Michael Batnick wrote a very intelligent post about the rage of the American wage earner last week called “This is Why We’re Angry,” in which he tried to reconcile the stagnant growth of wages and real wages with the incredible prosperity that the American economy has seen in the post war era.

We’re big Batnick fans and aren’t surprised that he’s the element of the financial publishing community to take on the glaring economic inequality that the his peers have been failing to confront for so many years, and are even now dodging despite its increased relevance. Batnick is smart enough not to take a run at a solution, because the ones being used are doomed to fail and the ones that might work are difficult to confront. “The Irrelevant Investor” has always operated from a posture that nothing he says or does is going to have much consequence… which is basically true at scale.

Batnick, who has a well-earned reputation as a pragmatic, data-based equities researcher, betrayed an ideological bias in his conclusion that surprised us.

“I believe in capitalism with every fiber of my being, but I also believe we need to do better.”

Michael Batnick, from “This is Why We’re Angry“, April 15, 2020

Anyone who told Michael Batnick that they “believed” in a stock or in the Non-Farm Payroll numbers would be politely laughed out of the room, no matter how many fibers of their being they had in it. We don’t expect that the author tipped his hand intentionally, and the second part of the quote betrays the beginnings of cognitive dissonance, brought on by the fact that these numbers are exactly what they appear to be: the result of a stacked deck.

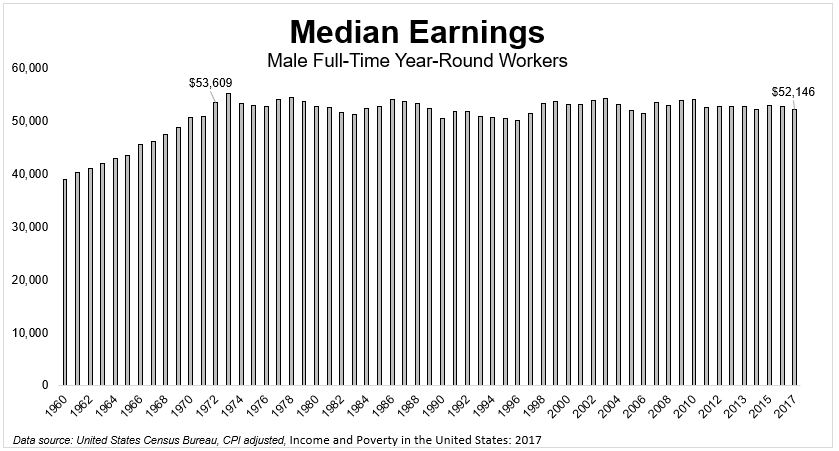

Potential Freudian slip aside, “This is Why We’re Angry” is mostly the Batnick we know and love. He takes a closer look at the numbers in a stab at determining whether or not this anger is justified. The lead chart and featured image shows flat growth in the median earnings of American full-time male workers (adjusted for inflation) going back to 1960. He follows the plot of income staying flat, even as GDP expands at pace, and makes earnest guesses at the potential reasons that the Gods of Capital may not be delivering to the masses the same splendor, proportionally, as to the clergy that inhabits the capital class.

Gotta look at both sides, wait for all the facts to come out.

Among the studies is a series of graphs put together by the people down at Washington DC’s American Action Forum, a think thank that doesn’t understand that data and ideology don’t mix or, at least, doesn’t really care. The self described “21st century center-right policy institute”‘s mission is to “provide actionable research and analysis to solve America’s most pressing policy challenges.”

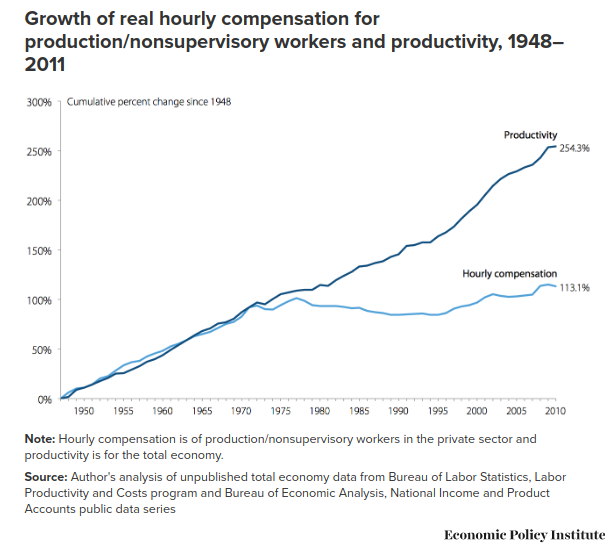

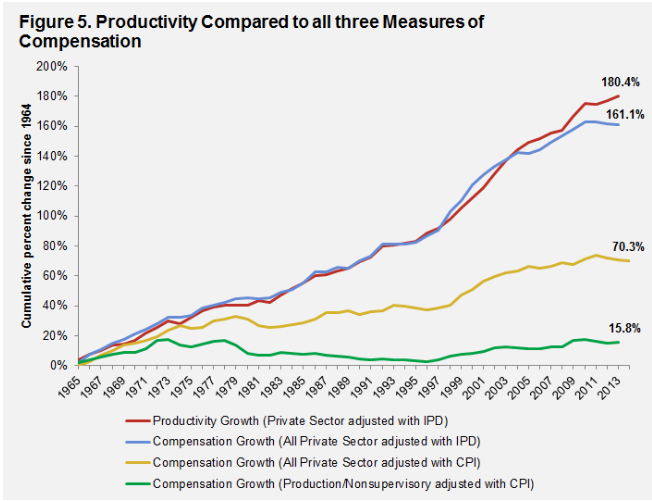

In the name of creating an apples-to-apples comparison, the AAF has re-made one of the more common income v. productivity charts, originally produced by rival lefty think tank the Economic Policy Institute to show that (surprise!) productivity growth and compensation growth actually track just fine.

In truth, the AAF found various ways to move the goalposts. It broadened the scope of the labour portion of the comparison to include both supervisory and non-supervisory workers, and changed the inflation index used on the data from the Consumer Price Index (CPI), which tracks the end price of consumer goods, to the Implicit Price Deflator (IPD) which tracks the difference between real GDP and nominal GDP.

The IPD is meant to track the inflation in the economy as a whole, not just the price of consumer goods. So, if the cost of private airplanes or industrial aggregates goes up (or down) it shows up in the IPD, but not the CPI. The last thing the IPD should be used for is adjusting wage-growth data – the CPI is there for the expressed purpose of measuring inflation’s effects on wage earners – but it’s a tough thing to understand, and it’s that way by design. This is the sort of thing that happens when one takes agenda-driven treatments of economic data seriously.

Batnick’s original instincts were closer to the mark. His showcase graphic of flat wages was from the US census bureau, and if productivity were equally flat, we’d expect to see a flat GDP, reflected in a flat stock market which, of course, we aren’t, which is what lead to the titular anger. The post brings up advances in standards of living over the same period, an apparent suggestion that a lag in wages led to such an advance, which is something taken as canon by the church of capitalism, but has never really been supported. Batnick implies a similar trade off occurred with the advancement of tech, as though our wage growth might have died for the right to buy an $900 iphone.

Are modern marvels like the smartphone and netflix made possible by a reallocation of gains that might have ended up in the median income? We have a tough time seeing how. Certainly, they’ve made for some enormous gains for the capital at risk in the markets, but all the Robinhood apps in the world aren’t going to grant universal access to those gains.

By and large, Americans don’t have much choice in the matter. The gains they’re missing out on on payday are being realized in the equities markets. Reasonable housing security is only available through the Real Estate market, and the stagnant income growth we’re discussing prevents them from accessing it without becoming a product in the debt markets.

Buy the Ticket, Take the Ride

And, so, here we are. An inordinate amount of savings, using an inordinate amount of leverage, has been poured into various asset bubbles that are very much threatening to deflate as the much-beleaguered working class are being kept off the job to keep 6%-8% of the population from dying. The government has printed trillions of dollars to prevent it all from falling apart in the interim, and we’re reaching the point at which those with the most at stake in those bubbles are grumbling that we ought to get back to it – because imaginary money might float it for a while, and they can ill-afford for it to all come apart – but as Batnick has helpfully pointed out: we’re angry.

While we don’t share Batnick’s devotion to the capital markets, we are big fans of them, and have been for as long as we can remember. It was Barry Ritholtz who once taught this author that “gold is a trade, not a religion,” and we’ve been observers and cheerleaders of markets ever since, trying our best to limit emotional investment and devotion.

The use of government money to perpetuate these over-valuation can only be described as “capitalism” by devotees whose judgement has been clouded by their faithfulness. Those of us who are just fans can see plainly that it’s against the rules. It uses the public purse to eliminate the risk faced by capital.

Airlines and hedge funds that can’t support themselves are supposed to fail. In the natural ecosystem of a capital economy, their useful parts are picked up at a bargain rate by organizations who can make use of them, to the misfortune of shareholders and unsecured creditors. Law of the jungle. This government-enabled damping makes it a far less interesting spectator sport but, more to the point, Boeing being owned by one group of interests or another group of interests isn’t going to make anyone less angry.

Because the people who are the most angry – and whose anger is the most justifiable – never dreamed on owning Boeing stock, or any stock at all. The markets confound them and they don’t earn enough money to throw it away at some casino anyhow. They’re trying to put their kids through college and save enough to not go broke if they run into an unexpected healthcare expense.

Batnick ought to be commended for taking an honest look at this very palpable anger, because it has a very real chance of becoming a larger consideration in the calculus of investment analysts as we move forward in an economy that amounts to an even more obviously stacked deck.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.