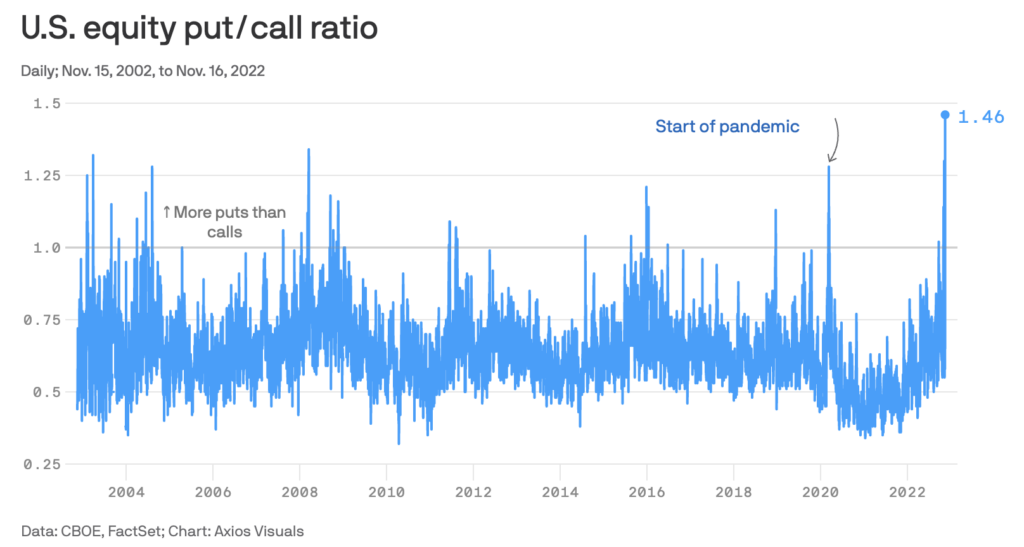

The options markets are showing a bearish outlook — the most in at least two decades. But it’s not all doom and gloom as this metric is usually used as a “contrarian indicator.”

The metric, known as the CBOE US equity put/call ratio, is an indicator of the sentiment or mood of the options markets. “Puts” are bets on falling stock prices, while “calls” are bets on rising stock prices.

Axios reports that the put/call ratio has recently reached its highest or most bearish level on record — going up to 1.46 on November 16 — showing the darkest outlook on the markets in at least 20 years.

But, this darkness in investor sentiment is actually good news for stocks, market analysts say, citing a contrarian effect where extreme levels — whether bullish or bearish — usually mean that stocks would tend to go the opposite direction.

But, since today’s markets are sitting in some unchartered territory, the keywords here are “usually” and “would tend.” It’s a game of wait-and-see.

Information for this briefing was found via Axios, Cboe, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.