Despite battling an ongoing global semiconductor chip shortage, numerous consumer complaints in China, and various other supply chain disruptions, Tesla (NASDAQ: TSLA) was still able to set a bullish tone for its second quarter earnings, by once again surpassing consensus estimates across the board.

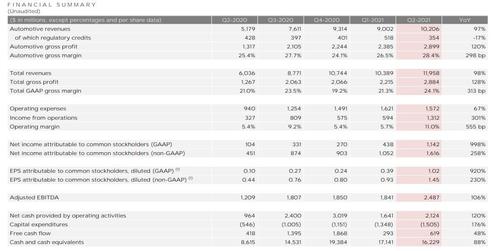

However, bearish sentiment still remains, particularly regarding the source of Tesla’s profit. Recall, in the first quarter, Tesla’s sales of regulatory credits rose to a record $518 million, while its GAAP net income stood at a mere $438 million— suggesting that no meaningful net income was generated from the sale of its main business— which is producing cars. This quarter, though, the situation has modestly normalized, as only $354 million in revenue came from the sale of regulatory credits, which amounts to approximately 30% of the $1.142 billion in GAAP net income.

In any case, investors’ concerns surrounding Tesla’s long-term future still remain elevated, and as such, the company’s stock is still down nearly 10% since the beginning of the year. Diving under the hood, though, Tesla’s revenue totalled $11.96 billion, beating estimates that called for $11.36 billion. Earnings per share also were up substantially from forecasts of $0.97 to $1.45, while free cash flow rose to a whopping $619 million, significantly outdoing estimates of -$319.1 million. Conversely, cash and cash equivalents were down $16.229 billion, missing estimates that called for a total of $16.55 billion.

In other notable highlights, Tesla also revealed that it had delivered a total of 201,250 vehicles, and was able to achieve an 11% operating margin while surpassing $1 billion in GAAP net income for the first time in the company’s history. However, lets not forget though, that over one-third was derived from regulatory credit sales. With respect to profit, Tesla reported a “bitcoin related impairment” of $23 million, while growth in its operating income was able to increase due to cost reductions and volume growth.

Finally, looking at Tesla’s energy business, it appears things aren’t going too well: the company solar deployments fell from 92 megawatts in the first three months of the year to 85 megawatts in the second quarter. With respect to the EV makers Soar Roof, there will only a minor update, noting that “Solar Roof deployments grew substantially both YoY as well as sequentially in Q2.”

Information for this briefing was found via Tesla. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.