Last night, Teladoc Health (NYSE: TDOC) confirmed that the pandemic is seemingly over, after seeing its valuation smacked down from roughly $9 billion down to $4 billion. This comes after Teladoc reported its first quarter financial results.

The company saw its revenue grow 25% year over year to $565 million, just slightly below the analyst consensus of $568 million. Gross margins stayed solid at 66%, only dropping 1% year over year. For the segments, access fee revenue grew 29% year over year while visit fee revenues only grew 12%.

The company reported a net loss of $6.6 billion, or earnings per share of -$41.58, which is currently higher than their share price, even after removing the negative aspect. This is thanks to a $6.6 million goodwill impairment relating to its Livongo acquisition, which was triggered by a number of things, such as a decline in Teladoc’s price target and lowered forecasted cash flow out of the business.

Notably, $7.9 billion in goodwill remains on the balance sheet, in addition to $1.9 billion in intangible assets, which may again need to be written down as a result of the current valuation of the company.

Adjusted EBITDA came in at $54.5 million, slightly higher than the consensus estimate and basically flat year over year. While the adjusted EBITDA margin dropped from 12.5% to 9.6%.

At the end of the quarter, Teladoc had 54.3 million U.S-paid members which represented an average U.S revenue per member of $2.52, this is up from the $2.09 average revenue per member in the first quarter of 2021.

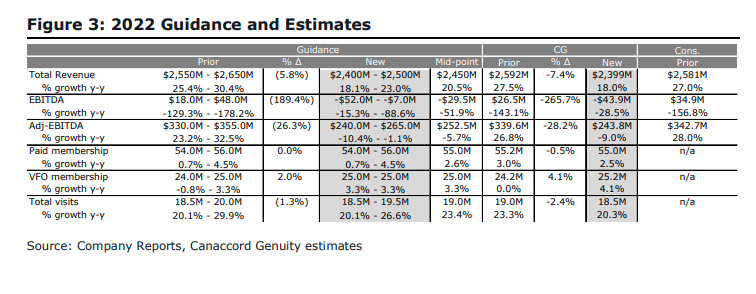

Teladoc also provided investors with second quarter and revised full-year guidance. The company expects second-quarter revenues to be between $580 and $600 million, which at the high range of guidance would be a year-over-year increase of only 19%. Adjusted EBITDA is guided to come in at a range of $39 to $49 million.

They expect the total U.S paid memberships to come in between 54 and 55 million, which signifies that the business growth looks to be slowing.

For the full year, Teladoc expects revenues to come in between $2.4 and $2.5 billion, which represents a 23% year-over-year increase but looks as if growth will be slowing into the second half of the year. While Adjusted EBITDA is expected in the range of $240 and $265 million.

Lastly, total U.S paid memberships is expected in the range of 54 to 56 million, which also signifies that the company is forecasting a very weak second half.

Practically all of Teladoc’s 30 analysts lowered their 12-month price target on the stock, bringing the average 12-month price target to $75 from $105. Out of the 30 analysts, 4 have strong buy ratings, 8 have buys and 18 have hold ratings. The street high 12-month price target sits at $210.

In Canaccord’s note on the results, they reiterate their buy rating but slash their 12-month price target from US$112 to US$50, while welcoming with open arms Teladoc to the penalty box. They add that the stock has been a “house of pain” for investors as people try and return to getting on with life without COVID-19.

They say that although the company is seeing a slight slowdown operationally, management had been able to effectively manage the expectations. This all changed with their first quarter 2022 results, they say that the quick shift in full-year 2022 guidance downwards puts management’s credibility in question.

They say that management has now noticed a reversal in D2C marketing trends, which leads to a lower yield for its BetterHelp business. This on top of a slower conversion rate of late-stage chronic care deals and wage pressures has led to this revision of full-year 2022 guidance.

Canaccord says that these new issues now raise additional questions regarding the longer-term growth targets which were provided by the company on their analyst day. Though they remain hopeful that management has stuffed all the bad news into this quarter and has ripped the band-aid off.

Below you can see Canaccord’s updated full-year 2022 guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.