The coronavirus pandemic has had a profound effect on global markets, nearly collapsing entire industries amid sudden shifts to disequilibriums. One of the hardest-hit markets has been the global oil industry, which saw a significant reduction in crude demand as the coronavirus pandemic brought travel to a standstill. Strongly related to the current oil market volatility however, is also the tanker ship industry, which has seen rates slide in mirror to global oil demand.

Tanker rates have been plummeting in the wake of the pandemic, with many shipping companies idly standing by waiting on new transport deals to arise. Daily rates for very large crude carriers that can transport up to 2 million barrels of oil between the Middle East Gulf and Asia fell to $20,000 as of Wednesday, with the global average now hovering around $26,537 per day. The new rates are a significant reduction from the $28,000 per day rates recorded only a year prior, and an even bigger jump from the all-time high of $250,000 daily rate in March.

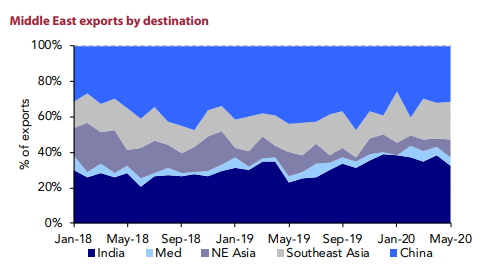

The increased competition amongst crude carriers in the Middle East Gulf has led to the limited number of outgoing cargos receiving multiple offers – some even in the double digits. Furthermore, many oil tankers that served as floating storage during the pandemic are now finally being unloaded, and with the impending oversupply of ships, cargo rates will be driven down even further.

Although increased competition among cargo carriers is drastically driving down daily rates, the volatility may only be short-lived. According to Jefferies analyst Randy Giveans, rates will continue to remain flat for the remainder of summer, but by the fourth quarter rates are expected to rebound to around $50,000 per day. Historically, the summer season has been subject to market slumps, with a significant rebound occurring later in the year. With a second wave of coronavirus threatening the globe however, over-relying on historical data may be irrelevant.

Information for this briefing was found via American Shipper and Poten & Partners. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.