sundial did have a slightly improved gross loss this quarter, with Mir expecting that the company invests more into its cultivation facilities, which will drive margins higher (and hopefully positive).

The company now has a cash balance of $950 million, which after recently announced M&A is down to $725 million, which is one of the largest cash balances among its peers. Mir writes, “in our view, Sundial now maintains an ample war chest to deploy into various strategic opportunities, similar to announcements seen to date, that can generate attractive risk-return profiles in the sector.”

Below you can see the updated 2021 and 2022 estimates to account for the company moving away from a high growth cannabis segment and lower actual revenue for the first quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.