After the market closed on July 19, Tesla, Inc. (NASDAQ: TSLA) reported good, but not blow-out, 2Q 2023 results. Adjusted EPS and automotive revenue were US$0.91 and US$21.3 billion, besting estimates of US$0.81 and US$21.0 billion, respectively.

On the other hand, the fierce price war raging in the electric vehicle (EV) industry caused Tesla’s automotive margins to continue to decline for the third successive quarter to 19.2%, a remarkable 870-basis point reduction from 27.9% in the period ended September 2022. Phrased differently, the average sales price of a Tesla vehicle was US$45,626 in 2Q 2022, down 16% from US$54,364 just nine months ago.

TESLA, INC. — Selected Financial Statistics

| (in millions of U.S. dollars, except per share and vehicle production data) | Twelve Months Ended 6-30-23 | 2Q 2023 | 1Q 2023 | 4Q 2022 | 3Q 2022 |

| Automotive Revenue | $81,230 | $21,268 | $19,963 | $21,307 | $18,692 |

| Automotive Gross Profit | $19,031 | $4,089 | $4,208 | $5,522 | $5,212 |

| Automotive Gross Margin | 23.4% | 19.2% | 21.1% | 25.9% | 27.9% |

| Services and Other Revenue | $7,333 | $2,150 | $1,837 | $1,701 | $1,645 |

| Services and Other Revenue Gross Profit | $463 | $166 | $135 | $96 | $66 |

| Recurring EPS – Fully Diluted | $4.00 | $0.91 | $0.85 | $1.19 | $1.05 |

| Operating Cash Flow | $13,956 | $3,065 | $2,513 | $3,278 | $5,100 |

| Capital Expenditures | $7,793 | $2,060 | $2,072 | $1,858 | $1,803 |

| Adjusted EBITDA | $19,292 | $4,653 | $4,267 | $5,404 | $4,968 |

| Cash – Period End | $23,075 | $23,075 | $22,402 | $22,185 | $21,107 |

| Debt – Period End | $2,331 | $2,331 | $2,676 | $3,099 | $3,553 |

| Shares Outstanding (millions) | 3,171 | 3,171 | 3,166 | 3,160 | 3,146 |

| Vehicles Produced | 1,726,132 | 479,700 | 440,808 | 439,701 | 365,923 |

| Vehicles Delivered | 1,638,123 | 466,140 | 422,875 | 405,278 | 343,830 |

| Average Tesla Vehicle Price | $49,587 | $45,626 | $47,208 | $52,574 | $54,364 |

| Sequential Change | -3.4% | -10.2% | -3.3% | -5.2% |

Tesla maintained its full-year 2023 production forecast of around 1.8 million vehicles, which suggests much smaller year-over-year gains in the back half of 2023 than in the first half. Many analysts had projected full-year 2023 manufacturing would reach two million units. Instead, the company expects production line retooling in 2H 2023 to limit the potential increases. For the twelve months ended June 30, 2023, Tesla produced 1.726 million vehicles. In 1H 2023, the company produced about 0.92 million EVs, 63% more than in 1H 2022.

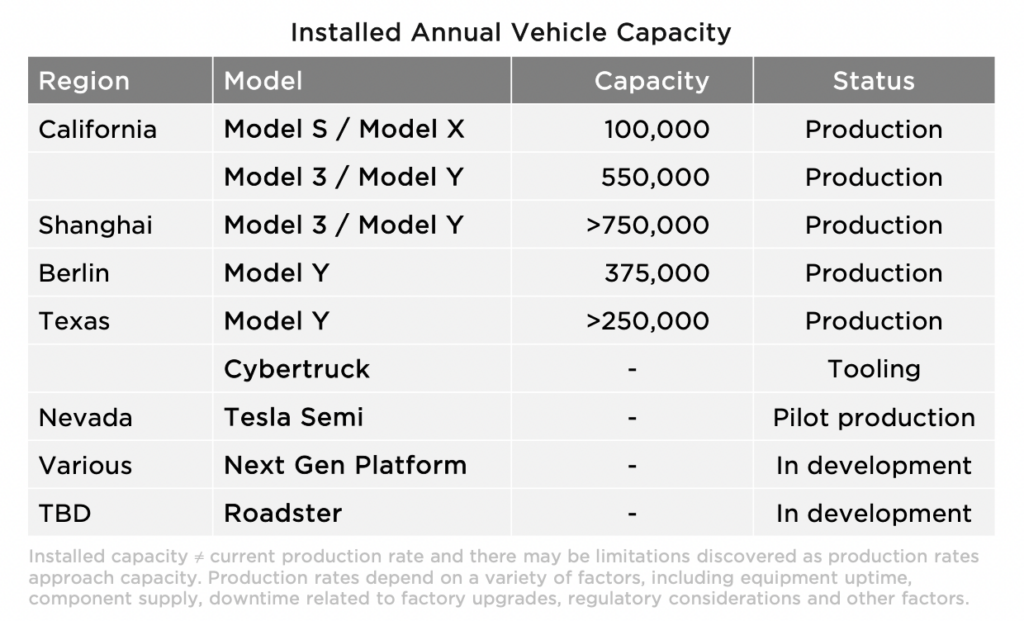

Tesla’s annual manufacturing capacity is now something over two million units, more than half of which is located outside of North America (Shanghai and Berlin). When the company begins production of the much-hyped Cybertruck in Texas later this year, that overall capacity figure will increase somewhat.

By the numbers, Tesla is very expensive. Based on trailing twelve month results for the period ended June 30, 2023, the stock trades at a P/E of over 40x. The ratio of Tesla’s enterprise value-to-adjusted EBITDA is even higher (about 46x) when compared with the average stock. These measures are especially high for a company which competes in an extremely capital-intensive business. Indeed, Tesla’ capital expenditures were US$2.1 billion in 2Q 2023 and US$7.8 billion over the last twelve months.

READ: Elizabeth Warren Calls for SEC Investigation into Tesla and Elon Musk’s Twitter Takeover

One of the recently dubbed “Magnificent Seven” tech stocks, Tesla has trounced the stock market so far in 2023, rising a remarkable 136%. The real question for Tesla investors is whether investors will continue to value the stock based on a very optimistic view of the future despite intensifying price competition in the EV sector, and the absence of the tailwind of sharp 2H 2023 unit sales increases that was seen in 1H 2023.

Tesla, Inc. last traded at US$291.26 on the NASDAQ.

Information for this story was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.