On November 11th, Sundial Growers (NASDAQ: SNDL) reported their third quarter results. The company reported net revenues of $14.4 million, an increase of 57% quarter over quarter and 12% year over year. Of the $14.4 million, $3.3 million was from investments and fees. Adjusted EBITDA came in at $10.5 million, up from a negative $4.4 million EBITDA loss last year. For the quarter, gross margins were ($1.2) million while the company reported a positive $11.3 million net income.

Additionally, the company announced a share repurchase program of up to C$100 million or 102.8 million shares under the program, which is equal to 5% of the issued and outstanding shares.

Sundial currently has 5 analysts covering the stock with an average 12-month price target of US$0.79, or a 14% downside to the current stock price. Out of the 5 analysts, 4 have hold ratings, and a single analyst has a sell rating. The street high sits at US$0.97 from Cantor Fitzgerald while the lowest comes in at US$0.50.

In Canaccord’s third quarter review, they reiterate both their hold rating and US$0.80 12-month price target saying the company acquisition of SpiritLeaf drove most of the revenue growth.

For the quarter, Sundial came in just below Canaccord’s estimates as they expected net revenue to be $15.77 million and a positive adjusted gross margin. As mentioned above, SpiritLeaf provided $6.1 million of revenue for Sundial this quarter, $3.9 million from corporate-owned stores, and $2.2 million from franchise sales.

For Sundials legacy business, they reported revenues of $8.2 million, or a decrease of 11% quarter over quarter, which Canaccord believes this decline is primarily attributable to the company moving away from the value segment and discount pricing. They also write, “We continue to see challenges for the company’s core cannabis segment as discount offerings maintain prominence at the end-user level.”

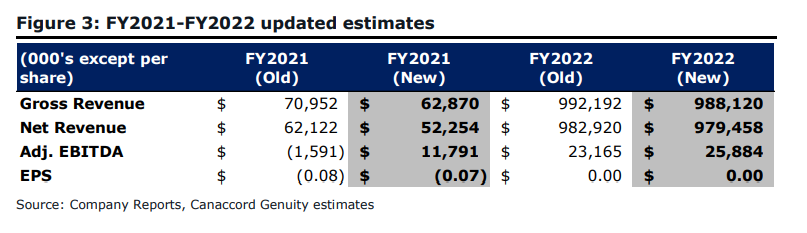

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.