Tesla (NASDAQ: TSLA) last night released its financial results for the fourth quarter of 2023, revealing revenue and profit figures that fell short of analysts’ expectations. The company’s stock experienced a nearly 9% decline following Thursday’s market open.

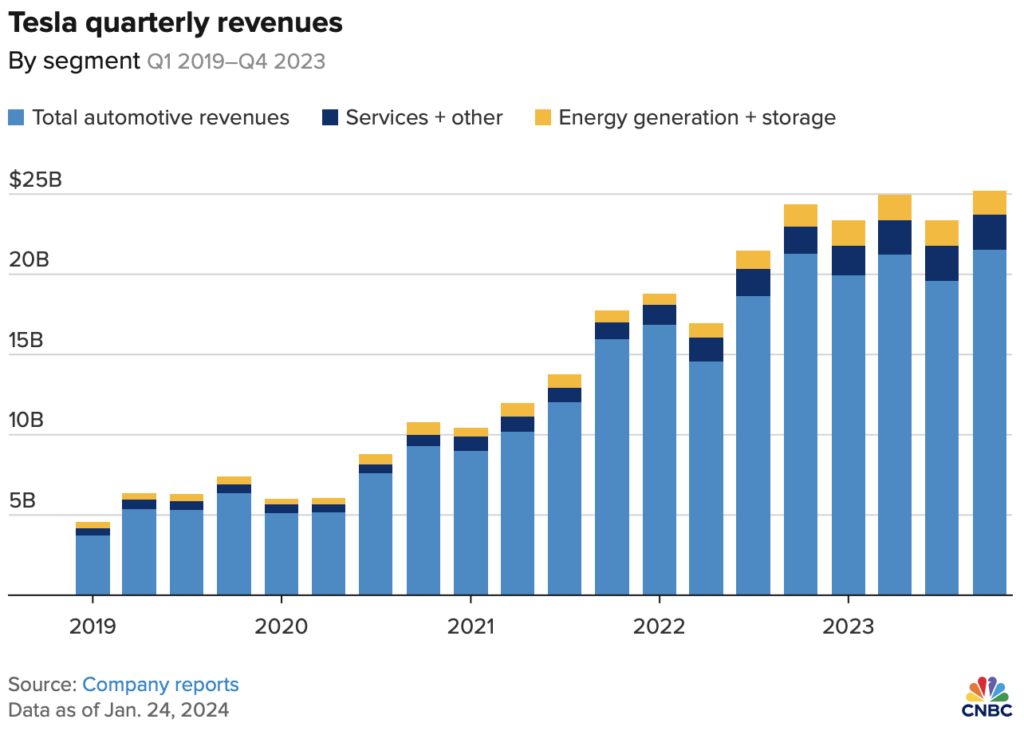

For the fourth quarter, Tesla reported earnings per share of 71 cents, adjusted, compared to the 74 cents expected by LSEG (formerly Refinitiv). Revenue came in at $25.17 billion, missing the $25.6 billion estimate from LSEG. While total revenue showed a 3% increase from the previous year, automotive revenue only saw a meager 1% rise.

TESLA EARNINGS JUST CAME OUT $TSLA

— GURGAVIN (@gurgavin) January 24, 2024

*TESLA 4Q REVENUE $25.17B, ESTIMATE $25.87B ( MISS ❌ )

* TESLA 4Q EPS $0.71, ESTIMATE $0.74 ( MISS ❌ )

*TESLA 4Q GROSS MARGIN 17.6%, EST. 18.1% ( MISS ❌ ) pic.twitter.com/0Csta3ezCg

$TSLA

— *Walter Bloomberg (@DeItaone) January 24, 2024

*TESLA 4Q REV. $25.17B, EST. $25.87B

*TESLA 4Q ADJ EPS 71C, EST. 73C

*TESLA 4Q FREE CASH FLOW $2.06B, EST. $1.45B

*TESLA 4Q GROSS MARGIN 17.6%, EST. 18.1%

The dip in automotive revenue was attributed to a reduced average selling price following significant price cuts globally in the second half of the year. However, net income for the quarter more than doubled to $7.9 billion, or $2.27 per share, with a substantial portion attributed to a $5.9 billion one-time noncash tax benefit.

Tesla acknowledged challenges in its investor presentation, stating that vehicle volume growth in 2024 “may be notably lower” than the previous year. The company cited ongoing efforts in launching its “next-generation vehicle” in Texas and emphasized being “between two major growth waves.”

During the earnings call, CEO Elon Musk addressed concerns about his desire to own 25% of Tesla, referring to a recent tweet about turning the company into a “leader in AI and robotics.” Musk floated the idea of a dual-class share structure, expressing discomfort with the possibility of being voted out by a shareholder advisory board.

Musk also provided insights into Tesla’s humanoid robot, Optimus, describing it as “by far the most sophisticated humanoid robot that’s being developed anywhere in the world.” While he expressed optimism about shipping “some number” of Optimus units next year, he cautioned about the unpredictability of timelines.

Tesla’s financials for the full year highlighted automotive revenue reaching $82.42 billion, a 15% increase from the previous year. The energy division saw a 54% rise in revenue to $6.04 billion, while “Services and Other” revenue increased by 37% to $8.32 billion.

Tesla $TSLA dumping in after hours after reporting an earnings miss pic.twitter.com/kv2vjcwBhi

— Barchart (@Barchart) January 24, 2024

The company faced challenges, with operating income decreasing year over year to $2.1 billion in the quarter. Tesla attributed this decline to the reduced average sales price of vehicles and increased operating expenses, partly driven by AI and other research and development projects.

Despite unveiling the Cybertruck and beating delivery expectations for the fourth quarter, Tesla experienced a 16% drop in its stock value in the early weeks of 2024. Musk remains optimistic about the Cybertruck’s success, predicting deliveries of around a quarter of a million units annually.

Looking ahead, Tesla revealed plans for a new mass-market vehicle, Redwood, expected to debut in mid-2025 with a starting price of $25,000. Musk hinted at the vehicle’s profound impact on both design and manufacturing systems, but refused to take any questions about the new model on last night’s conference call.

But from the fintwit community’s perspective

In evaluating Tesla’s Q4 2023 financial performance, analysts on Twitter (now X) have expressed a range of opinions, shedding light on both positive and concerning aspects of the electric car manufacturer’s latest quarterly results.

Dean Sheikh, an industry observer, highlighted the absence of positive cash flow from Tesla’s business. He noted a substantial increase of $4.3 billion in accounts payable, accrued liabilities, debt, and other obligations. This was offset by a $3 billion surge in cash, a $1 billion increase in accounts receivable, and a $600 million rise in prepaid expenses.

“With 5% price cuts so far in Q1, things look to get much worse from here,” he added.

ICYMI: Tesla's business generated no cash. AP/AL/Debt/Other Liabilities went up $4.3B offset by $3B cash, $1B in A/R, and $600M in pre-paid expenses increases.

— Dean Sheikh (@DeanSheikh1) January 24, 2024

With 5% price cuts so far in Q1, things look to get much worse from here.

Zero Hedge delved into Tesla’s forward-looking statements, emphasizing the potential deceleration in vehicle volume growth for 2024. Stanphyl Capital responded by interpreting this as an indication of diminishing demand for Tesla’s existing, higher-margin products, particularly in light of their focus on launching a next-generation vehicle at Gigafactory Texas.

Yeah, in other words demand for our existing, higher margin products is dying.

— Stanphyl Capital (@StanphylCap) January 24, 2024

Ross Hendricks, another commentator, highlighted Tesla’s triple-miss in Q4, with disappointing figures in revenues, earnings per share (EPS), and gross margins. Hendricks noted that these results fell short even after analysts had adjusted their estimates downward over the preceding 12 months.

“My $100 price target for 2024 appears too high,” he noted.

$TSLA out with the triple-miss

— Ross Hendricks (@Ross__Hendricks) January 24, 2024

Revenues, EPS and gross margins all disappoint

And that's despite analysts taking a chainsaw to their estimates over the last 12 months

My $100 price target for 2024 appears too high pic.twitter.com/UW6KXqBGBK

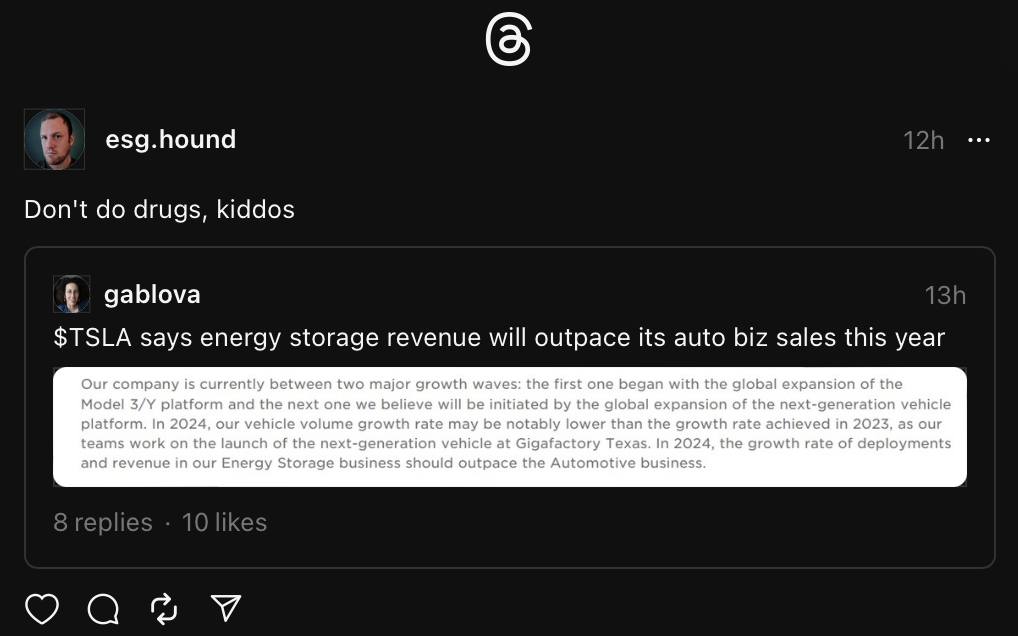

In Tesla’s forward-looking statements, the firm painted a more optimistic picture, acknowledging being between two major growth waves: “the first one began with the global expansion of the Model 3/Y platform and the next one [it believes] will be initiated by the global expansion of the next-generation vehicle platform.”

“In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next-generation vehicle at Gigafactory Texas,” the company explained.

The automaker also said that “the growth rate of deployments and revenue in [its] Energy Storage business should outpace the Automotive business” in 2024, while also noting that vehicle volume growth rate may be lower compared to last year “due to the launch of the next-generation vehicle at Gigafactory Texas.”

Motorhead, however, questioned the credibility of Tesla’s guidance, suggesting it might be indicative of internal challenges.

For $TSLA to say this, things must be in a world of hurt for them right now. This company has never guided negatively before. pic.twitter.com/vosktIkpIJ

— Motorhead (@BradMunchen) January 24, 2024

Gary Black acknowledged Tesla’s beat on Q4 auto gross margin but underscored the lack of guidance for FY’2024 volume, which could potentially disappoint investors. The absence of clarity on future volume growth and auto gross margin outlook raised concerns for Black.

“Unless [management} clarifies 2024 volume guidance or provides a 2024 auto gross margin outlook on the call, investors are unlikely to respond favorably to these results,” he said.

$TSLA beat on 4Q auto gross margin ex-RC (17.2% vs 16.7%E) but declined to provide FY’2024 volume guidance, instead saying growth would be lower than FY’2023 of +38% (+21%E). Non-GAAP EPS was $.71 (vs $.74E) but included -$.04/share of unfavorable Other Expense.

— Gary Black (@garyblack00) January 24, 2024

Unless mgmt…

Meanwhile, Musk’s comments on licensing Tesla’s Full Self-Driving software to other carmakers sparked skepticism among some analysts. Dan O’Dowd questioned the authenticity of Tesla’s autonomous driving capabilities, referring to Musk’s past claims and labeling Full Self-Driving as a “stock pumping joke.”

So @elonmusk had talks about licensing Tesla's Full Self-Driving software to other car makers, but they "don't believe it's real".

— Dan O'Dowd (@RealDanODowd) January 25, 2024

Maybe they know autonomous driving is not a "solved problem" for Tesla, like Elon claimed in 2016, and FSD is a stock pumping joke to real experts. pic.twitter.com/X3KsoA7sQ2

In response to Musk’s statements during the earnings call, Jim Cramer suggested that Tesla’s stock resilience in the face of disappointing quarterly results might indicate a potential surprise or strategy from the company.

Posit this: Tesla's barely down after an awful q. Might the Magician have something up his sleeve?

— Jim Cramer (@jimcramer) January 24, 2024

The results came in while the carmaker is grappling with employee dissatisfaction as it delays a second pay adjustment while Musk demands a substantial increase in his shares.

Information for this briefing was found via CNBC, The Guardian, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.