Over the weekend, Tesla (NASDAQ: TSLA) was one of many automotive companies to announce their third-quarter production and delivery numbers. The company announced that production during the third quarter was 365,923 cars, of which 19,935 were Model S/X, and 345,988 were Model 3/Y cars. At the same time, deliveries were 343,830 cars, with 18,672 Model S/X cars being delivered and 325,158 Model 3/Y being delivered.

In the news release, Tesla says that as its production continues to increase, “it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks.” As a result, the company has started to transition to “a more even regional mix” of production weekly.

Tesla currently has 43 analysts covering the stock with an average 12-month price target of $299, or an upside of about 24%. Out of the 43 analysts, 12 have strong buy ratings, and 15 have buy ratings. Ten analysts have hold ratings, while three analysts each have sell and strong sell ratings. The street high price target sits at $461, which represents an upside of about 90%.

In Canaccord Genuity Capital Markets’ note on the production and delivery numbers, they reiterate their buy rating and $304 12-month price target but say that investors should “mind the gap.” The gap being the number of cars produced over the number of cars delivered during the quarter.

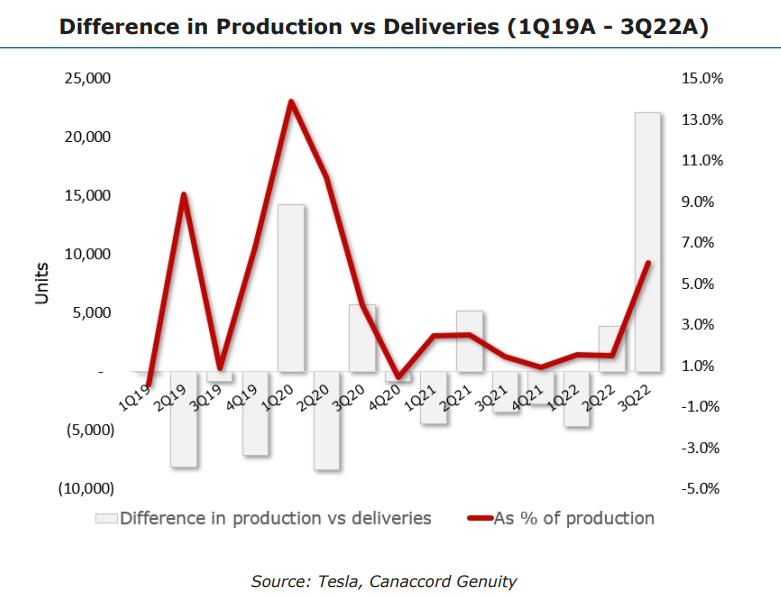

Canaccord says that this roughly 22,000 car overproduction is material and asks what gives. They are hoping that during the earnings call, Tesla will be able to answer two important questions: how much does this differ from normal, and why?

They say that this gap of roughly 22,000 cars is the largest gap in the last 15 quarters on an absolute basis and the fourth largest on a percentage basis.

As for Tesla’s reasoning in the news release, Canaccord trusts that the gap is due to attributes outside their control but notes that “given the growing data points from a macro and Tesla-specific perspective,” all point to a potential slowdown in order rates.

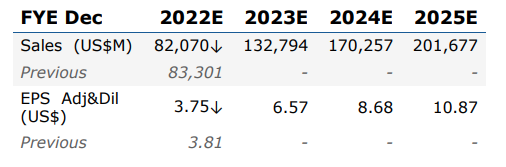

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.