The housing market appears to be headed in a direction that is undesirable for many households. The latest data compiled on the matter, which was conducted by Apollo Global Management, indicates that the average monthly mortgage in the United States is approaching $1,400 on existing homes sold.

Perhaps more significantly, the data was combined via Apollo’s own work, as well as data compiled by NAR. That data from NAR assumes an 80% loan to value ratio on properties, or in other words, assumes homebuyers have placed 20% down on the property in which they have purchased. From there, it uses the average effective mortgage rate to calculate the estimated mortgage payment.

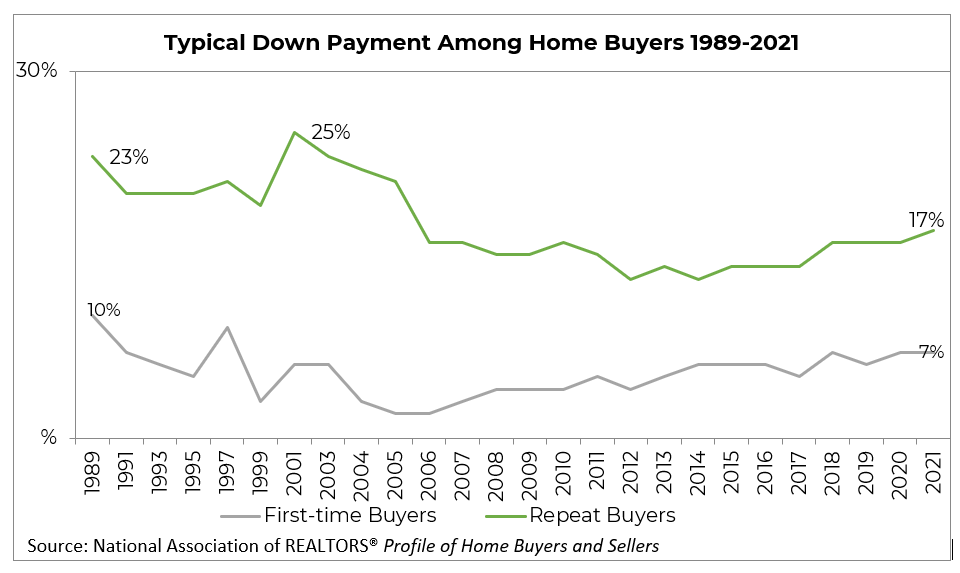

The problem with this data, which points to potentially dramatically higher mortgage payments, is that the National Association of Realtors itself earlier this year indicated that first time home buyers typically put down 7% of the value of a home at the time of purchase, while repeat buyers put down up to 17%.

Some buyers however are able to put just 3.5% down via an FHA loan. Data compiled by NAR found that up to 15% of buyers use an FHA loan, although down payments under these loans may have been higher than the minimum requirement.

Elsewhere, cracks are starting to show in the market. As per a report by MarketWatch, homes in foreclosure climbed by 7,000 last month, while 78,000 properties in the US entered foreclosure in the first quarter of the year. Foreclosure rates are up 39% on a quarter over quarter basis, while year over year that figure has climbed by 132%. What’s more, is mortgage delinquencies have climbed by 70% from pre-pandemic levels.

Skewing this data however is foreclosure moratoriums that were put in place as a result of the pandemic, which delayed the filing of foreclosures as families were hit with the impact of job losses and income reductions due to factors outside their control. And lets not forget that certain forbearance programs are still in place, which may be delaying a potential landslide of foreclosures as those programs continue to end.

This, as mortgage rates continue to rise and affordability gets further out of reach for many. In this regard, Twitter user @lenkiefer shared an excellent chart, demonstrating the affordability of housing as rates continue to rise, and what higher priced markets might have in store as consumer dollars are able to be stretched less in a rising rate environment.

result of double digit percent changes in house prices and nearly two percentage point increases in mortgage rate

— 📈 Len Kiefer 📊 (@lenkiefer) April 20, 2022

average monthly payment is up 42% from a year ago pic.twitter.com/GGYoCcNngi

Information for this briefing was found via MarketWatch NAR, Apollo Global Management and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.