When the Bank of Canada paused its overnight rate last week at five percent, it followed some very public lobbying by the premiers of BC and Ontario, who don’t like their respective provinces’ economies’ chances under a tight and tightening rate environment.

The official reason for the pause was an unexpected Q2 contraction in GDP (0.2%), which The Bank supposed could do the inflation-fighting work of a rate bump. August CPI numbers are due out September 19th… we’ll see.

Much of the buzz around the macroeconomic water cooler made the GDP contraction reasoning out for a cover.

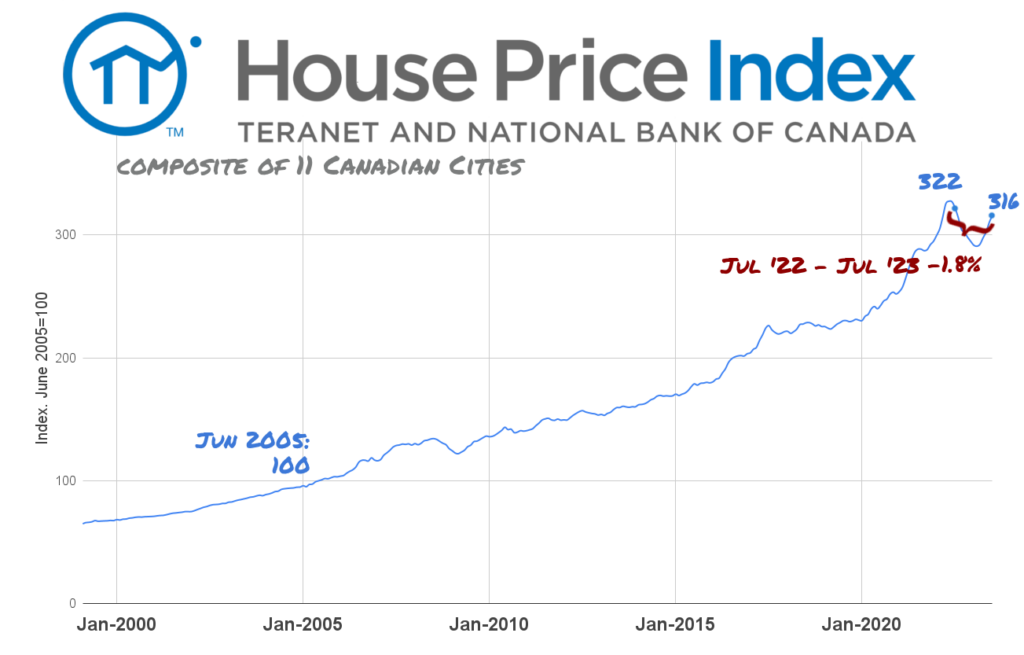

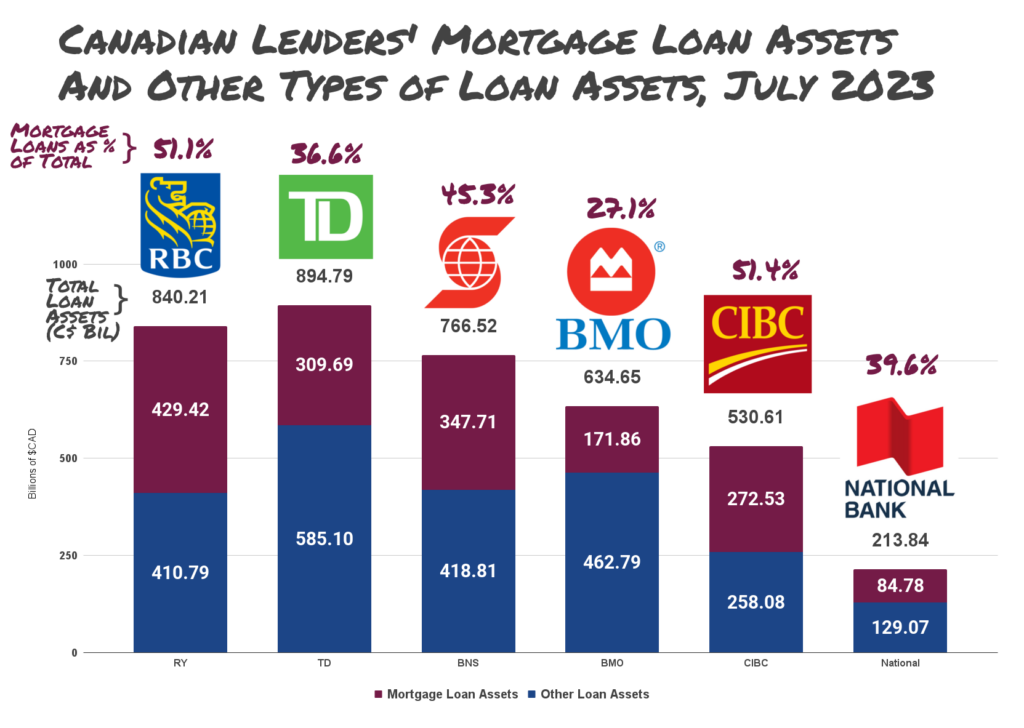

Word from people who act like they know is that the BOC held rates to buy some time for the commercial banks; holders of a collective $1.68 trillion worth of mortgage debt, backed by the homes that make up the housing market, to put their house in order.

Markets are supported by buyers, and higher rates tend to chase buyers away. Pausing the hikes is a way to slow down the housing market’s fall, and buy some time for the chartered banks, who have a lot of ways to go here.

They can extend the amortizations on their existing mortgage portfolios as far down the line as the borrowers will go (which, typically, is as far as the bank will let them)… Pack it up in new and exciting ways, and lay it off on the credit markets… Whatever. If this really is a stall for the banks, it probably also comes with an unofficial warning to brace for impact.

The banks only ended up with $1.68 trillion worth of mortgage asset exposure because the crown-owned Canada Mortgage and Housing Corporation wrote them insurance on it. The CMHC presently carries $488 billion in insurance exposure to the commercial banks’ mortgage assets, so the rate pause is hardly favoritism. More like a careful step sideways, looking for thicker ice to cross on… as partners.

And since this objective oligopoly is government assisted…

The O-Word gets thrown around a lot when private institutions call the shots for government, and it does look that way from a great distance. Oligarchies preserve interests in the best and most lucrative businesses for government-connected operators, and use public resources to advance and protect those interests. Usually, the government holds a joint interest, so it isn’t an inside track, technically… it’s just prudent management. Sound familiar?

It only looks like an oligarchy. It’s really just capitalism.

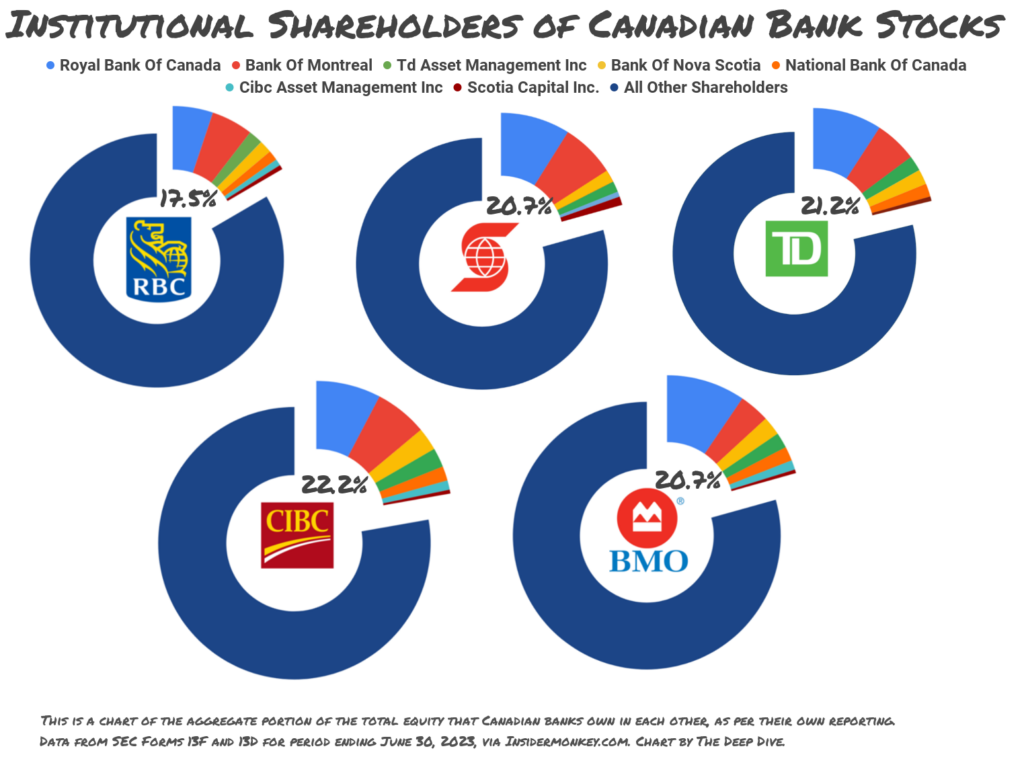

But when we zoom in close enough to see the details, The Royal Bank is hardly Gazprom. Canadian banks are publicly traded, capital stock companies. Anyone who cares to can buy their common shares from the public market, and tie their fortunes to whichever bank they want, or all of them.

Canadian bank stocks have been tremendous money makers for those with the capital available to back them. Functionally, those people occupy the same Canadian social and economic class as the Russian oligarchs who are given petroleum concessions and banking licenses, but not because of dirty, underhanded, nepotistic back-room deals the way the Russians do it. Canadian oligarchs are just richer. This is capitalism and they have more capital than everyone else.

Western democracies with capitalist economies like to throw shade a despot-run oligarchies. It gives them a sense of superiority. This column is hardly the first to point out the irony in all that, but it might not be hypocrisy, exactly.

Take Elon Musk, for example. The world’s most obnoxious billionaire, through his founding and control of SpaceX, has put himself in control of a high-test satellite internet system that can effectively put internet access in places that are well outside of infrastructure backbones, and take it away just as quickly.

Functionally, that makes Musk the final sign-off on any kind of drone-based war action being conducted in locations outside of urban internet architecture. Musk and his biographer made a bunch of noise in the press last week about having denied Starlink access to a Ukrainian fleet of drone submarines that were looking to mount a naval action against Russian forces in Crimea.

We’re not inclined to take anything Musk says at face value, because he’s a press fiend and a serial liar. But whether he’s lying or not, it’s still SpaceX’s satellite system, and there isn’t anything that says Musk can’t gate-keep access to it. SpaceX has significant partnerships with both NASA and the US Department of Defense, developed during an ongoing era of neolibralism that continues to privatize government functions in search of cost savings and efficiency. Since no partnership operates unilaterally, it’s fair to say that Elon Musk has significant input into the US government’s space and defense operations.

“Slowly at first, then all at once.”

This isn’t a condition that anyone set out to create; just the opposite. Market-based democracies are meant to spread the power and resources around, so that no entity in government or industry ever becomes so big that they’re a shot caller. But capitalism is built around wealth, and wealth and power go hand-in-hand. Nobody meant to give that yoyo they keys to anything important, he just built it. And the capital markets were more than happy to finance it.

Meanwhile, back here in Canada, as the central bank backs off the inflation fight to give the banks a minute to adjust, the Prime Minister and his cabinet are faced with a need to do something about the cost of stuff everyone can’t help but buy, like housing and groceries. To that end, the cabinet has invited the CEOs of the country’s incredibly profitable grocery companies in for a chat. Stay tuned.

Information for this briefing was found via Sedar+, Reuters, Globe and Mail, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.