Although the demand for zero-emissions and electric vehicles is expanding steadily despite the economic hurdles posed by the coronavirus pandemic, it appears that America’s most flamboyant EV manufacturer is not being that well-received in one of the world’s largest markets.

According to Bloomberg, Tesla has once again reduced its prices on its performance and longer range models sold in China by 23,000 yuan. This will be the seventh time that Tesla has had to initiate such a move this year, as the demand for its unique vehicles does not seem to be taking off as previously anticipated. GLJ Research’s Gordon Johnson noted that Tesla’s September sales numbers came in significantly weaker, and are the main reason for the sudden reversal on pricing in the communist country.

China, which suffers from a serious pollution problem compared to other major economies, has recently taken a proactive approach to curbing air pollutant levels. The communist country has imposed quotas on car ownership in some of its larger cities, and provides rebates on zero-emission vehicles for those consumers fortunate enough to own a car. As a result, the demand for electric vehicles has skyrocketed in the country, prompting EV manufacturers to flood the market.

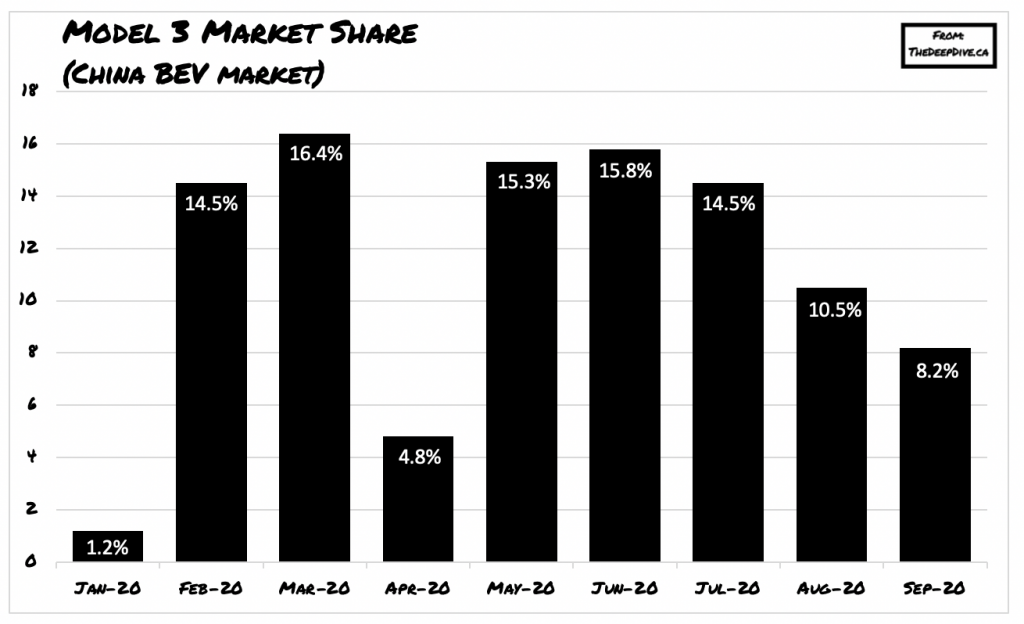

However, Tesla saw its vehicle inventory in China nearly double in September, despite ceasing production during the last ten days of the month. Johnson attests this to be the likely reason behind the recent price cuts, and why Tesla is now trudging through plans to export its Chinese-made cars to other parts of Asia and Europe. Johnson also brought attention to Tesla’s apparent market share decline in China, which fell by 2.3% between August and September.

As Tesla attempts to stoke demand for its electric vehicles in the rest of Asia and Europe, many consumers have taken notice of Tesla’s lack of competition against major automakers such as GM, which sold more than two times the amount of electric vehicles in China during the month of September compared to Tesla. Nonetheless, for a company that allegedly attributes itself as supply constrained, Tesla sure has been going through price cuts like toilet paper. As supply and demand theory states, when one has to continuously reduce the price of an item while failing to sell inventories for three consecutive months, then there is likely a demand problem, rather than a supply problem.

Information for this briefing was found via Bloomberg and GLJ Research. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.