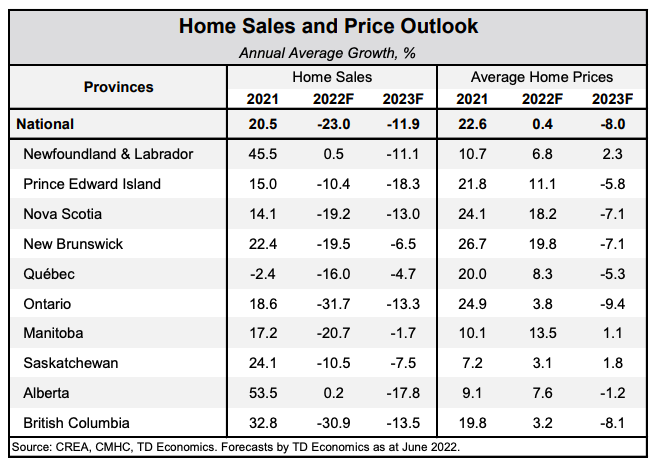

Canadian home sales could fall by 23% on average this year, and remain low at a 12% average decline into 2023, according to a report by TD Economics.

The report, published on Wednesday last week, comes after a series of interest rate increases by the Bank of Canada as inflation kept breaking records.

According to the report, TD expects soaring borrowing costs to “weigh heavily on housing activity.” The bank sees a “33% peak-to-trough decline in Canadian home sales from 2022Q1–2023Q1.” After this period, housing activity is expected “to firm” as interest rates go down from their multi-year highs but still remain at low levels.

The bank has significantly lowered its home sales and price forecasts versus March, “as monetary policy has tightened more acutely than anticipated.”

With the lower demand, average Canadian home prices are expected to go down between the 2022Q1 to 2023Q1 period, with a projected peak-to-trough decline of 19%. But prices are likely to modestly go up after this period, with some demand recovery.

In the report, TD sees average home sales and prices declining the most in B.C. and Ontario for 2022 and 2023. Quebec, meanwhile, is set for a “relatively modest price growth due to the notable deterioration in affordability since early 2020.”

In June, TD raised its key interest rate by 50 basis points, or half a percentage point, to 1.5%. Before this, the bank also raised its key interest rate in March and then in April. A new rate announcement is set for July 13.

Information for this briefing was found via TD Economics and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.