Among the current issues hurling Tesla (Nasdaq: TSLA), it seems like problems are something of which it won’t run out of supply. With bitcoin hitting its all-time low for the year, the automaker’s then-bullish investment in the crypto asset could spell trouble for its next earnings release.

The digital coin is sustaining massive losses from a series of factors stemming from the whiplash of the rising inflation. Crypto lender Celsius Network alone sent the market plummeting after it lost 70% of its CEL token’s value following its decision to halt all withdrawals.

The bullish outlook

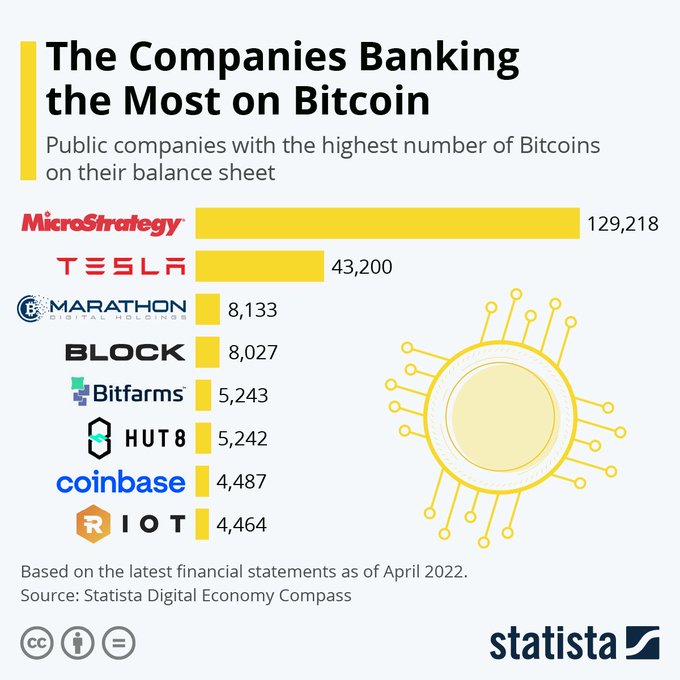

Back when bitcoin was the darling of the crowd investors, the automaker bought around US$1.5-billion worth of the digital asset, making it the second-biggest public company holder.

“We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash,” the company said at the time of the purchase. The bitcoin value then traded around US$34,000.

The firm then sold in the same quarter around US$272-million worth of bitcoin when the price hit the US$50,000-mark.

The whiplash

As it stands, when the value of the digital asset increases, the gains are not reflected in the firm’s financials as these are considered “indefinite-lived intangible assets.” But the decline in value from the asset’s book value should be reported as an impairment charge.

With bitcoin traversing the US$22,000-mark, Tesla’s US$1.5 billion purchase in 2021 is now effectively worth around US$1.0 billion. Any potential drastic change notwithstanding, the automaker is looking at recording an impairment loss of around US$500 million.

Best part about bitcoin shitting the bed is @elonmusk and $TSLA have 43,000 bitcoin on their balance sheet.

— Vinny Chase (@NotMrVinnyChase) June 13, 2022

Wen bankrupt? 🤔

The potential loss adds to the company’s growing laundry list as it was also recently kicked off the S&P 500 ESG Index due to “codes of business conduct.” The share price decline that followed cost Musk US$12.4 billion.

The prospect of Tesla as an institutional hodler following this windfall is quite unclear. In April 2022, former Twitter (NYSE: TWTR) CEO Jack Dorsey’s digital payment firm Block (NYSE: SQ) announced its partnership with crypto firm Blockstream to create a renewable energy-powered bitcoin mining facility in Texas using Tesla’s solar and energy storage products.

In the meantime, should bitcoin price don’t pick up, there’s an anticipated blemish to the automaker’s quarterly financials come July.

Tesla last traded at US$647.21 on the Nasdaq.

Information for this briefing was found via Seeking Alpha and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.