In case you aren’t reading financial media every day, diesel prices are up, inventories are low, and refining capacity is not about to increase. Chances are this is going to have a significant impact on the economy, market, and global international relationships over this upcoming winter.

What may be a surprise to some is how quickly things have escalated. As of last week, according to GasBuddy annual prices of diesel were up over 45% at pumps across America. And it doesn’t stop there. Joe Biden keeps threatening to embargo oil refineries. He’s bickering with those nasty large oil companies who aren’t agreeing to expand capacity, and he’s depleting the Strategic Petroleum Reserve going into midterm elections. This is a problem, because the more reserves that are used today, means the less there will be to stabilize markets later.

All of this combined with Russian sanctions and the recent OPEC+ cuts has led to a significant reduction in global oil production. And these issues aren’t happening just in the United States – as prices increase, workers and industry participants gain leverage and start to shake up the landscape. For example, France is currently experiencing a refinery strike, which has caused a shortage of gas in 30% of their stations – and an import spike of 70% for diesel.

This means – you guessed it – higher diesel prices.

Now, why is this such a big problem?

Diesel is the workhorse of the global economy.

Most freight and delivery trucks as well as trains, buses, boats, farm, construction, and military vehicles, even some cars and light trucks have diesel engines. A shortage would mean higher costs for everything from trucking to farming to construction. This means pretty much all this stuff around us is going to cost more to make and cost more to deliver to us.

So let’s start with how diesel is made. When a barrel of oil is refined, it is separated into various products using the different boiling points of its components. According to Visual Capitalist, gasoline boils at a lower temperature than diesel and represents about 43% of each barrel of oil. Diesel makes up approximately 27%, with the other 30% destined to become heating oil, jet fuel, asphalt, and other important materials. Because of its higher energy density per gallon and the efficiency of engines designed to use it, diesel is a desirable fuel, especially for long-haul trucking.

Supply Gets Tight as Demand Cranks Up

Recently New York harbor spot prices hit over $200 per barrel of diesel. According to the EIA, the US has just 25 days of diesel supplies while at the same time, the four-week rolling average of distillates supplied, which is a proxy for demand, rose to its highest seasonal level since 2007.

So let’s talk about the refineries. According to EIA estimates, U.S. refining capacity is now lower than it was before the start of the pandemic. Capacity shrank in 2021 for a second consecutive year to stand at 17.9 million barrels per calendar day at the start of 2022. Leaving the US with 130 operable petroleum refineries in the country.

Now there was one new refinery built in Texas that came online in February 2022, but it was small and only able to refine upto 45,000 b/cd. For the last major refinery with significant downstream capacity, we have to go back to 1977 when Marathon’s facility in Garyville, Louisiana, came online with an initial capacity of 200,000 b/cd.

Refineries are Closing

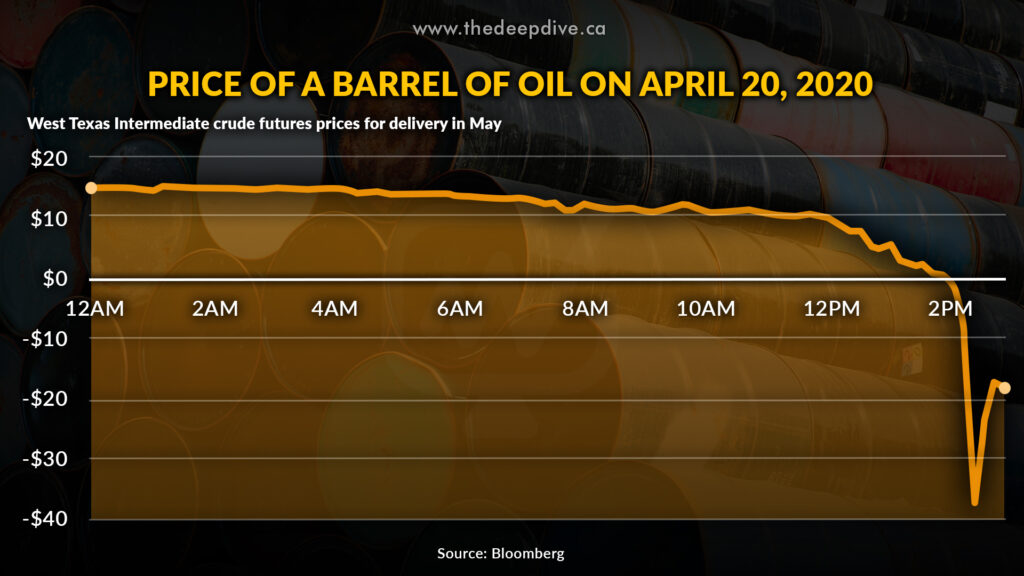

Of course, we all remember during COVID when the economy shut down and oil prices actually went negative. This was was seen as a final kick in the nuts for an industry where capital just feels unwanted. Since March 2020, we keep seeing U.S. refiners shutting down.

Here’s a quick breakdown of why they are shutting down:

- The Lyondellbasell Facility in Houston, which had a capacity of nearly 260k barrels a day, said in April of 2022 that it would permanently shut the refinery by year-end 2023, as the owners were unable to find a buyer and did not want to invest to keep the facility open.

- The Phillips 66 Alliance Facility in Belle Chase, Lousiana, which had around 250k barrels per day capacity, announced in November 2021 that it would not reopen, which was shutdown in mid-August ahead of Hurricane Ida. This may have made some sense, because the 50-year-old refinery was severely damaged after several feet of water flooded it during the storm.

- Shell announced in November 2020, they would shut down the Shell Convent facility in St. James Lousiana after attempts to sell the plant between July and October were unsuccessful. Citing the plant refinery became unprofitable as COVID-19 spread across the United States.

- The Marathon refinery in Martinez, California was shut down due to low fuel demand during COVID, and will be reopened as a biodiesel facility which will go from having refined 161k bpd, to around 17,000 barrels per day.

We could keep going, but the point is this: Oil refineries across the country are being retired and converted to other uses as owners balk at making costly upgrades.

So the question becomes, what is the US government doing to increase refining capacity?

The Biden Administration’s Game Plan Is Confusing…

According to Bloomberg, at a closed-door discussion back in June, Chevron’s CEO Mike Wirth walked through the economics, supply logistics, and constraints of US refining with the Secretary of Energy and other US officials. The meeting ended with everyone agreeing on one point: The shortage of refining capacity will persist. And it could get worse.

Given these record profits, you’d assume we’d start to see some news releases about companies ramping up capacity or changing their plans to shut down refineries. Right? Cricket Noises…

So why aren’t investors flocking to the space? Simply put, they fear the profits will be short-lived. Whether it is the Biden administration’s environmental priorities or rising public concern about climate change, couple it with today’s ESG-focused investor, and these challenges make it nearly impossible to raise money for operating refineries.

But, The Big Guys Have Money, Right?

The big oil companies don’t need to raise money but choose to not invest it back into refining. Building and upgrading these gigantic facilities is messy and it’s expensive. These upgrades often drag on longer than a decade, so even the big oil companies run the risk of these upgrades getting abandoned before the investment sees any returns.

So we can see why some short-term volatility in pricing doesn’t have companies enthused to spend money that will begin returning capital 10 years down the road. Also let’s not forget, with that kind of time lag, there is plenty of time for OPEC to start cranking up production and ruin the returns of new entrants.

In June, Chevron’s CEO Mike Wirth told Bloomberg, “My personal view is there will never be another new refinery built… You’re looking at committing capital 10 years out, that will need decades to offer a return for shareholders, in a policy environment where governments around the world are saying, ‘We don’t want these products.’

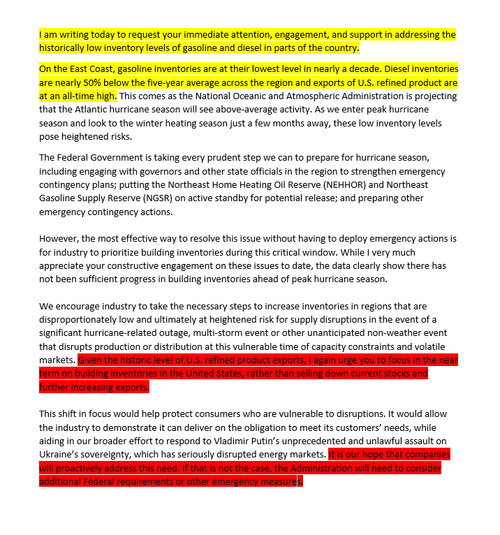

Biden keeps playing hardball, in August, Energy Secretary Jennifer Granholm sent a letter to refiners threatening “emergency measures” if they didn’t reduce exports. “Given the historic level of U.S. refined product exports, I again urge you to focus in the near term on building inventories in the United States, rather than selling down current stocks and further increasing exports. … It is our hope that companies will proactively address this need. If that is not the case, the Administration will need to consider additional Federal requirements or other emergency measures.”

Let’s Talk About the SPR

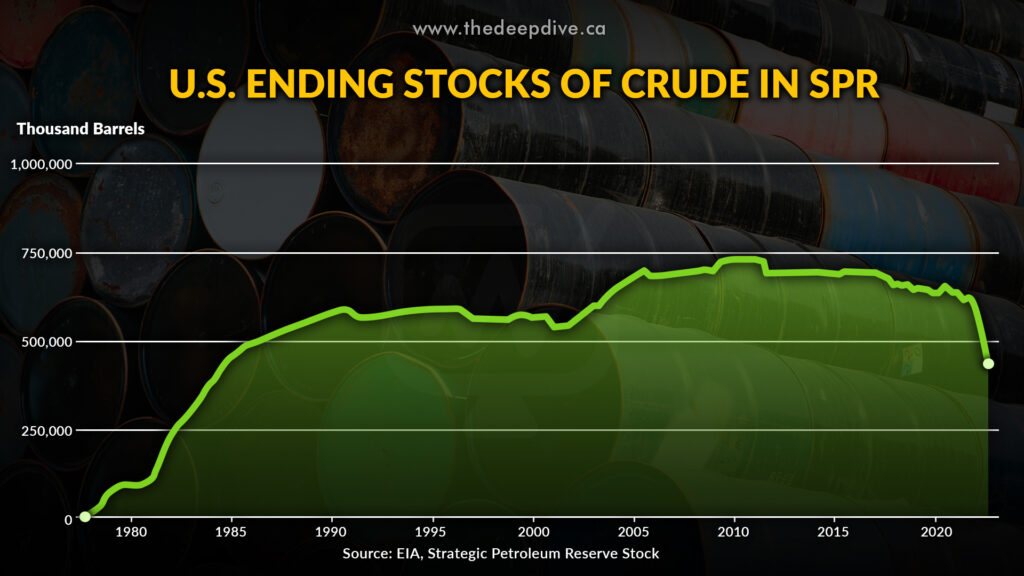

In 1973, the Organization of Arab Petrolem Exporting Countries imposed an oil emgargo against the United States. This sent the US into a recession. To mitigate the damage from any future shortages of oil, President Gerald Ford signed the Energy Policy and Conservation Act of 1975, which established the Strategic Petroleum Reserve, also known as the SPR.

This is an emergency stockpile of petroleum maintained by the Department of Energy known as the largest public emergency supply in the world; its underground tanks in Louisiana and Texas have capacity for 714 million barrels. This is a tool used to alleviate the market impacts of both domestic and international disruptions.

Biden began using the SPR before Russia invaded Ukraine, back in November 2021, due to high gasoline prices, releasing 50M barrels. On March 1st of 2022, the Whitehouse announced they would release 30M barrels shortly after Russia invaded Ukraine. And then 30 days later they announced they would release 180M barrels over the next 180 days.

So today, we’re at the lowest reserves since 1985 and left wondering what happens after the midterm elections, if this war drags on, and the SPR starts to fully deplete. As I said earlier, this is a problem, because the more reserves that are used today, means the less there will be to stabilize markets later.

Getting Back to Diesel

So, getting back to diesel the issue here is twofold: 1) the US and the Western World needs enough oil to meet demand, and 2) we need the refineries to refine it.

It’s clear that this requires strategic thinking from leadership beyond cutting off one of the world’s largest oil suppliers and using up the world’s largest oil reserve to stabilize the market, hoping that a country you call a pariah state will come to your rescue.

Eventually, the US will deplete the SPR, and at the rate, we’re going that is going to happen well before we’ve transitioned to a world of electric vehicles and renewable energy.

In the meantime, we can expect two things. Higher inflation from energy prices. Followed by higher interest rates to destruct demand. Because that’s what Paul Volker did back in the 70s. But if you look into history, higher interest rates weren’t the only solution to solve high inflation.

According, to the Global Head of Commodities Research from Goldman Sachs, Jeff Currie “It wasn’t just all Volker that solved the 70s. There was a huge amount of investment that went into North Sea, Alaska North Slope, Gulf of Mexico, Mexican production, Brazilian, Norwegian… I can keep on going down the list and that investment that came to fruition did a lot to ease the inflationary pressures as you went into the 80s.“

So Where Are We Going?

Solving these problems requires two types of investments. What we need right now is concurrent investment in infrastructure for both domestic oil and gas and renewables. With the goal of moving towards smart grids, nuclear power, energy storage, hydrogen, or whatever the future looks like.

Both of these investments need to happen at the same time, whether it makes us feel warm and fuzzy or not.

Otherwise, you have to explain to the single mom who can’t afford to feed her kids or fill up her car with gas, how it’s all okay, because her kids might have renewable energy 20 years from now. Perhaps, the more desperate we become, the more innovative we become. But that’s really pegging the bulk of the problem on the working class. Bank of America tells us the working class often spends over 10% of their credit card bills on gasoline, which is about to get worse.

But the last time I looked, Germany tried to go cold turkey on oil and dive into renewables. They got off nuclear power which for the most part is pretty green, but in the end, chose to put their economic prosperity over pain and innovation. They ended up addicted to Russian fossil fuels, which led to Putin invading Ukraine, and today they are turning to coal.

These are complicated issues that require making optimal decisions without perfect answers.

But the point is this. Watch out for diesel prices this winter.

Stock is low, demand is high, and all bets are off for what it will do to the global economy.

Information for this briefing was found via the links provided within the article. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

They’ll build refineries if they’re facing tax implications, but that’s about it. Why sink the money into infrastructure that will ultimately lower their take from the barrels in the ground, when they can just keep it?

A wealth of information not normally seen in print. Just to add some fuel to the fire…There are about 20 gallons of gasoline and 10 gallons of diesel in a barrel of oil. The gasoline is refined off before the diesel. Unless you are selling it separately or hiding it somewhere; to be short diesel you could expect to be short gasoline as well. Were the oil reserves sold off to make room for diesel? Barrels of oil do you no good without the refineries. Most countries have nationalized some segment of the petroleum industry to make sure supply will meet demand. Gasoline is perishable, storage in large quantities is not practical or safe.

Venezuela is a warning.