Following market close on Monday, Tesla released its financial results for the first quarter, surpassing consensus estimates. However, it also turns out that the company’s revenues were largely generated from the sale of regulatory credits and bitcoin, rather than its core business, which is manufacturing and selling electric cars.

Elon Musk’s company reported a profit of 93 cents per share, significantly surpassing Refinitiv estimates of 79 cents per share. Similarly, Tesla’s first quarter revenue rose by 74% to $10.39 billion, exceeding estimates that called for revenues of $10.29 billion. The company’s free cash flow rose to $293 million, beating estimates of $82.8 million.

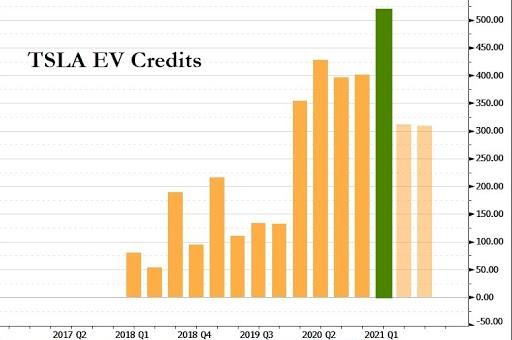

Despite the positive earnings results though, Tesla’s business model also appears to be running into a problematic scenario— that is, its not actually earning any money from the sale of its electric vehicles, but rather from regulatory credits and digital currency sales. According to the company’s financial summary, income from operations totalled $594 million; however, the sale of regulatory credits were up from $401 million in the first quarter of last year, to $518 million between January and March 2021— the highest on record.

So, while GAAP net income totalled a mere $438 million, it means that Tesla did not generate any meaningful net income without the help of regulatory credits. And, on top of that, Tesla owned $1.3 billion in digital assets at the end of the quarter, of which it sold $271 million in bitcoin, amounting to a profit of $101 million. Although it can be assumed that it was all bitcoin, it remains unknown how much of the EV maker’s “digital assets, net” were comprised of Musk’s favourite meme currency, Dogecoin.

All of this aside though, Tesla did in fact achieve seven straight quarters of profits. However, its heavy reliance on the sale of regulatory credits poses its own set of problems, which will only become more amplified. As other established automakers gain market share in the EV sector, they will no longer need to purchase as many credits, despite toughening emissions standards around the globe.

In the meantime, Tesla delivered 184,800 Model Y and Model 3 cars in the last quarter, significantly outpacing expectations and beating its own previous record. At the same time, the EV maker also noted it did not produce any of its higher-end models, including the Model S sedan and the Model X SUVs; it did, however, deliver 2,020 of its older Model S and Model X EVs from previous inventory.

Going forward, Tesla said it anticipates to reach an average annual growth of 50% in vehicle deliveries for 2021, signifying a minimum delivery of 750,000 units in the current year. However, Musk’s company also faces an onslaught of new competition from its rivals this year, including startups by Amazon-backed Rivian Automotive Inc, as well as established automakers including Volkswagen AG and General Motors Co.

In response to this, Tesla reassured investors in its quarterly release by citing rising consumer demand for EVs and its own efforts to quickly ramp up production capacity. “As more OEMs join our mission by launching EVs, we believe consumer confidence in EVs continues to increase and more customers are willing to make the switch.” The automaker also noted that its becoming more efficient at producing cars, reporting an automotive gross margin of 26.5%, exceeding Bloomberg estimates of 24.2%.

Information for this briefing was found via Tesla. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.