The West’s sanctions against Russia are backfiring, particularly for the US dollar, which is slowly but surely losing its grip on global dominance.

After witnessing western nations unilaterally freeze Russia’s foreign assets in response to Moscow’s military operation in Ukraine, central banks have been boosting their gold reserves so the same thing doesn’t happen to them should Washington suddenly turn unfriendly. Over $300 billion of Russian foreign reserves— not including assets owned by businesses and individuals— were frozen by the Biden administration and other western allies.

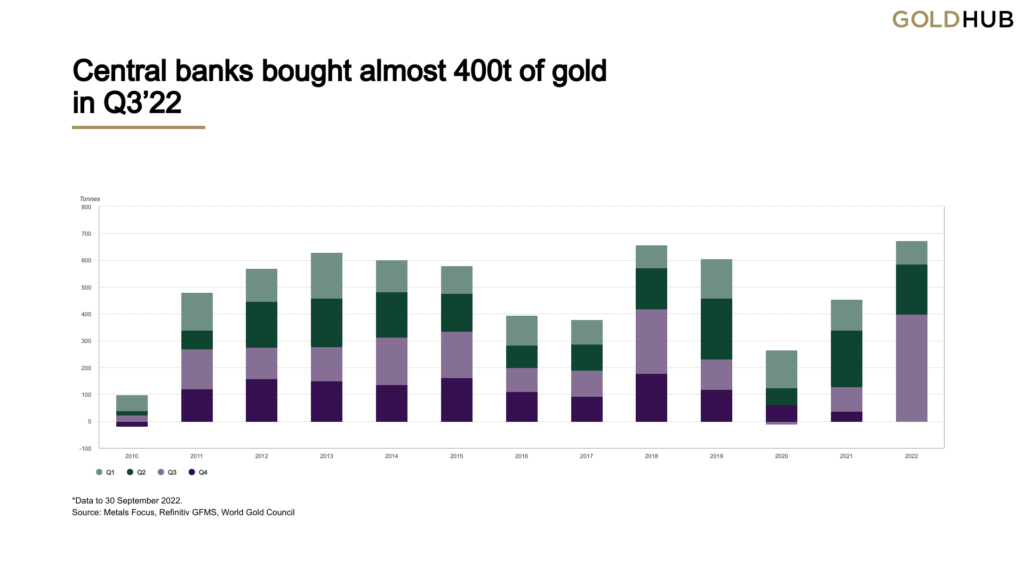

At the same time, data from the World Gold Council revealed that major regulators quadrupled their gold purchases in the third quarter 2022 to 399.3 tons, marking a stark increase from the 186 tons bought during the second quarter, and the 87.7 tons purchased in the first three months of the year. In fact, the year-to-date total exceeds any such period since 1967! Most of the gold was purchased by the central banks of Turkey, Uzbekistan, and India, each reportedly buying 31.2 tons, 26.1 tons and 17.5 tons, respectively. However, it remains unclear which countries purchased the remaining total reported by the industry group.

Indeed, such an unaccounted-for portion of “this magnitude is unheard of,” said precious-metals analyst Koichiro Kamei, as cited by the World Gold Council. Another market analyst, Itsuo Toshima, said “China likely bought a substantial amount of gold from Russia,” which is normal behaviour for the People’s Bank of China. The communist country stopped reporting data on its gold purchases in 2019, after disclosing a purchase of 600 tons sometime between 2009 and 2015.

“Anti-Western countries are eager to accumulate gold holdings on hand,” said economist Emin Yurumazu, as cited by Asia Nikkei. The gold shopping spree comes as central banks around the world ramp up efforts to secure their assets and cut back their exposure to the US dollar. China has been at the forefront of the de-dollarization frenzy, dumping $121.2 billion worth of US bonds between March and October.

Information for this briefing was found via Asia Nikkei, the World Gold Council, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.